A new report from the Parliamentary Budget Officer (PBO) indicates that inflation and rising interest rates will erode the purchasing power of Canadians, especially low-income households, starting in 2022. On the other hand, better off families increased their purchasing power during this period.

Parliamentary Budget Officer Yves Giroux said that since the last quarter of 2019, the average purchasing power of Canadian households has increased by 21%. This gain was made possible by government transfers, salary hikes and net investment income.

However, this conclusion does not provide a comprehensive picture of the recent evolution of purchasing power in Canada. Indeed, it is generally accepted that inflation and accompanying monetary policy tightening have a disproportionate impact on the purchasing power of households depending on their income level.

Underlines the report. For households in the two least well-off quintiles [parmi les 40 % les moins riches, NDLR]A more modest increase in income was not enough to counter the impact of inflation on their purchasing power.

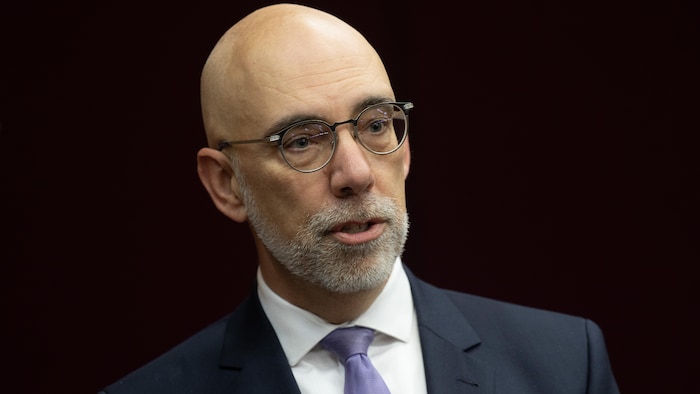

Parliamentary Budget Officer, Yves Giroux. The organization under his leadership is a neutral and independent body of the Canadian Parliament whose mission is to inform decision-making, particularly by providing economic analyses. (archive photo)

Photo: Canadian Press / Adrian Wilde

Report of DPB It indicates that the investment income of households in the first quintile, i.e. the richest 20%, grew faster than their interest payments on their debts. Hence, the net increase in their income is higher than inflation and strengthens their purchasing power in 2023.

For other households, interest payments on their debt grew faster on average than their investment income last year.

The Bank of Canada has kept its key rate high in recent years to curb inflation in the country. For the first time in four years, it has been gradually receding since this summer.

Photo: Radio-Canada / Benoit Roussel

As a result, households in the third and fourth quintiles saw their purchasing power stagnate, while that of lower-income households declined.

The DPB It also emphasizes that purchasing power has developed differently from one province to another. Quebec, Ontario and British Columbia were among those with average purchasing power increases, while Newfoundland and Labrador, Nova Scotia and Alberta experienced declines in this index.

Between the last quarter of 2019 and the first quarter of 2024, the purchasing power index increased by 3.9 percentage points in Quebec, 3.3 points in Ontario and 1.3 points in New Brunswick.

More Stories

Russia imposes fines on Google that exceed company value

Historic decline in travel in Greater Montreal

Punches on the “Make America Great Again” cap: Two passengers kicked off the plane