Controversial Montreal company Blue Bridge has failed in the Supreme Court and will have to disclose to tax authorities a list of its wealthy clients suspected of using Quebec as a tax haven.

Also read: Due to the trusts in Montreal the French fortune received refuge from the tax authorities

Also read: The Montreal company in France is suspected of tax fraud

Also read: French billionaires hide their fortunes here

The Supreme Court of Canada yesterday refused to hear the Blue Bridge Trust Company’s appeal against Revenue Canada.

Blue Bridge sought to challenge a previous judgment of the Federal Court of Appeals in this case.

Revenue Canada is acting on behalf of France in this matter. French authorities have been trying for years to get their hands on a list of beneficiaries of trusts hosted at the Blue Bridge in Montreal.

The trusts were formerly based in Bermuda, but were transferred to Quebec when the archipelago concluded a communications agreement with France in 2009.

France turned to Ottawa in 2012 to assist in obtaining the information.

Blue Bridge has raised policies for many years before courts to prevent the list from being provided, specifically arguing that it was kept secret by Canadian law.

Former Swiss banker

Blue Bridge is owned by Alain E., a former Swiss banker with offices in downtown Montreal. Wealth management company managed by Roche.

Our Bureau of Investigation is the first media organization in the world to screen French authorities’ suspicions about the Blue Bridge in a two-page research published in 2019.

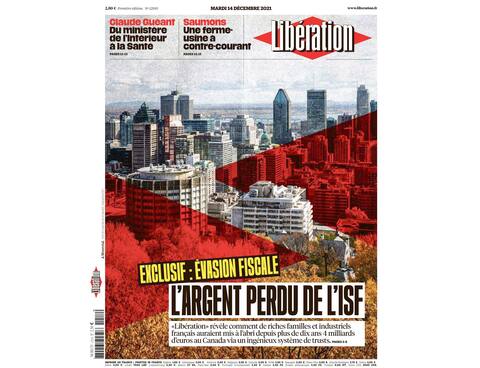

The report raises the question of whether Quebec has become a tax haven for French billionaires.

The names of Blue Bridge and Alain Roach were already mentioned in the media in 2016, during the Panama Papers scandal, a massive leak of documents.

Official notice

Last May, our investigative office received an official notice from the Metropolitan Law Firm to ban us from exposing for the first time the existence of a criminal investigation into France, targeting the Blue Bridge.

French newspaper Release This week is dedicated to a In this case a file of several pages, Baptized daily through the “ISF Gate”.

Familiar families

Release Published a list of beneficiaries, including the Seydoux, Schlumberger and Guerrand-Hermès families, as well as persons of former French aristocrats.

ISF is an acronym for Wealth Tax. According to our Bureau of Investigation and Release Reportedly, the use of Canadian trusts is specifically for French billionaires to avoid paying the non-Canadian wealth tax (ISF). It is also possible to make capital distributions tax-free in France Release.

More Stories

Sportswear: Lolle acquires Louis Garneau Sports

REM is still innovative enough to foot the bill

A trip to the restaurant with no regrets for these customers