(Bloomberg) — Crude oil is the world’s most crucial commodity, but it’s worthless with out a refinery turning it into the items that persons essentially use: gasoline, diesel, jet-gasoline and petrochemicals for plastics. And the world’s refining business nowadays is in pain like by no means ahead of.

“Refining margins are certainly catastrophic,” Patrick Pouyanne, the head of Europe’s best oil refining team Full SA, instructed investors past month, echoing a commonly held check out among executives, traders and analysts.

What occurs to the oil refining market at this juncture will have ripple outcomes throughout the rest of the strength field. The multi-billion-greenback plants hire 1000’s of folks and a wave of closures and bankruptcies looms.

“We consider we are entering into an ‘age of consolidation’ for the refining field,” reported Nikhil Bhandari, refining analyst at Goldman Sachs Inc. The major names of the sector, which collectively processed well in excess of $2 trillion truly worth of oil last yr, are giants such as Exxon Mobil Corp. and Royal Dutch Shell Plc. There are also Asian behemoths like Sinopec of China and Indian Oil Corp., as perfectly as huge independents like Marathon Petroleum Corp. and Valero Energy Corp. with their ubiquitous gas stations.

The trouble for the refiners is that what’s killing them is the medicine that’s conserving the broader petroleum field.

When U.S. President Donald Trump engineered report oil creation cuts concerning Saudi Arabia, Russia and the relaxation of the OPEC+ alliance in April, he may have saved the U.S. shale industry in Texas, Oklahoma and North Dakota, but he squeezed refiners.

A refinery’s economics are in the long run basic: it thrives on the price variation among crude oil and fuels like gasoline, earning a earnings which is known in the business as a cracking margin.

The cuts that Trump brokered lifted crude price ranges, with benchmark Brent crude soaring from $16 to $42 a barrel in the area of a couple of months. But with demand from customers nonetheless in the doldrums, gasoline and other refined items selling prices have not recovered as strongly, hurting the refiners.

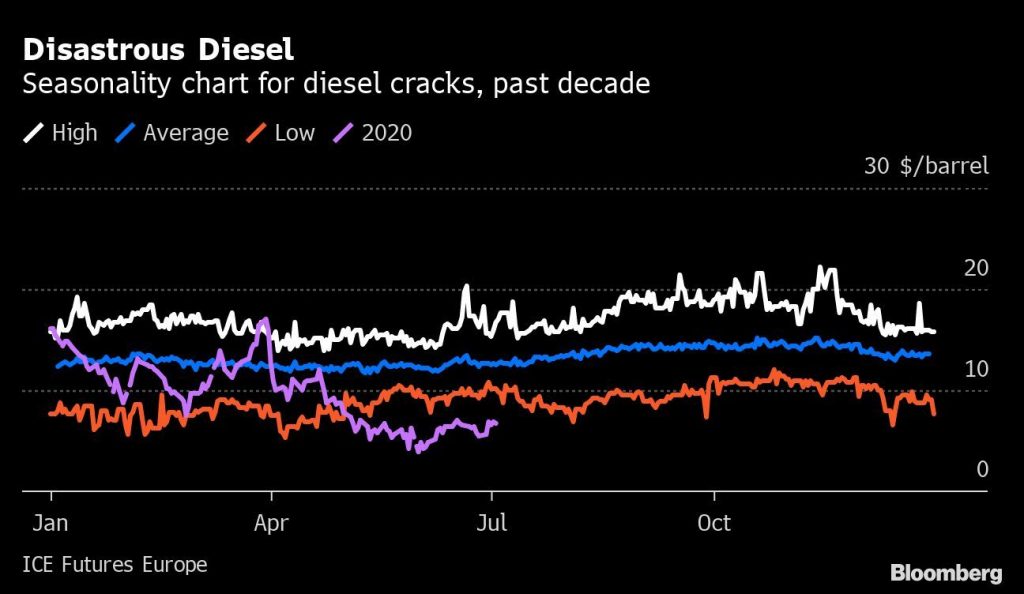

The industry’s most rudimentary measure of refining financial gain, regarded as a 3-2-1 crack distribute (it assumes a few barrels of crude would make two of gasoline and just one of diesel-like fuels), has slumped to its least expensive stage for the time of the calendar year due to the fact 2010. Summer months is typically a good period of time for refiners simply because need rises with individuals hitting the highway for their vacations. This time, even so, some plants are actually shedding revenue when they procedure a barrel of crude.

Worst Anxiety

Just a couple months in the past, the outlook appeared to be enhancing for the world’s largest oil people. Need in China was virtually back again to pre-virus amounts and U.S. usage was step by step rebounding. Now, a second wave of infections has prompted Beijing to lock down hundreds of thousands of citizens. Covid-19 instances are also on the increase in Latin The usa and somewhere else.

With demand in the U.S. now demonstrating indications of heading south again as coronavirus instances flare up in top gasoline-consuming regions which include Texas, Florida and California, the margins are at danger of deteriorating in The united states, which accounts for almost two in just about every 10 barrels of oil refined around the world.

“The worst concern for refiners is a resurgence of the virus and one more sequence of lockdowns all-around the earth that would once again considerably impression need,” explained Andy Lipow, president of Lipow Oil Associates in Houston.

Yet another trouble is that — where by it has been recovering — the demand pickup has been uneven from just one refined product or service to the next, making significant headaches for executives who will need to pick out the ideal crudes to purchase, and the proper fuels to churn out. Gasoline and diesel intake has surged again, in some situations to 90% of their typical amount, but jet-fuel continues to be just about as frustrated as at the nadir of the coronavirus lockdowns, working at just 10% to 20% of ordinary in some European nations around the world.

Refiners had settled the trouble by blending substantially of their jet-fuel output into, correctly, diesel. But that, in change, is making a new challenge: much too considerably of so-termed middle distillates like diesel and heating oil.

“Right now gasoline need is hardly maintaining some plants alive,” mentioned Stephen Wolfe, head of crude oil at expert Energy Facets Ltd. “And with jet output shifting over to diesel and gasoline output, that puts even additional strain on products provide,” he included.

In the U.S. refining belt, processing premiums are being continuously tweaked in response to prospective fluctuations in need. In April, in the course of the height of U.S. lockdowns, Valero Electricity Corp.’s McKee, Texas, refinery minimize costs to about 70%. It then elevated processing to in the vicinity of 79% in anticipation of the Memorial Day getaway, before discovering a new reduced of 62% by mid June, in accordance to individuals familiar with the scenario.

In the end, if refiners don’t make revenue, they acquire considerably less crude, most likely capping the oil-cost recovery of the previous handful of months for Brent and other benchmarks. Even so, the steps of Saudi Arabia, Russia and the relaxation of the OPEC+ team propose that refiners will keep on being squeezed for more time, with oil price ranges outpacing the recovery in fuel rates.

The speedy difficulty is compounded by a for a longer time-expression development: the industry has possibly overbuilt about the final many years, and older vegetation in spots like Europe and the U.S. cannot contend with new types popping up in China and in other places in the globe.

“Refinery margins in the subsequent five decades are likely to be worse than the ordinary for the past 5 yrs, and particularly bad in Europe,” reported Spencer Welch, vice president of oil markets and downstream consulting at IHS Markit. “We previously assumed that refining was in for a rough time, even far more so now.”

Catalyst for Modify

The weak spot means that the industry’s collective earnings will plunge to just $40 billion this year, down from $130 billion in 2018, according to an estimate from industry guide Wooden Mackenzie Ltd. of 550 refineries about the planet.

That could be a catalyst for adjust. The demand strike from the virus is still to trigger any delays in a variety of mega-refining assignments, most of which are in China and the Center East, that will commence operations from 2021 to 2024, according to the analysts at Goldman Sachs. This will bring about world utilization prices to be 3% decrease about this time period than in 2019. Plants are additional most likely to shut in designed nations because the bulk of demand from customers — and new refining capability — is in producing nations, they reported.

Lots of of the refineries that are currently being created in the Center East and China will also get authorities backing, a point that only tends to make lifetime extra tough for the plants in Europe and the U.S.

The field is now shifting to take care of the overcapacity: oil trader Gunvor Group Ltd. has reported it may mothball its refinery in Antwerp, and U.S. refining team HollyFrontier Corp. in June announced it was changing its Cheyenne plant from processing crude oil into a renewable diesel facility.

For now nevertheless, there’s a more mundane actuality to deal with: the market place. OPEC and its allies can constrain the provide of crude — squeezing refiners — but they cannot make conclusion buyers consume fuel.

For additional content like this, be sure to go to us at bloomberg.com

Subscribe now to continue to be ahead with the most dependable small business information source.

©2020 Bloomberg L.P.

More Stories

Sportswear: Lolle acquires Louis Garneau Sports

REM is still innovative enough to foot the bill

A trip to the restaurant with no regrets for these customers