Many companies are unable to repay loans sanctioned by the Ministry of Economy (MEIE). In total, the government could lose around $600 million due to risky financial interventions.

• Also Read: Help for businesses: A nearly $4 billion bill over ten years

• Also Read: Quebec will go into $2 billion in debt to help businesses

In the 2022-2023 report of the Economic Development Fund (FDE), Quebec established a value of more than $586 million in loans “for which there is no reasonable guarantee of recovery and for which [le gouvernement] Derecognition of interest income.

As of the end of March, there were 144 loans with an average value of nearly $4.1 million on which borrowers had defaulted on interest payments.

Of this $586 million, “there's a good chance we won't get any of it back,” asserted Aurelie Desfleurs, an accounting professor at the University of Sherbrooke.

A year earlier, 96 loans were in serious trouble, totaling $478 million (an average of $5 million per loan).

“It's starting to get harder”

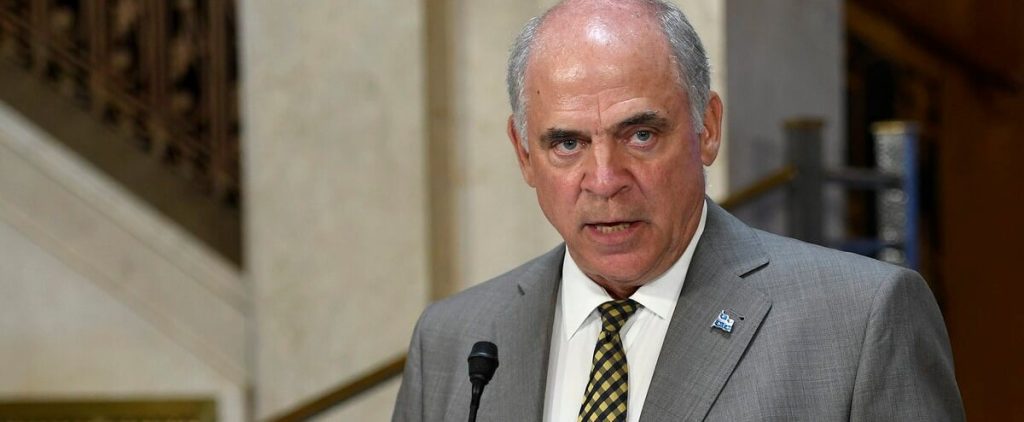

“There are many businesses that are having trouble repaying their loans. Maurice Gosselin, an accounting professor at Laval University, said the economy “is still an indication that it's going to be a tough start”.

“The quality of borrowers seems to be deteriorating,” said Felix Jogning, professor of accounting at the University of Sherbrooke.

High-risk amounts of $586 million represent about 16% of the approximately $3.8 billion provided by MEIE to businesses as of March 31. This is higher than the 14% recorded in 2021-2022, but still lower than previous years.

Interestingly, the entire $3.8 billion loan portfolio is subject to provisions for losses “based on an assessment of their level of risk,” Investment Quebec (IQ), which manages FDE for the government, said in response to a request for access. For information.

As of the end of March, provisions recorded in FDE accounts were approximately $888 million, or 23.5% of the total value of the business loan portfolio.

This compares to a ratio of 22.3% for loans granted by Canada Economic Development Quebec Regions, a federal agency similar in role to the MEIE.

Partial grants

“The government is taking a lot of risks,” said M.me Flowers. Some loans may be treated as grants.”

IQ ensures that the government takes all necessary steps to increase the chances of repayment of loans made.

“If Quebec companies are well positioned, the counter-cyclical role of Investment Quebec is unique to support them. That's why we support businesses. That's why we can withstand accidents. That's why our financing is more patient,” said Isabelle Fontaine, a spokeswoman for the state-owned company.

About $3.8 billion over ten years

The final defeat News magazine MEIE's generous business aid has cost taxpayers nearly $3.8 billion over 10 years, it revealed. This does not include the total amount invested by the state in companies, but only those lost due to bankruptcy or other financial difficulties.

Despite the importance of the sums involved, the government gives very little detail on distressed loans. It is impossible to know which companies are in question unless one of them is insolvent.

“We only disclose what is necessary. It's rare for people to be exposed above the minimum,” says Aurelie Desfleurs.

For his part, Maurice Gosselin believes that in Quebec, it is time to “discuss” the appropriateness of granting too much aid to businesses.

“In 2024, given the low unemployment rate we have, the question we can ask ourselves is: Should we still be supporting these fragile companies that are creating jobs? He asks.

MEIE Business Help in Statistics

- Total loans: $3.77 billion

- Present value of loans (net of loss provisions): $2.89 billion

- Equity investments (at cost): $2.19 billion

- Interest Free Loan Ratio: 40%

- Proportion of loans with an interest rate of 3% or less: 21%

- Net cost of business assistance to taxpayers in 2022-2023: $475 million

Note: Data for Economic Development Fund as on March 31, 2023.

More Stories

Sportswear: Lolle acquires Louis Garneau Sports

REM is still innovative enough to foot the bill

A trip to the restaurant with no regrets for these customers