When you run a large company and two employees say they cheated, you fire them and call them a bad apple. It corresponds to an inevitability: in all organizations, we find bad apples, people who cheat, who steal, who evade the rules.

But if hundreds of employees have committed fraud, that is a different matter! We can no longer talk about some simple exceptions. Instead, we should be concerned more broadly with what is happening in the organization.

What happened at the Canada Revenue Agency (CRA) with the administration of the Canada Emergency Response Benefit (CERB)? Since the start of the program, which was quickly launched during the pandemic, there have been fears of fraud. And there are many. But no one suspected that a massive fraud would be uncovered among the officials responsible for the programme.

Widespread fraud

A year ago, the CRA admitted it had to fire 120 employees who cheated to get CERB payments they weren't entitled to. The investigation continued and last March, it revised this number upwards by announcing the layoff of 232 employees.

New update this week: We are now talking about dismissals of 330 civil servants who defrauded the PCU. In addition to this, disciplinary measures were attached to a few dozen cases that were said to be less serious.

As a taxpayer, I welcome the fact that even after all these years, we are bringing the investigation to a conclusion in these cases of fraud by insiders. Above all, the fact of dismissal demonstrates seriousness in the handling of cases and sends a message to others.

However, I cannot be satisfied with such a simple conclusion: villains eliminated, case closed. When employees cheat by the hundreds, it raises deeper questions.

Who manages?

Who appoints state employees to sensitive positions who play with our money and touch sensitive tax files of taxpayers? How are applications filtered? Are we taking precautions (personality tests, criminal background checks)?

Once they are hired, what messages are sent to staff? What are the consequences for them in case of illegality? What kind of oversight is there in program management? Are there basic internal rules to prevent an agent from handling his own file or that of his relatives?

During the pandemic, the CRA asked CERB to manage it, but in normal times, the same teams manage tax credits and tax benefits. Taxpayers must be able to count on civil servants of impeccable integrity. The CERB model is not very reassuring.

When the CRA reports hundreds of fired employees, I apologize, but there must be some bosses who pay for the lassitude that allowed them to get caught.

More Stories

Russia imposes fines on Google that exceed company value

Historic decline in travel in Greater Montreal

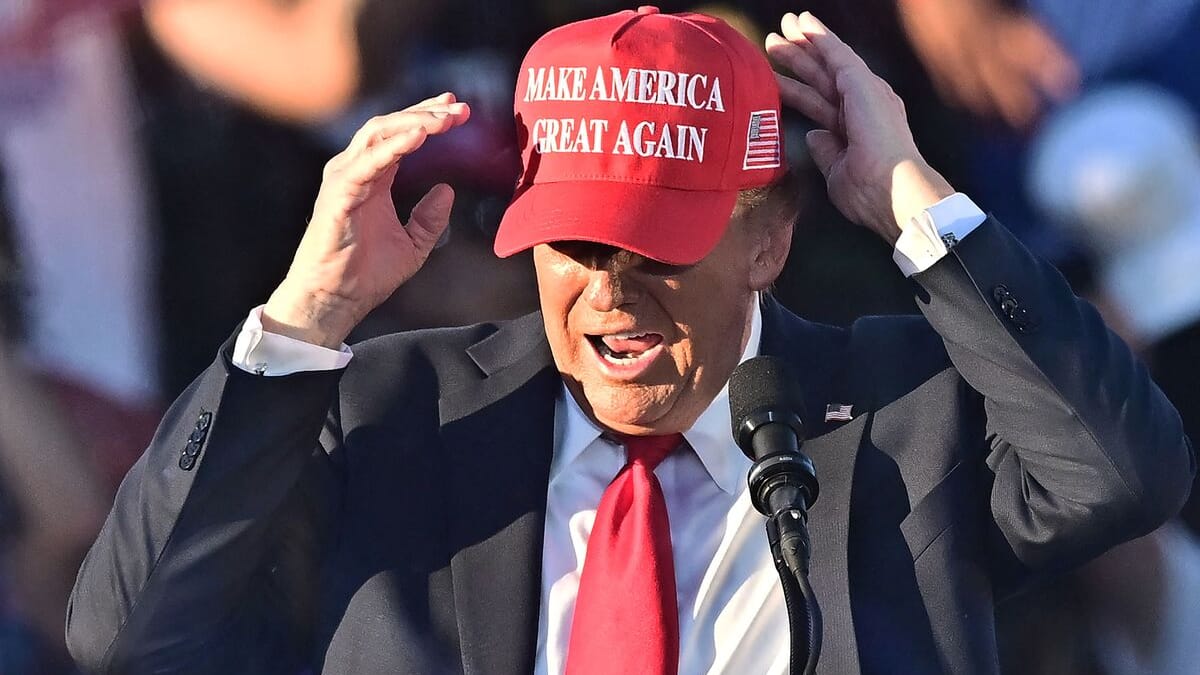

Punches on the “Make America Great Again” cap: Two passengers kicked off the plane