Justin Trudeau's Liberals' stock in trade has always been “the middle class and those who work hard to be part of it.”

So at the start of a tough election campaign, the Trudeau government is ramping up the number of ads aimed directly at the “lower middle class,” which is dragging the devil by the tail.

Paying too long and too expensive

One of the most important aspects of household wealth is property.

For many, access to property is a forced saving mechanism.

However, houses are rarer and more expensive. The recent reductions in interest rates are not enough to provide some breathing space to buyers who cannot afford to become homeowners.

Trudeau's solution? Let's extend mortgage loan forgiveness for new homes to 30 years. Payments are low and more people can afford it.

The other side of the coin? The interest payable is very high and buyers also have to pay a premium (between 2.8 and 4%).

The smaller your down payment, the lower your payments, but the more you pay.

Buy payments

The Trudeau government's proposed relief does not address the issue of new housing affordability. It is a magic trick to make the middle class feel that something is being done to relieve them.

Additionally, nothing is being done to equip young people with savings.

Today, you no longer buy a home, you buy a down payment. We no longer buy a car, we buy a payment.

Rather than lowering the standards for access to property, we should tighten them.

Increasing the required down payment and extending the loan tenure to 25 years is good for creating a culture of savings. Many people live beyond their means.

More Stories

Russia imposes fines on Google that exceed company value

Historic decline in travel in Greater Montreal

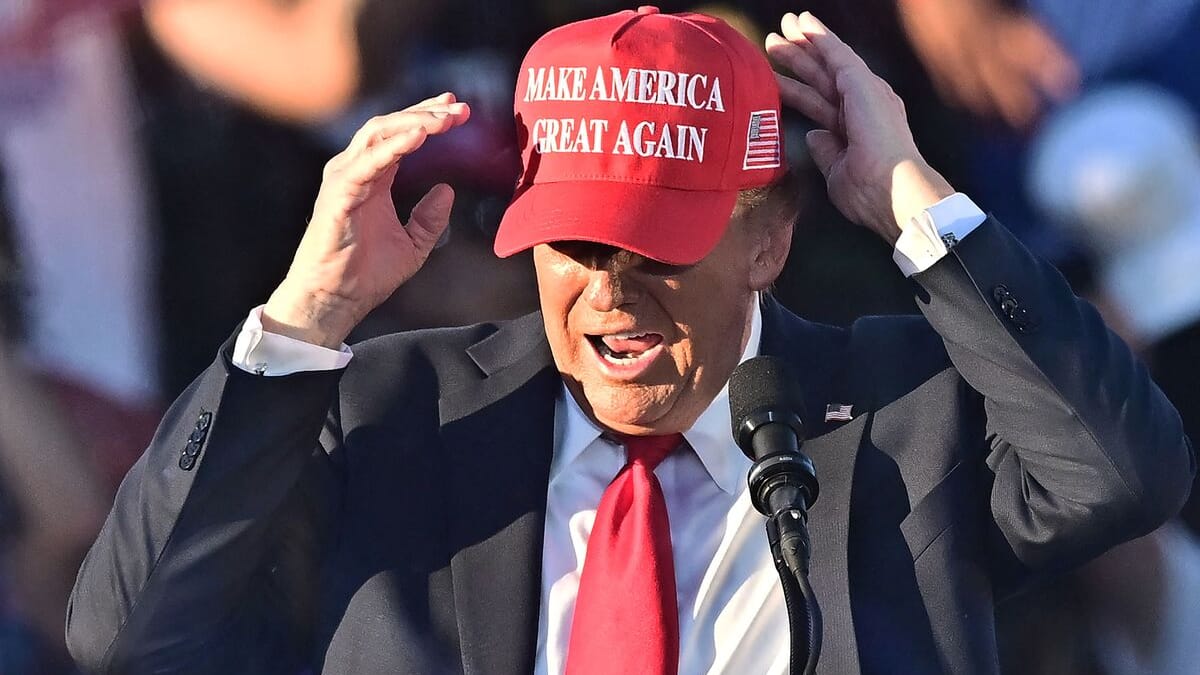

Punches on the “Make America Great Again” cap: Two passengers kicked off the plane