(Bloomberg) — China’s fairness market is firmly in the spotlight right after an practically unprecedented rally that helped raise world-wide stocks to a a single-month large.

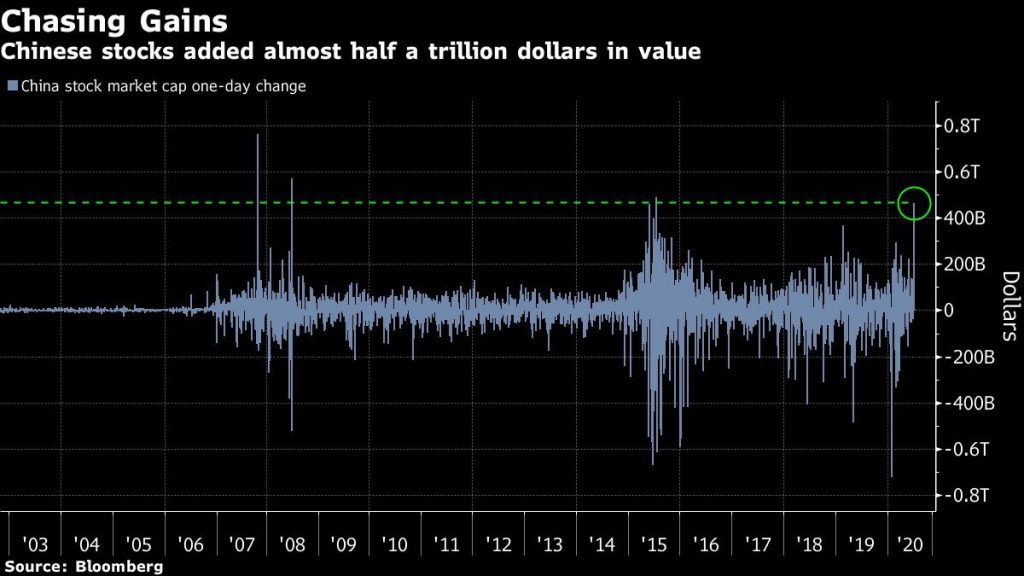

The speed of the previous week’s gains in China is in several ways unseen considering the fact that the inventory bubble that burst five decades back. Monday’s surge by yourself additional far more than $460 billion to Chinese stock values, driving just a single day in July 2015 as the most important maximize in shareholder prosperity considering the fact that the international money disaster.

The progress continued on Tuesday, although at a slower tempo. The CSI 300 Index rose 1.9% as of 1:31 p.m. in Shanghai to prolong its 5-calendar year significant, with investing quantity a lot more than three situations the 3-month whole-day average. The offshore yuan strengthened earlier 7 for every greenback for the initial time considering that March.

China’s condition media struck a a lot more measured tone on Tuesday, after previously publishing commentaries that highlighted the situation for shopping for shares. Two newspapers urged buyers to be rational: the Securities Moments — one particular of China’s most widely circulated monetary publications — said buyers must be aware of potential dangers and not use the industry as way to make a fortune right away.

“The current market will very likely consolidate just after solid rallies, specifically as large caps have outperformed scaled-down friends by a big margin in the earlier week,” explained Shen Zhengyang, an analyst with Northeast Securities Co. “Regulators wouldn’t want to see swift gains in the industry possibly. But there remain loads of prospects, and traders will continue to rotate into some laggards so the uptrend is nevertheless intact.”

Wang Hongyuan, the co-chairman of First Seafront Fund Administration Co., warned buyers need to be cautious. China’s equities have “the strongest fundamentals in the world” but the bubbles in some areas of the sector “are unseen in 5 yrs and the dangers are large,” he reported in penned feedback shared with Bloomberg.

As China’s limited capital controls restrict the investment decision choices for the country’s savers, this year’s reduced desire charges and the first losses at any time for some well-liked wealth-management solutions are driving retail buyers to shares. But some analysts, as perfectly as mainland media, say the country’s financial recovery and the government’s handling of the coronavirus outbreak have aided underpin the rally.

Mainland traders are counting on the momentum to keep on, escalating the sum of leverage in the equity industry to just about 1.2 trillion yuan ($171 billion), the greatest given that late 2015.

The hazard-on sentiment sent Chinese governing administration credit card debt plunging, with the produce on notes due in a decade climbing more than 3% for the 1st time given that January on Monday. The generate on China’s 10-year governing administration bonds was previous at 3.02%.

A measure of tech shares rose 4.9%, the most since June 1, as the finest performer amongst the CSI 300 Index’s 10 market teams Tuesday. Purchaser shares also rose, with Kweichow Moutai Co. surging 6.3% to get its sector capitalization more than $300 billion for the to start with time.

For more articles or blog posts like this, remember to pay a visit to us at bloomberg.com

Subscribe now to stay in advance with the most dependable business enterprise information supply.

©2020 Bloomberg L.P.

More Stories

Sportswear: Lolle acquires Louis Garneau Sports

REM is still innovative enough to foot the bill

A trip to the restaurant with no regrets for these customers