(Bloomberg) — One of Wall Street’s best improvements is currently being hailed as the probable crucial to luring trillions of actively managed dollars to the booming industry for trade-traded resources. But two of the industry’s greatest gamers want no aspect of it for now.

Vanguard Group and Point out Avenue Corp. say they’re in wait-and-see method as energetic, non-clear funds choose their crucial very first actions in the $4.3 trillion U.S. arena for ETFs.

These products and solutions appear with quite a few of the benefits of traditional ETFs but significantly reduced disclosure requirements. That can make so-called ANTs a probable conduit to bring inventory-picking procedures to the exchange-traded universe.

The market’s largest participant, BlackRock Inc., has already submitted to use the framework right after the funds debuted in April. JPMorgan Chase & Co. — which also plans its possess ANTs — estimates non-transparent ETFs could in the end command more than $7 trillion in assets.

Vanguard, No. 2 in ETFs, is in no rush to wade into untested waters, according to its head of ETF solution management.

“This is an chance for us to discover from what other people are performing,” Rich Powers reported in an job interview. “Investors make their way to great lively approaches, no matter of no matter whether it’s first to sector.”

Gradual Get started

So far, it would seem they have however to flock to ANTs.

Soon after remaining in the building for nearly a 10 years, 6 non-clear ETFs have released to date from a few issuers: American Century Investments, Legg Mason Inc. and Fidelity Investments. 5 adhere to significant-cap equities and a person tracks mid-cap shares.

Collectively, they have attracted nearly $240 million in property, with the $133 million American Century Concentrated Dynamic Development ETF leading the pack. Overall performance is mixed: 50 percent of the new solutions are handily beating their benchmarks, two are lagging, and 1 is neck and neck.

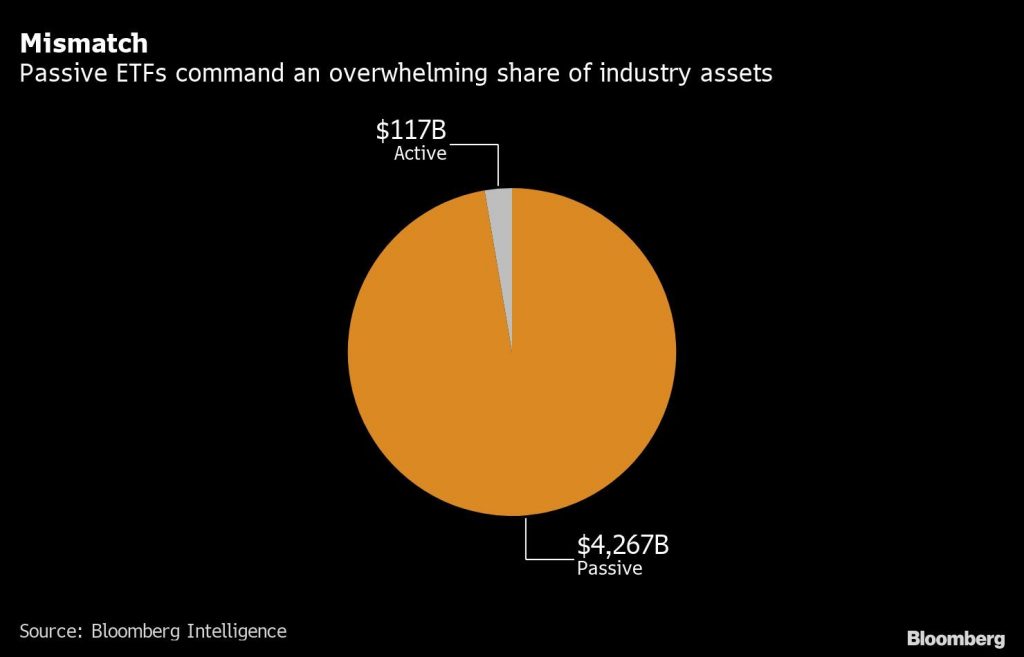

In the eyes of State Street’s Rory Tobin, there are two large hurdles to attracting traders to this new form of fund. To start with, the sheer dominance of passive methods, which account for a lot more than 95% of all U.S. ETF belongings. 2nd, the relative price of the ANTs.

“You’ve obtained your financial commitment proposition, you have obtained your ETF mechanics, and then there is the economics,” said Tobin, world-wide head of State Street’s SPDR ETF company. “How do traders experience about the rate stage at which these are currently being positioned?”

The common expense ratio for the new non-transparent money is .52%. By comparison, the world’s greatest ETF — State Street’s SPDR S&P 500 ETF Have faith in, ticker SPY– has a fee of considerably less than .1%.

To start with Movers

For some marketplace watchers, the query of need runs even deeper than charge. Ben Johnson at Morningstar Inc. reckons all the hoopla about the non-transparent framework has been driven by issuers instead than buyers.

“What has been absent is any apparent indication of demand,” said the director of world-wide ETF exploration. “This is a option in lookup of a dilemma, and the dilemma that ANTs clear up is chiefly in my thoughts an asset administration trouble.”

Nonetheless, issuers stay optimistic. Greg Friedman, head of ETF management and tactic at Fidelity, mentioned the business expects expansion for its merchandise around time, with significant institutional buyers coming on board the moment the cash have a observe record.

American Century claimed it experienced fascination from “a large amount of different get-togethers,” and pointed out that it correctly launched practically at the height of this year’s current market anxiety.

“Almost no 1 was launching ETFs, and practically everyone was pulling theirs back,” mentioned Edward Rosenberg, head of ETFs at American Century.

Examine additional: No In-Human being Conferences, Volatility Behind 86% Drop in ETF Debuts

That variety of perseverance may possibly very well pay out off in the lengthy operate, due to the fact the ETF ecosystem has a keep track of-report of providing a 1st-mover edge.

SPY, for occasion, has accumulated $273 billion in assets since its launch in 1993. BlackRock’s iShares Main S&P 500 ETF, ticker IVV, is considerably less expensive with a fee of .03%. But it continues to be a distant 2nd, possessing gathered $195 billion since its start in 2000.

“The merchandise in current market have tested not only that the structure functions, but that they work efficiently in volatile markets,” according to Rick Genoni, the head of ETF small business for Legg Mason. “It is not unusual for any new strategy, no matter of the wrapper or composition, to practical experience modest sales until finally they have a track history and are out there throughout platforms and we imagine that the ActiveShares ETF structure will demonstrate to be appealing.”

Mutual Benefits

The new funds reveal their holdings just as soon as a quarter, as opposed to the each day disclosures carried out by a frequent ETF.

That’s an alluring prospect for mutual fund supervisors confronting the ongoing march of cheaper, simpler to access passive products and solutions. They can adopt very similar buildings when shielding their secret sauce from entrance-running or replication by rivals.

But lingering concerns about how the construction will hold up through moments of sector stress are preserving asset allocators this kind of as E*Trade Financial’s Mike Loewengart at bay.

The share value of a classic ETF normally stays in lockstep with the worth of their fundamental holdings thanks to specialized traders identified as licensed members, who action in to capitalize on any value discrepancies and retain the two shifting in tandem. With an ETF that conceals its holdings, that process seems to be a bit different.

Most ANTs introduced so far use the so-named ActiveShares product from Precidian Investments. The framework publishes an indicative worth just about every next to assistance traders make a selling price and enlists an company broker — recognised as an licensed participant agent — to confidentially acquire and market securities for the APs.

Different methodologies from Fidelity, T. Rowe Value Group Inc., Natixis SA and Blue Tractor Group LLC have also been authorized.

“It has not truly been tested nevertheless,” mentioned Loewengart, the handling director of financial investment tactic at E*Trade. “They need to have to become additional seasoned.”

(Updates with Legg Mason remarks.)

For more posts like this, you should visit us at bloomberg.com

Subscribe now to continue to be in advance with the most reliable small business news supply.

©2020 Bloomberg L.P.

More Stories

Sportswear: Lolle acquires Louis Garneau Sports

REM is still innovative enough to foot the bill

A trip to the restaurant with no regrets for these customers