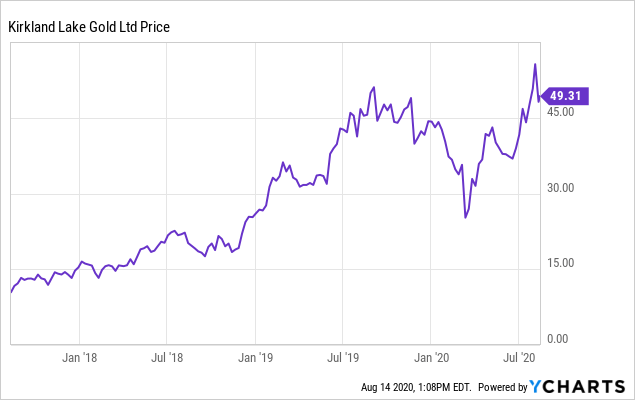

This is an update on Kirkland Lake Gold (KL), a growing gold miner with operations in Canada and Australia. Kirkland Lake Gold is one of the standouts in the mining sector, returning 804% over the past five years, compared to a 63% return in the price of gold (GLD) and an 86.69% gain in the benchmark VanEck gold miners index (GDX), according to Yahoo Finance.

Previous coverage: KL production update and stock analysis

On May 20, I called the stock a buy, stating that the weakness in its share price was temporary and a buying opportunity, and on July 8, with the stock at $45.61, I stated: “I think we’ve still got a bit more upside in its shares. I believe we’ll see Kirkland Lake’s stock break the $50 levels once the miner reports its next earnings report.”

Kirkland Lake’s stock almost hit $55 per share earlier this month and is now flirting with $50 after a small pullback. But is the stock a buy now post-earnings? I break down the company’s earnings report, recent equity sales, its valuation, and my current recommendation.

Kirkland Lake’s Q2 earnings

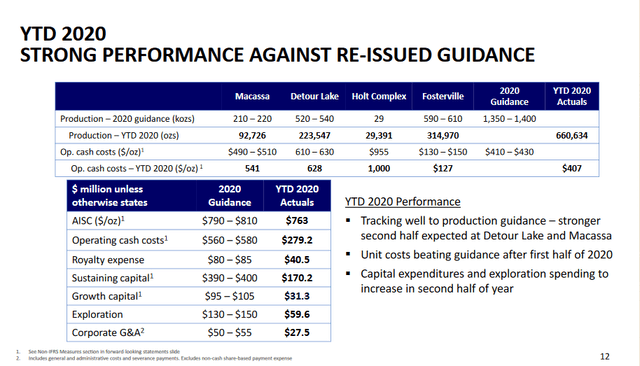

(Kirkland Lake’s year-to-date performance has been strong as expected. Credit: KL Gold presentation)

Kirkland Lake Gold’s Q2 results saw the miner record strong growth in its production, earnings and cash flow despite COVID-19. The Detour Lake mine acquisition in particular has really started to pay off.

The company produced 329,770 ounces of gold, a 54% increase from the prior year (mainly due to the Detour Gold takeover), at all-in sustaining costs of $751/oz ($526 without Detour Lake), versus $638 in Q2 2019.

Net earnings were $351.1 million, or $1.32 per share, a 65% jump from last year, with net cash flow of $463.7 million and free cash flow of $226.7 million.

Sale of Osisko and Novo shares

In a news release on August 13, Kirkland Lake says it has dumped its equity holdings in Osisko Mining (OTCPK:OBNNF), and part of its stake in Novo Resources (OTCQX:NSRPF).

The company says it sold its entire stake in Osisko, selling 32,627,632 shares at a price of $4.45 for a total consideration of $145,192,962. Between June and August, the company sold some of its Novo stake at $3.52 and $3.28, bringing in $2.57 million.

“The sale of Osisko and Novo shares further enhances our already industry-leading financial strength, which will support our efforts as we pursue our key strategic priorities, including investing in our three cornerstone assets and returning capital to shareholders.” – CEO Tony Makuch.

This all but rules out a future takeover of Osisko Mining in my opinion, as it’s clear Kirkland Lake would rather invest in its three core operations, and return cash to shareholders, than take on a new project at this point in time.

Kirkland Lake Gold valuation

Kirkland Lake Gold’s stock isn’t necessarily a deep value play, but it’s not expensive, either. I’ve compared KL stock with some of its peers below:

| Metric | Kirkland Lake | Newmont | Agnico | Yamana |

| P/CF | 11.66 | 14.51 | 20.43 | 10.92 |

| EV/EBITDA | 10.44 | 7.42 | 14.06 | 13.31 |

| P/E | 16.90 | 12.14 | 38.18 | 21.36 |

| P/S | 6.21 | 4.91 | 7.15 | 4.07 |

(Data as of 8/14/20. Source: Morningstar, Seeking Alpha)

The stock trades at a P/E ratio of 16.90X, a price to cash flow of 11.66X, and an EV/EBITDA of 10.44X, according to Morningstar. These metrics are a bit higher than its peer Newmont (NEM); however, lower than Agnico Eagle Mines (AEM) and about the same as Yamana Gold (AUY).

Kirkland Lake arguably deserves a higher valuation than peers given its top-tier mining jurisdictions (Canada and Australia), immense profitability, and organic growth.

Also consider the fact that the average EV/EBITDA ratio for a company in the S&P 500 ranges from 12X to 19X, depending on the sector, according to Siblis Research, while the S&P 500 currently carries a P/E ratio of 29.02, according to Multpl.com.

Technical analysis update

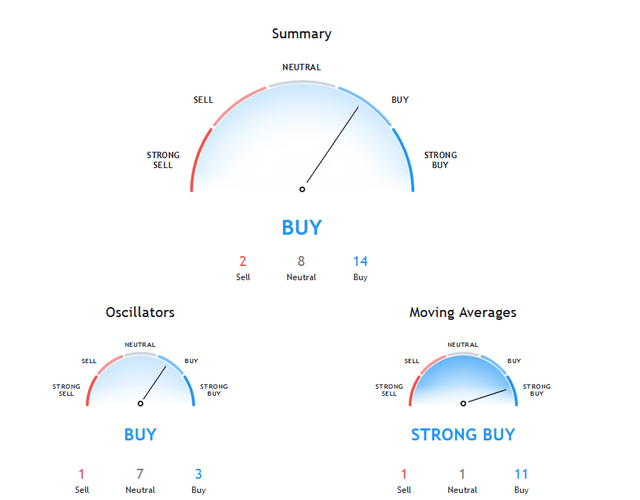

(Kirkland Lake’s monthly technical analysis shows the stock rated as a buy. Credit: TradingView.com)

Here’s a quick technical analysis update.

On the weekly summary, Kirkland Lake is rated a Buy with strong buy signals coming from its moving averages. That’s also the case on the monthly summary, with the stock rated a Buy, and a Strong Buy when it comes to its moving averages.

Kirkland Lake’s 50-day moving average crossed over its 200-day moving average in early April, a bullish signal known as a “golden cross.”

My current recommendation

Based on Kirkland Lake’s profitability and future earnings power with gold at $1,900/oz, I view the stock as a Buy, but not for short-term traders; for investors planning to hold shares for at least 1 year.

In the short term, it’s unclear where the stock is headed. But I think the stock will react positively to the company’s Q3 earnings report (September) when it reports earnings based on an average realized gold price that will likely be above $1,850/oz. It should be a record quarter for its earnings, and potentially for its stock price.

Personally, I’d prefer to see the stock pull back a bit to the $40-45 level before buying more shares, as my cost basis is $20.80. I’m monitoring the stock closely.

In conclusion, Kirkland Lake Gold had a good Q2 2020 given the circumstances, and I believe its future is very bright as I expect the company to essentially print cash from its gold mines for years to come. Its Detour Lake gold mine acquisition is starting to really pay off and will likely support additional dividends and share buybacks.

What do you think of Kirkland Lake Gold? Let me know in the comments.

If you want more gold mining stock analysis, subscribe now to The Gold Bull Portfolio. I help my subscribers find the best money-making opportunities in the gold & silver sector.

Receive frequent updates on gold mining stocks, access to all of my top gold and silver stock picks and my real-life gold portfolio, a miner rating spreadsheet with buy/hold/sell ratings on 110+ miners.

I offer a substantial discount on annual subscriptions as well, and I’m currently offering 10% off for any new subscriber – in addition to the free trial!

Disclosure: I am/we are long KL. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

More Stories

Sportswear: Lolle acquires Louis Garneau Sports

REM is still innovative enough to foot the bill

A trip to the restaurant with no regrets for these customers