Owners who regularly rent out their accommodation on Airbnb will have to pay a hefty resale tax.

The Tax Court of Canada recently handed down a decision confirming that taxpayers who frequent rental platforms qualify for the 13% Harmonized Sales Tax (HST) on their property, reported Thursday. Toronto Star.

The sale of a principal residence is generally exempt from this tax. According to this decision, if the seller uses his property for periodic short stays of visitors, the entire amount of the transaction will now be taxed.

So fans of short-term rentals have to drop tens or even hundreds of thousands of dollars when selling their property. For example, a transaction that reaches one million dollars is taxed at $130,000.

The decision comes in the wake of a real estate transaction in Ottawa in which the Tax Court of Canada confirmed that the seller must pay HST on the sale of his condo rented for short-term stays through Airbnb over a 14-month period. .

The court held that the condo was not a “residential complex” at the time of sale, but was being operated as a hotel.

When asked by Toronto media, real estate lawyer John Zinati said that those who rent out their property occasionally do not need to pay this tax. “It had to be on a regular basis,” he recalls.

Another attorney in the field, Dale Barrett, explains Toronto Star There is a rental threshold of 90% of the property that the seller must not meet in order to avoid paying HST.

“Be careful if you decide to rent short-term,” he added, but lamented that the method for calculating the 90% threshold was currently “not clear”.

More Stories

Russia imposes fines on Google that exceed company value

Historic decline in travel in Greater Montreal

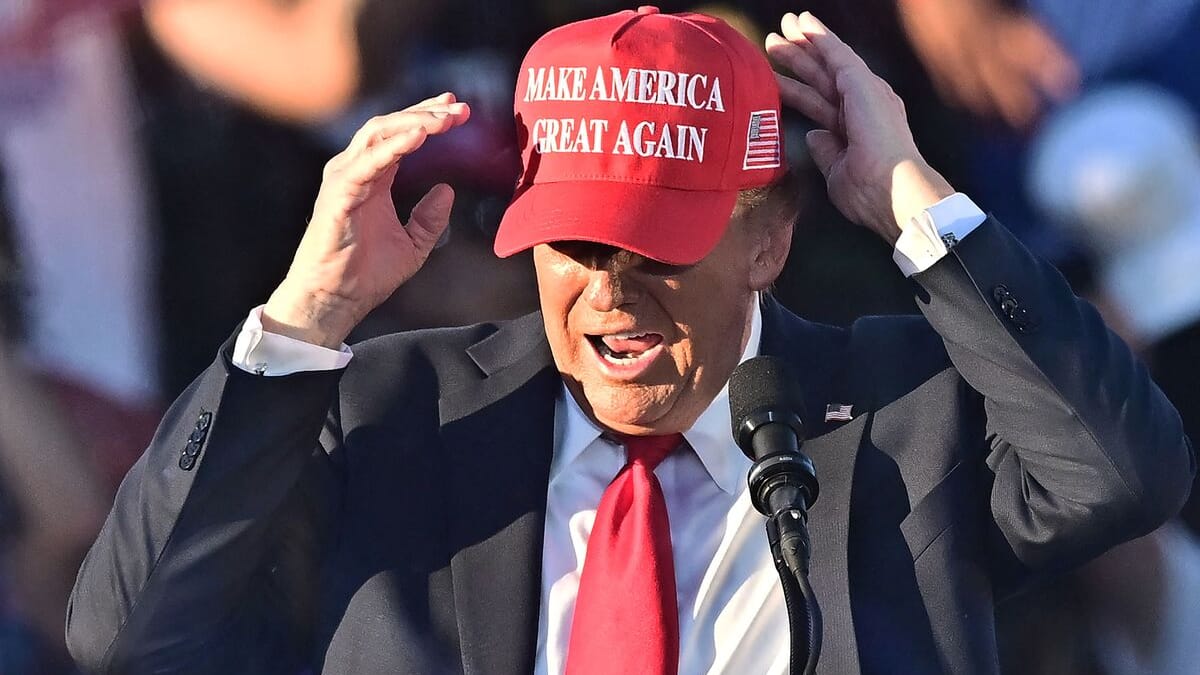

Punches on the “Make America Great Again” cap: Two passengers kicked off the plane