Even though 6% of Desjardins service centers have reduced the use of cash to non-existent, there is a real battle between merchants who reject it and those who accept it. The Journal Consider this issue affecting Quebecers' wallets.

In recent days, The Journal Reports that carrying $2,000 in cash will be more difficult due to a new provision in the law.

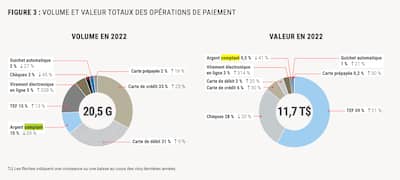

What happens on the ground when we know that according to Payments Canada, the volume of cash transactions has fallen more than 59% in seven years and last year only 8% of merchants were accepting cash in their physical stores. Bank of Canada?

For Blainville resident Gilles Grisay, 75, doing without was out of the question.

“I also pay my bills in cash. “I come to cash my pension check once a week,” he whispers.

“I pay in cash wherever I go, like in a restaurant. I always have $100 in my pocket,” he adds.

“There is no question of me working in banks. I work for myself and I don't see the day that will change,” protested Vincent Beck, co-owner of Glaces et Sorbets Chem Koba, a mile-end establishment.

This immigrant of French origin made no secret. On the sidewalk leading to his business, posters warn him that everything is done in cash.

“It's always been that way. We have been here for 14 years,” he said.

Wilensky's, a legendary sandwich shop in Montreal founded in 1932, did not allow electronic payment before the pandemic. But fears that some customers would handle cash convinced its owner to try a debit-card-only experiment.

“Debit system is cheaper than credit for the merchant. And we noticed it was smooth on the counter,” observes its owner, Sharon Wilensky.

“But even though payment by debit card is now allowed, I'd say between half and two-thirds of our customers continue to pay in cash,” she continues. […] Our long-time customers are used to it. It's so funny.”

Attacked by cards

At Complexe Desjardins, Jean-Pierre Mercier, president and third-generation owner of Gio Mercier Boutique, experienced the opposite.

“Only 10% of our sales are in cash. We used to make one deposit a week, we only do one now,” he says.

“A year ago, it was 20% to 30%. is decreasing Today, people buy travel items for $2.99 and pay with a card. We associate costs with it,” says the man, who has been selling backpacks and travel bags since the 1920s.

A few blocks away, a neighborhood thrift store owner was experiencing the same thing.

“I would easily say 90% of my clients have no money in their pockets. Often even any bank card, in a small matter. They pay me directly with their cell phone,” he concluded.

-In collaboration with Julian McEvoy

Highlights

According to Payments Canada, cash transactions account for 10% of total payment transaction volume, especially for low-value transactions, which average $29.

We swear by transfers only

More than nine out of 10 young people in Quebec make at least one interac transfer per month, reveals a Léger survey from April 2023. If young people embrace virtual money, older people are also on board, albeit less so. Only 71% of boomers (ages 60 to 78) have exchanged money through an Interac transfer in their lifetime. Canada to reach 1 billion transfers milestone in 2023

Interac transfers in Quebec

- 2018: 76 million transfers (+55%)

- 2019: 107 million transfers (+40%)

- 2020: 155 million transfers (+ 45%)

- 2021: 206 million transfers (+32%)

- 2022: 220 million transfers (+11%)

- 2023: 220 million transfers

Interac e-transfers in Canada

- 2018: 347 million

- 2019: 485 million

- 2020: 705 million

- 2021: 937 million

- 2022: 1.04 billion

- 2023: 1.03 billion

Source: Interac

More Stories

Russia imposes fines on Google that exceed company value

Historic decline in travel in Greater Montreal

Punches on the “Make America Great Again” cap: Two passengers kicked off the plane