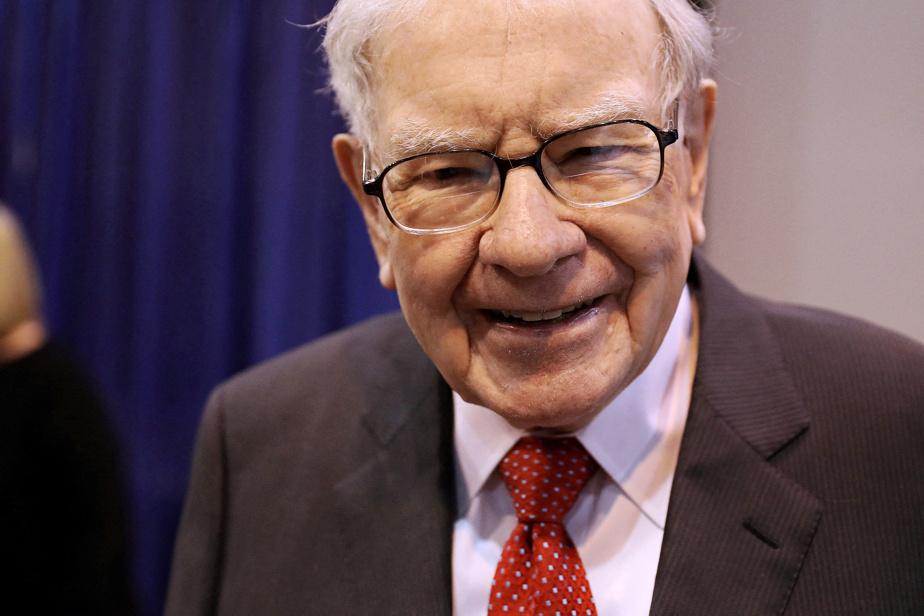

(OMAHA) Warren Buffett’s company announced that its first-quarter profits rose along with the paper value of its investment portfolio, offering some good news to thousands of shareholders who filled an amphitheater Saturday to hear questions from the billionaire and several other senior executives.

“This is a once-in-a-lifetime opportunity” to attend the conference for the first time from Singapore and Mr. said Chloe Lynn, who came to learn from Buffett and his longtime investment partner Charlie Munger.

A Berkshire Hathaway shareholders meeting always draws crowds of people who both admire investors and want to hear all the wisdom they have to offer about recent events and life lessons. And with both men in their 90s this year, some people in the crowd felt the need to attend while both were still around.

“Charlie Munger is 99 years old. I wanted to see him live. It’s on my to-do list, says Sheraton Wu, 40, of Vancouver. I must attend as much as I can. »

One of the few concessions Mr. Buffett makes to his age is that he doesn’t visit a showroom before a meeting. In past years he has reportedly been mobbed by stakeholders trying to take photos with him, while a team of security guards worked to manage the crowd. Mr. Munger has been in a wheelchair for years, but both men are still mentally sharp.

To address concerns about their age, Berkshire Hathaway showed clips of questions about a series of past meetings dating back to the first meeting they filmed in 1994.

Two years ago, Mr. Buffett has finally announced that Greg Abel will replace him as CEO, but he has no plans to retire. Mr. Abel already oversees all of Berkshire Hathaway’s non-insurance businesses.

But not all those who attended the meeting were worshippers. Outside the arena, Berkshire Hathaway NetJets pilots protested the lack of a new contract and pro-life groups displayed signs proclaiming ‘Buffett’s billions killed millions’ in opposition to his many charitable donations to abortion rights groups.

Berkshire Hathaway earned $35.5 billion, or $24,377 per Class A share, in the first quarter on Saturday morning. 5.58 billion or 6 times more than last year’s $3,784 per share.

But Mr. Buffett has long warned that those net numbers could be misleading for Berkshire Hathaway, because huge changes in the value of his investments — many of which are rarely sold — can distort earnings. During the quarter, Berkshire sold just 1.7 billion shares, but the paper posted a profit of 27.4 billion.

The $2.4 billion increase in investment gains this year is due to Berkshire Hathaway’s planned purchase of a majority stake in truck stop company Pilot Travel Centers in January.

Mr Buffett said Berkshire Hathaway’s operating profit excluding investments is a better measure of the company’s performance. By that metric, Berkshire Hathaway’s operating profit rose nearly 13% to $8.065 billion from $7.16 billion a year earlier.