Stocks continue to push higher, encouraged by signs of progress on the new US government stimulus package [see earlier post]. The FTSE 100 index in London is now almost 0.5% ahead at 6,134, a 29 point gain, while the Dax in Frankfurt gained 0.4% and the Ibex in Madrid added 0.76%. The CAC in Paris and the FTSE MiB in Milan slipped 0.1%.

Brent crude oil edged up 0.1% to $43.46 a barrel after yesterday’s declines, and gold is trading at $1,931, down 0.55%, after surging to a new record of $1,980.

Russ Mould, investment director at AJ Bell, has looked at the moves in London:

On the UK stock market, energy and tech stocks led the way, following by a good showing from consumer cyclicals and utilities. After recently rallying amid strong precious metal prices, miner Fresnillo was the biggest FTSE 100 faller after publishing half-year results.

Shares in grocery sellers including Marks & Spencer, Morrisons and Ocado shrugged off news that Amazon Prime customers will be eligible for free grocery deliveries in London and the south east from today.

European luxury stocks hit by poor results

In London, the FTSE 100 index has pushed 0.4% higher and Germany’s Dax is 0.28% ahead, while the French and Italian indices have fallen into the red again, dragged down by poor results at luxury companies. The pan-European Stoxx 600 has edged up 0.2%.

Luxury stocks are down after results from LVMH, the world’s biggest luxury company. It said sales across Asia excluding Japan fell 13% in the second quarter, compared with the previous quarter’s 32% slump. Overall, revenues plunged 38% to €7.8bn on a like-for-like basis between April and June.

LVMH’s finance chief Jean-Jacques Guiony said:

I do not think we have ever seen such a perfectly negative alignment of planets against us.

He warned that the group’s travel retail business would suffer for several more quarters, as Chinese consumers’ spending at home could not offset their lack of spending abroad.

LVMH shares fell 4.45%, while Gucci owner Kering slipped 1.3% and France’s Hermes lost 2.1%. Moncler, which makes luxury puffer jackets, posted a first-half operating loss for the first time in its history, triggering a 4.36% fall in its share price.

A giant mockup of a suitcase outside an official retail outlet of the French luxury goods maker Louis Vuitton in Shanghai, China. Photograph: YONHAP/EPA

Precious metals rally eases; markets await further US stimulus

The precious metals rally is running out of steam, for now. The price of spot gold has fallen 1.5% to $1,913 an ounce while spot silver has lost nearly 6% to $23.20 an ounce, after hitting a seven-year high of $26.19 an ounce.

There is some profit taking, but the dollar has also recovered some ground after hitting two-year lows.

Markets are awaiting more news on a fiscal stimulus package, after Republicans in the Senate proposed a $1 trillion coronavirus aid bill last night hammered out with the White House. It immediately drew criticism from both camps – Democrats, whose $3 trillion proposal passed the House of Representatives in May, criticised the Republican proposal as too little while some Republicans think it’s too much.

Meetings started immediately after the bill was proposed, and House speaker Nancy Pelosi (a Democrat) said:

We hope that we would be able to reach an agreement. We clearly do not have shared values. Having said that, we just want to see if we can find some common ground to go forward. But we’re not at that place yet.

She and Senate Democrat leader Chuck Schumer met for nearly two hours with Treasury Secretary Steven Mnuchin and White House chief of staff Mark Meadows, who described it as a “good meeting”.

Senator Mitt Romney speaks during a news conference on Capitol Hill in Washington, Monday, July 27, 2020, to highlight the Republican proposal for the next coronavirus stimulus bill. Photograph: Susan Walsh/AP

Updated

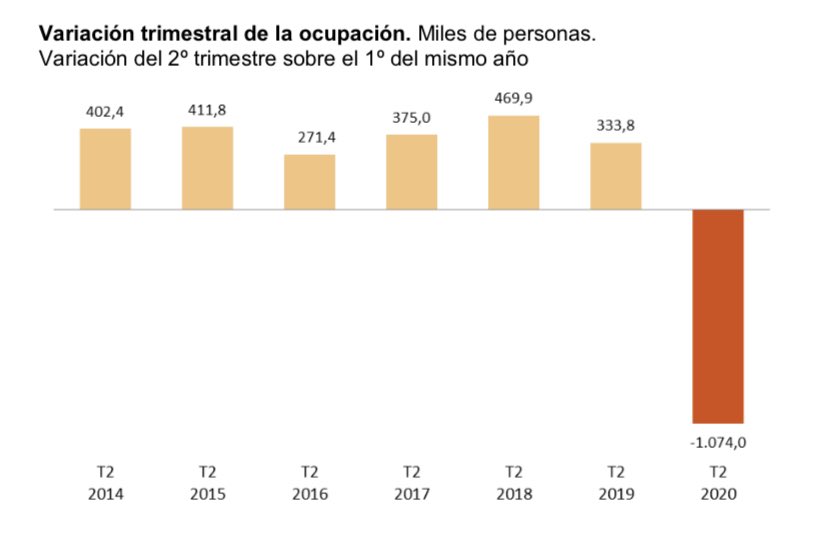

One million jobs lost in Spain because of the coronavirus crisis – that’s a staggering number. Economists say it’s worse than during the financial crisis.

Daniel Lacalle

(@dlacalle_IA)Spain 🇪🇸 One million jobs lost in a quarter. Worst quarter than peak of previous crisis. Including furloughed jobs, 26% of labour force in some form of unemployment benefit scheme. pic.twitter.com/Evf8jBkq1K

Spain’s jobless rate rises to 15.3%; 1m jobs lost due to Covid-19

Spain’s unemployment rate rose to 15.3% in the second quarter, from 14.4% in the first. It’s the highest rate since the first quarter of 2018, albeit not quite as bad as expected – economists had pencilled in a rise to 16.7%.

The number of people out of work increased by 55,000 to 3.37 million, said Spain’s national statistics agency.

The jobless numbers are set to swell in coming months, with the current figures not capturing the full extent of the crisis. Workers who are in a furlough scheme are not counted as unemployed.

The statistics office also said that just over a million people lost their jobs during the quarter, but were not included in the count as they didn’t meet the technical definition, such as active job search.

Eduardo Suárez 😷

(@eduardosuarez)#COVID19 distroyed at least 1 million jobs in Spain in 2Q 2020.

Unemployment rate: 15% https://t.co/emdqIPAhNw pic.twitter.com/V6GTYmmgXl

Updated

Julie Palmer, partner at business advisory and restructuring firm Begbies Traynor, says:

The success of Greggs has been the envy of the high street in recent years, however, even the bakery chain hasn’t been immune to the impact of Covid-19 which has forced its stores to close and eaten away at its top line.

For Greggs, achieving rent reductions from landlords will be first on the tick list, and indeed this has been a priority for many on the high street. But once these costs have been reduced its push to return to success will begin. And given its track record of marketing & PR success with its famous vegan sausage roll, I wouldn’t be surprised to see another high profile campaign on the horizon that captures the sentiment of a nation experiencing seismic change.

Let’s have a look at today’s corporate news. Greggs, Britain’s biggest bakery chain (known for its vegan sausage roll) has warned that sales won’t get back to pre-pandemic levels for as long as physical distancing continues.

But it’s fared better than other retailers: sales are now running at 72% of the 2019 level. All of its 2,050 stores reopened by July, after being forced to close during the Covid-19 lockdown imposed on 23 March. Greggs made a £65.2m loss before tax in the first half, compared with a £36.7m profit a year ago.

People are seen outside a Greggs store. Photograph: Lee Smith/Reuters

Updated

And we’re off. UK and European shares have edged higher at the open.

- UK’s FTSE 10 up 0.2%

- Germany’s Dax up 0.4%

- France’s CAC down 0.2%

- Spain’s Ibex up 0.3%

- Italy’s FTSE MiB up 0.08%

Last night Spain’s prime minister, Pedro Sanchez, criticised the UK’s decision to impose a 14-day quarantine on travellers entering the UK from Spain – a popular destination for UK holidaymakers. He pointed out that much of the country had a lower infection rate than the UK.

According to the Daily Telegraph, the UK government is planning to cut quarantine periods for travellers arriving in the UK from 14 days to 10 if they test negative for coronavirus. You can read more on our UK live blog:

Introduction: Europe to open higher

Good morning, and welcome to our rolling coverage of the world economy, the financial markets, and business.

Gold has continued its rally amid fears of a second Covid-19 wave and mounting US-China tensions. Regarded as a safe-haven investment in times of turmoil, the precious metal blasted to $1,980 an ounce, a fresh record high and not far off the $2,000 an ounce level. Is now hovering around $1,940 an ounce as some investors have cashed in their gains.

The dollar has bounced back a bit after hitting two-year lows yesterday, ahead of the US Federal Reserve meeting that begins later today and wraps up tomorrow. The Fed is expected to reaffirm its super-easy policies, and might signal its willingness to tolerate higher inflation in the long run which would allow it to keep interest rates low for longer. Against a basket of currencies, the dollar rose 0.2% to 93.918 after touching a two-year low of 93.492.

European stock markets are expected to open higher after finishing in the red yesterday. Wall Street has fared better, thanks to the popularity of tech stocks such as Apple, Facebook, Twitter and Google parent Alphabet, which will report results later this week. Asian stock markets traded flat to positive.

Ipek Ozkardeskaya, senior analyst at Swissquote Bank, says:

It is hard to predict the short-term market direction in such choppy conditions. Hope for more monetary and fiscal stimulus keep investors on track for buying equities, however, the company fundamentals and the economic situation don’t improve at the desired speed.

This means that the country and company debts are exploding without a concrete positive impact on businesses and economies. And as we move forward, the margin for more stimulus tightens. When and how this would impact the market sentiment is yet to be seen.

It’s another light day on the economic data front. Spain’s unemployment rate is expected to rise to around 16.7% from 14.4%. The country has been hard hit by Covid-19 and the UK’s decision to take it off the safe-country list at the weekend has dealt it a big blow, as tourism will suffer.

The Agenda

- 8am BST: Spain unemployment rate (forecast: 16.7%)

- 11am BST: CBI retail sales survey (UK)

- 3pm BST: US consumer confidence (forecast: 94.5)

Updated

More Stories

Healing Streams Live Healing Services with Pastor Chris: Miracles Await this March 14th – 16th, 2025!

Essential Care for Hermann’s Tortoise: A Guide to Thriving Pets

Nail Decisions: Which is Better for You, Acrylic or Gel?