(Bloomberg) —

Leaving driving the waters of the Caribbean Sea, the 1,100-ft long oil tanker Maran Apollo is emblematic of the wider petroleum sector.

Steaming at 11.5 knots, she’s heading towards China, exactly where oil desire is quick recovering, hauling a cargo of two million barrels of U.S. crude. But her voyage didn’t start off a few days in the past. She loaded in early May perhaps, and with no customers through the worst of the coronavirus outbreak, the supertanker stood floating in the U.S. Gulf of Mexico for virtually two months, waiting around for much better occasions.

Only a number of times back, she weighed anchor and remaining for the Chinese port of Rizhao — a sign that refiners are beginning to pull in crude that went unwelcome for months.

It is not any type oil on board, even though. Refiners are competing for barrels in just one corner of the marketplace acknowledged as medium-major bitter crude — barrels with a larger information in sulfur and rather dense. It is the kind of oil that Saudi Arabia and its allies pump. And also the type of crude which is pumped offshore in the U.S. Gulf of Mexico — and which is what is in the Maran Apollo’s tanks.

Like the wine business, the oil marketplace has its personal vintages: world wide refiners seek out their barrels substantially like connoisseurs covet bottles of Bordeaux and Burgundy. Urals of Russia and Arab Mild from Saudi Arabia are ordinarily two of the most extensively consumed — believe Cabernet Sauvignon, possibly a Merlot. But in today’s oil marketplace, these crude is in more and more shorter supply because of to record output cuts by the two nations and their allies.

“Deep OPEC+ cuts and desire recovery have tightened balances and this has been mirrored in enhancements in physical differentials,” said Bassam Fattouh, director of the Oxford Institute for Electricity Research. “But the restoration has not been even, with medium-bitter crudes faring better than light-sweet crudes.”

In usual moments, medium-bitter crude is ordinarily more affordable than other streams, specially people regarded as mild sweet crude that have a lower sulfur information and are fewer dense.

But OPEC, which pumps largely medium-sour crude, has cut output to the cheapest given that 1991, and Russia has also implemented brutal reductions. On top of that, medium and heavy sour crude accounts for the bulk of the materials from Iran and Venezuela, exactly where manufacturing has collapsed under the body weight of U.S. sanctions and deficiency of investment.

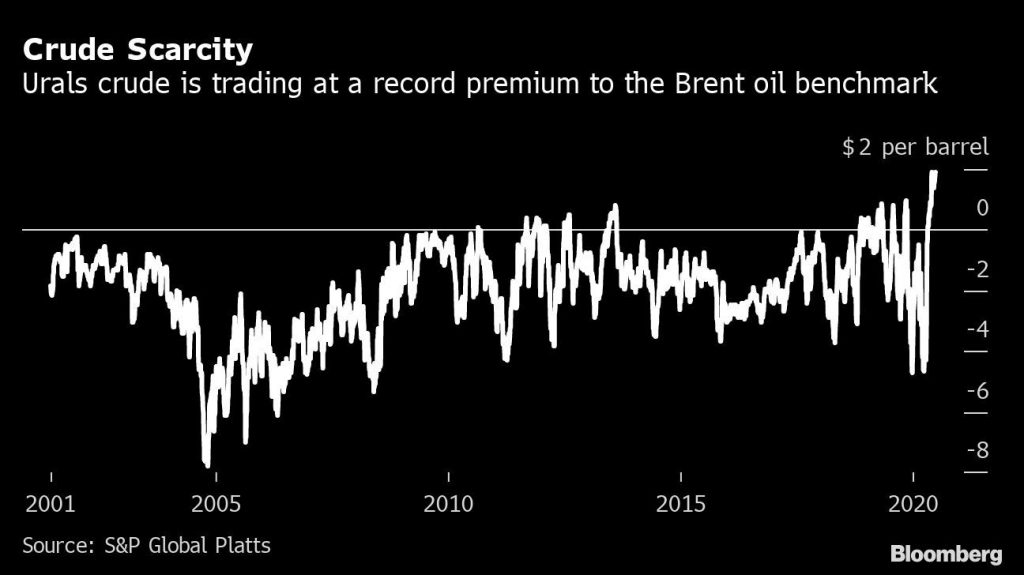

The market place is reflecting the underneath provide. The value of Urals, Russia’s flagship quality, has surged to a record premium to the Brent crude benchmark. Final week, it briefly modified palms at $2.40 a barrel higher than Dated Brent, a regional benchmark, in contrast with a price cut of extra than $4.50 a barrel in April, in accordance to traders. S&P World Platts, a price-reporting agency, assessed the quality at a top quality of $1.90 for delivery to Rotterdam on June 29, matching a prior record substantial.

The surge usually means that Urals is promoting in Rotterdam, the principal oil refinery hub in northwest Europe, at around $45 a barrel, in contrast with a lower point of about $15 a barrel in early April.

The price pattern is very similar for other sour crude streams, from Oman in the Center East to Oriente in Latin The us. All are commanding significant prices at a time when oil need globally continues to be down around 10% down below regular degrees. Mainly because bitter crude tends to make a important chunk of a typical refinery’s eating plan, the rate enhance is strangling the plants’ profitability.

“OPEC+ carries on to tighten the screws,” Amrita Sen, main oil analyst at advisor Vitality Areas Ltd. claimed, referring to the group’s output cuts.

With the bodily oil sector tightening, OPEC is now capable to increase the price ranges it fees to refiners. On Monday, Saudi Aramco, the state-owned oil corporation, lifted its formal promoting rates to Asia for the third consecutive thirty day period, mainly reversing all the discounts it offered during a brief cost war with Russia in March and April.

Aramco and other national oil providers offer their crude at differentials to oil benchmarks, announcing each individual thirty day period the price reduction or premium they’re charging to global refiners. These so-known as formal selling costs enable set the tone in the actual physical oil industry, the place true barrels adjust fingers.

The Saudi oil big is now advertising its most dense crude, named Arab Heavy, for the initially time ever, at about the exact same selling price at its flagship Arab Mild, an sign of the energy of the industry for the medium-weighty bitter grades. Usually, Arab Large has bought at a lower price of about $2-to-$6 a barrel to Arab Gentle.

Not only is medium-weighty bitter crude buying and selling at a quality to benchmarks, but barrels for speedy supply are commanding rates to ahead contracts, a cost sample recognised as backwardation that also displays a restricted physical-sector. Dubai crude, a Center Japanese medium sour barrel, is one example: backwardation in between barrels for supply now and in three months has surged to 60 cents per barrel. In mid-April it stood at minus $9.24 per barrel for the reason that the actual physical industry was so glutted back again then.

For extra articles like this, please check out us at bloomberg.com

Subscribe now to stay forward with the most dependable business information supply.

©2020 Bloomberg L.P.

More Stories

Sportswear: Lolle acquires Louis Garneau Sports

REM is still innovative enough to foot the bill

A trip to the restaurant with no regrets for these customers