Tesla (TSLA) has slashed the cost for its Product Y crossover by $3,000 to $49,990 from $52,990 previously. The go arrives less than four months immediately after Tesla started delivering the car in mid-March.

It is also not the very first price lower of late. Tesla decreased the selling price for the Model S and the Product X by $5,000 and $2,000 respectively in Might.

The selling price cuts were being considered as an “acknowledgment that Tesla is not immune to materials North American demand weak spot,” commented Roth Funds analyst Craig Irwin at the time.

However TSLA subsequently declared full 2Q deliveries of 90,650, effectively ahead of FactSet consensus of 68,380. Product S/X deliveries have been 10,600, ahead of consensus’ 8,660 estimate, while Product 3/Y deliveries have been 80,050 vs. consensus of 59,250 Design 3/Y.

Not that RBC Capital’s Joseph Spak was also impressed. “A fantastic all round functionality in mild of the pandemic, but indications of difficulty for much more mature marketplaces/products” the analyst wrote.

“Yes, TSLA capable to display superior headline quantities relative to an auto marketplace that genuinely felt effect of COVID-19. But we will have to also recall, that TSLA added benefits from coming into a new marketplace this calendar year (sure they offered in China prior, but only commenced earning in China in earnest this 12 months). This of class, counts as expansion, and new marketplaces/items is aspect of the TSLA story” he discussed.

But what seriously stopped the analyst from getting a much more optimistic look at on Tesla stock was the rate. Shares are now investing up a whopping 270% 12 months-to-day.

“Bullishness is really superior we cannot advocate introducing believing that current price tag far more than discounts beneficial arguments” Spak concluded. He has a promote score on the stock and $615 price goal.

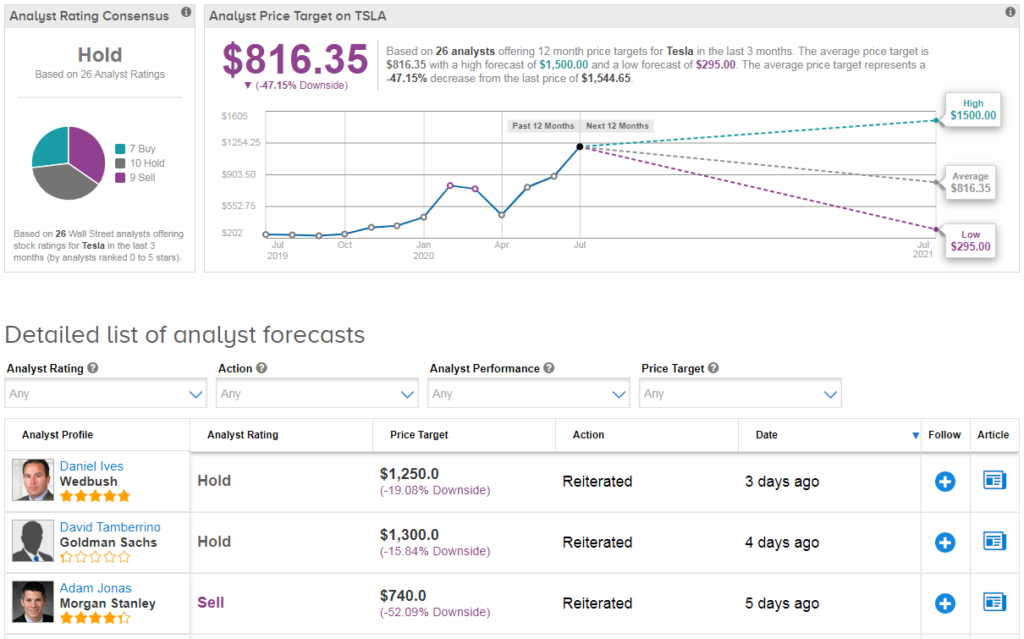

Over-all Wall Avenue analysts are sidelined on the stock’s outlook. The Maintain analyst consensus breaks down into 9 Offer scores and 10 Hold scores versus 7 Invest in ratings. In light-weight of the recent rally, the $816 average value goal now indicates 47% draw back prospective. (See Tesla’s inventory analysis on TipRanks).

Connected Information:

Amazon Delays Prime Working day- This Time Right until Oct

Has Apple Surged As well Considerably, Way too Rapidly? Analyst Weighs In

Alibaba’s CEO Sets Out Ambitious Ambitions Sees 2B Consumers By 2036

More Stories

Sportswear: Lolle acquires Louis Garneau Sports

REM is still innovative enough to foot the bill

A trip to the restaurant with no regrets for these customers