Great morning, and welcome to our rolling coverage of the earth overall economy, the economic markets, the eurozone and company.

Traders have loads to fear about currently.

Tensions amongst the US and China are increasing yet again, as American politicians struggle to concur a new stimulus package and the financial expense of Covid-19 mounts.

China’s yuan weakened right away, dropping below 7 towards the US dollar, following the US requested China to shut its consulate in Houston amid accusations of spying.

Initially Squawk

(@FirstSquawk)CHINA’S YUAN OPENS TRADE AT 7.0088 Per Greenback VS Very last Close AT 6.9989

President Trump has hinted that he could buy much more consulates to close, telling reporters that a fireplace was noticed on the Houston consulate’s grounds after the US Office of State purchased the closure.

“I guess they were burning paperwork and burning papers.”

Beijing slammed the move as an “unprecedented escalation,” and there is converse it could retaliate in form.

China’s CSI 300 stock index tumbled 2% at the commence of trading, just before slowly and gradually recovering its losses as traders digest the scenario:

Investing.com

(@Investingcom)*CHINA’S BLUE-CHIP CSI300 INDEX DOWN Extra THAN 1% IN Morning TRADE pic.twitter.com/9rWAJ61lNP

A renewed US-China trade war is just what the markets really don’t want to see proper now. It would disrupt the entire world overall economy, just as countries all over the world try to return to growth.

Mark Haefele, chief investment officer at UBS World wide Prosperity Management, fears we could experience months, or even a long time, of such jitters:

“US-China tensions could persist into the US election in November. A improve of leadership may well not mark the conclude of tension on China from the US.

Buyers all around the entire world require to take into consideration the implications of trade policy and other big election plan troubles for their portfolios.”

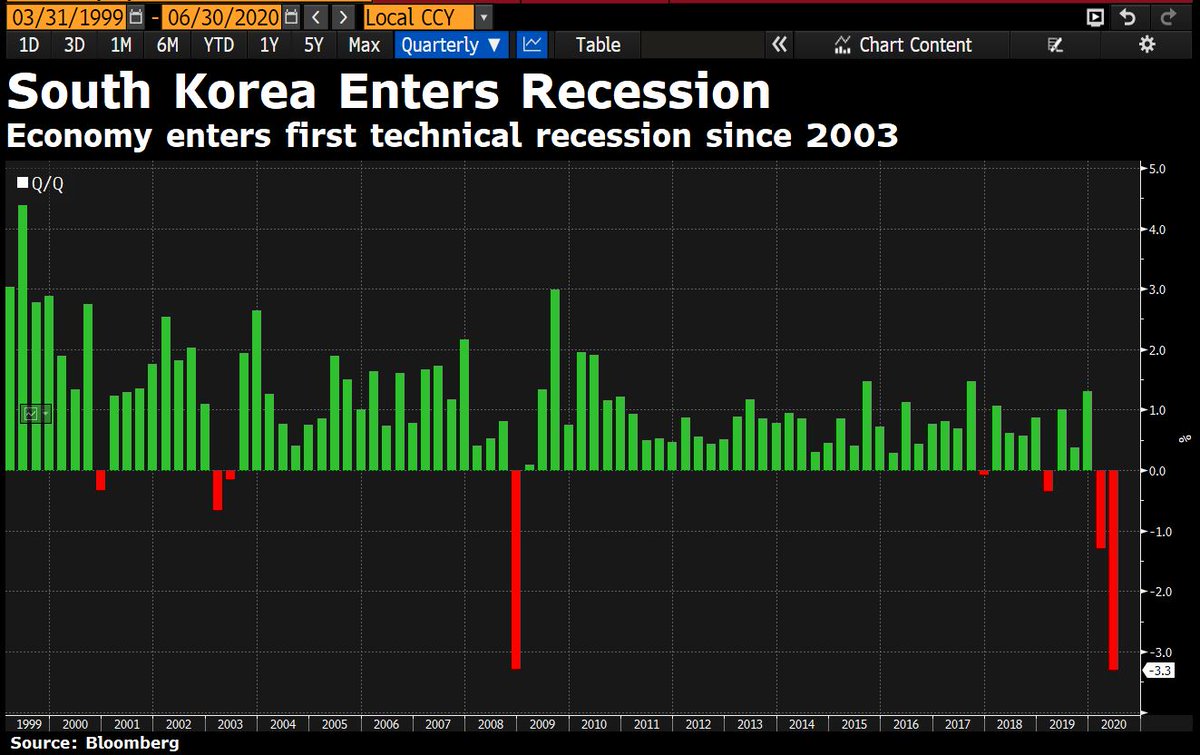

Covid-19 proceeds to wound the worldwide economy as well, with South Korea falling into its 1st recession in 17 a long time:

David Ingles

(@DavidInglesTV)South Korea enters first specialized economic downturn since 2003. pic.twitter.com/gvEDycvnbi

The Covid-19 pandemic continues to rage, with California recorded its best amount of new circumstances in a solitary day and the international whole of conditions exceeding 15m.

With the reopening of America’s economic system stalling, Senators on Capitol Hill are battling to concur a new stimulus deal right before the present-day offer expires.

Democrats are pushing to extend positive aspects for the unemployed, even though the White Household favours a payroll tax lower to set a lot more revenue into the pockets of these who are performing.

Jeff Stein

(@JStein_WaPo)The number I’ve heard additional routinely (such as now) is that GOP will propose $200/7 days Pelosi proposes $600/week & they conclusion up somewhere all over $400/week.

But this report indicates GOP will arrive in decreased, at ~$100/week, which is decrease than what Trump claimed yesterday https://t.co/3cCGRwbhQ5

Jim Reid of Deutsche Lender claims hopes of a quick breakthrough are fading:

The however large caseload throughout the US suggests that the want for supplemental stimulus is however quite acute, nonetheless optimism encompassing a monthly bill getting enacted in the up coming 2-3 months is fading.

Congressional Democrats and Republicans stay almost $2tr aside in funding. Senate Minority Chief Schumer explained late yesterday that it would not make sense for Democrats to commence conversing to their Senate counterparts right until Republican leadership experienced a bill to operate off.

The agenda

- 9.30am BST: Hottest ‘fast indicators’ of Covid-19’s influence on British isles economic system unveiled

- 11am BST: CBI index of British isles organization self-confidence

- 12pm: Bank of England’s Jonathan Haskel webinar: “From Lockdown to recovery – the economic effects of COVID-19”

- 1.30pm BST: Uk weekly jobless figures

More Stories

Healing Streams Live Healing Services with Pastor Chris: Miracles Await this March 14th – 16th, 2025!

Essential Care for Hermann’s Tortoise: A Guide to Thriving Pets

Nail Decisions: Which is Better for You, Acrylic or Gel?