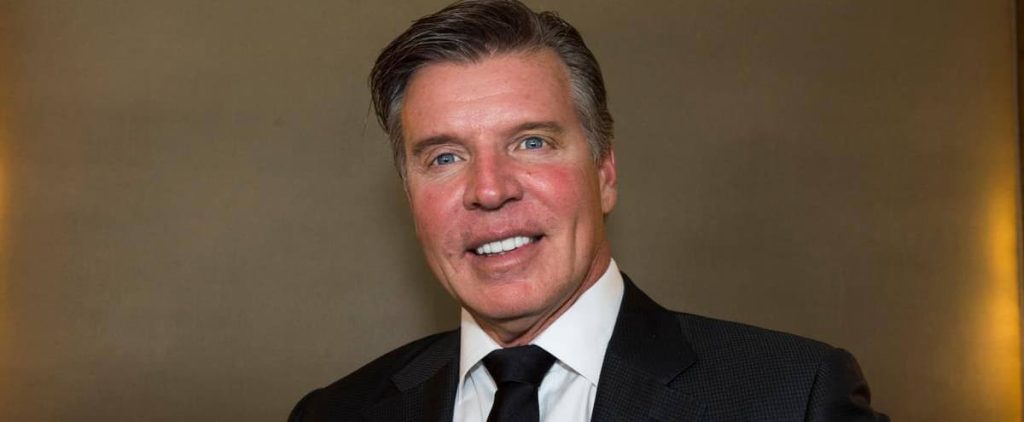

Despite his silence in recent months, Real Boecklin does not intend to abandon group selection without making a last-ditch effort to regain control.

• Also Read: The group began canceling the selection to reduce over a billion in debt

In a letter to National Bank and PricewaterhouseCoopers (PwC), and News magazine Obtained a copy, the Laval businessman said he was preparing to file a global proposal that was in “the best interests of all parties.”

“In the coming weeks (…), we plan to provide you with a constructive overall solution that takes into account the interests of the parties involved in the reconstruction process, as well as our residents, our employees and their interests,” it was written. The rest are our shareholders”.

The sale process has begun

The letter, signed by Real Boecklin, is dated February 20. This comes as PwC, which must appear before Superior Court Judge Michel A. Pinsonault this Wednesday, reports its comptroller’s fourth.

In this document of just over twenty pages, controller Christian Bork argues that the time has come to begin the formal process of a sale or investment request.

“This is said to optimize the chances of recovering the best value for the parties’ property (…) or to find an investor to facilitate restructuring.”

Few clues in sight

Although we tried, it was not possible to speak with the real Boecklin. Moreover, the letter that was sent gives few clues as to the type of “constructive total settlement” envisioned by its author.

At the most, Réal Bouclin confirms that it is “working closely” with RBC Capital Markets to “evaluate and implement” the options “to pursue its important mission” and to “negotiate with financial partners and other stakeholders in the restructuring” on its behalf. process”.

The names of these partners are not mentioned. However, the entrepreneur spoke of “significant progress” with serious financial partners who have a way to support GS’s operations. [Groupe Sélection] In the short, medium and long term”.

Protect its strategic assets

“Our main objective, he continues, is to enable GS [Groupe Sélection] To emerge from the restructuring process in sound financial health, while preserving its strategic assets and operations, including a significant portion of its construction, development and maintenance activities.

In addition to the controller, the missive from Group Selection’s founder was personally sent to two members of National Bank (BN) management, Dana Ades-Landy and Caroline Podsiadlo.

BN led the banking syndicate which, in November, fought against Select Management for PwC’s involvement in the file. A copy of this letter was sent to the main law firms on file, as well as to Investment Quebec.

More Stories

Sportswear: Lolle acquires Louis Garneau Sports

REM is still innovative enough to foot the bill

A trip to the restaurant with no regrets for these customers