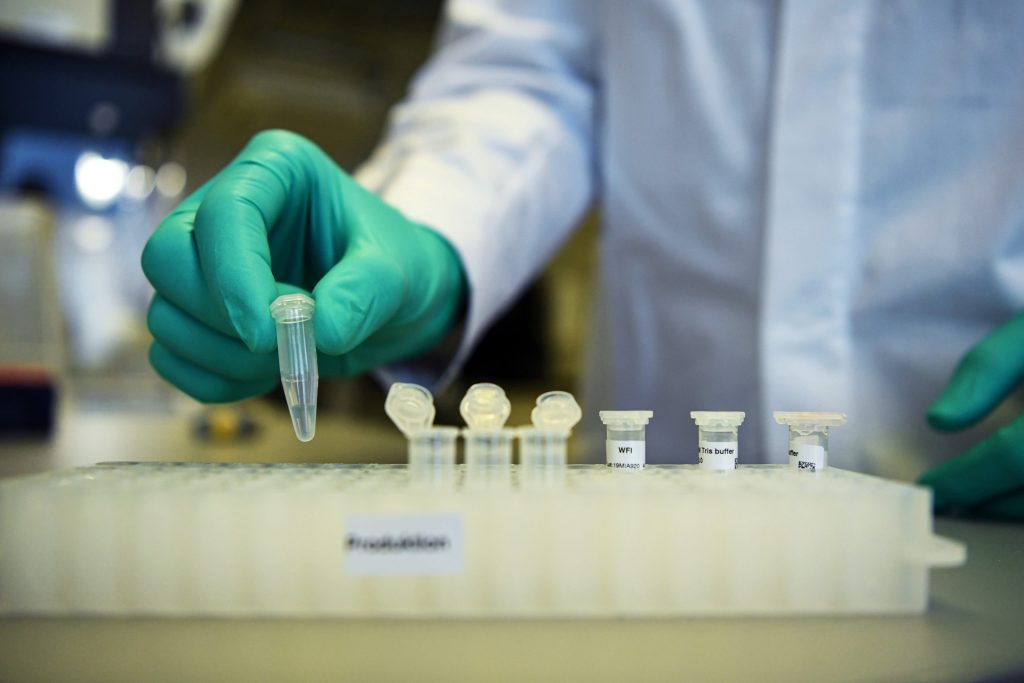

An staff of German biopharmaceutical business CureVac, demonstrates investigate on a vaccine for the coronavirus (COVID-19) sickness at a laboratory in Tuebingen, Germany, March 12, 2020.

Andreas Gebert | REUTERS

CureVac raised $213 million in its original public featuring (IPO) in New York on Thursday, a person familiar with the make a difference stated, location the stage for the very first inventory marketplace debut of a company acquiring a promising vaccine to beat the coronavirus.

The German biotechnology firm sold 13.33 million shares at $16 apiece, the major stop of its indicated selling price selection, the source explained, requesting anonymity forward of an first announcement. The IPO presents CureVac a valuation of about $2.8 billion.

CureVac did not quickly react to a request for remark.

CureVac is exploring how to use messenger RNA to treat a sequence of ailments, which include the coronavirus. It is an experimental tactic that has also been adopted by some of its peers, which include Moderna and BioNTech.

By utilizing messenger RNA, scientists hope they can compel a patient’s individual body to develop proteins that can engage in an significant part in combating illness.

In June, the German governing administration took a 23% stake in CureVac for about $343 million, a indication that it views the company’s exploration to be strategically crucial to its national pursuits. In July, GlaxoSmithKline and the Qatar Expenditure Authority acquired a stake in the organization.

The Tuebingen-dependent corporation, which is also backed by Microsoft founder and billionaire Bill Gates, secured a 75 million euro ($85 million) mortgage from the European Expenditure Bank last month.

Outside of the coronavirus, CureVac is also looking into therapies to battle cancer, rabies, and other diseases. SAP SE co-founder Dietmar Hopp owns a managing stake in CureVac and is expected to hold a tiny much less than 50% soon after the listing, according to a firm filing.

Lender of The united states, Jefferies, and Credit Suisse are direct underwriters on the IPO. CureVac shares are because of to start buying and selling on Nasdaq on Friday underneath the image ‘CVAC’.

More Stories

Sportswear: Lolle acquires Louis Garneau Sports

REM is still innovative enough to foot the bill

A trip to the restaurant with no regrets for these customers