National Bank’s big boss still doesn’t see a recession on the horizon. At least not yet.

Posted at 6:54 am

Updated at 4:09 pm.

“The most likely scenario for the Canadian economy is a slowdown, a soft landing,” Laurent Ferreira said Wednesday at the National Bank’s quarterly results presentation.

“Although inflation has shown signs of easing recently, it remains very high. The Bank of Canada should continue to raise interest rates next month to dampen demand and ease inflationary pressures. Central banks will begin to focus on the impact of rate hikes on unemployment and may adjust accordingly. »

Interest rates should normalize in the fall above the 3% mark, he said. In this scenario, the unemployment rate should stabilize at just 5.5% in 2023, he said.

Canadian economy remains strong in CEO’s eyes. “There is a lot of savings. The unemployment rate is very low. And the high cost of raw materials is a godsend for the country’s economy. »

However, he noted that the current environment is “complex and uncertain”, dominated by high inflation, rising interest rates and high geopolitical risks.

As the election campaign officially begins in Quebec, Laurent Ferreira believes that short-term uncertainty (the next 6 to 12 months) should be put aside and that the main economic issue is long-term growth.

“I firmly believe in the reindustrialization of Quebec,” he said in an interview.

This is also a priority of the current government, adds Laurent Ferreira. “In the context of energy transition, we have a lot to contribute. The province can take the lead. And also globally. »

For him, the best way to position yourself against inflation is to create wealth in industries that will benefit Quebec’s economy in the long run.

“The energy transition is a very important phenomenon for the planet. But it is very inflationary for the economy in the long run. Participating in the supply chain is the best way to position yourself. If we establish promising policies that attract capital and talent to Quebec based on this energy transition, we will be in a better position to create wealth and combat inflation in the long run.” We will stay. »

He is thinking specifically about the battery sector and new energy sources.

Results in line with expectations

Profits of the country’s sixth-largest banking firm totaled 826 million for the months of May, June and July, down 2% year-on-year.

The result equates to $2.35 per share, while analysts were expecting $2.34.

The deteriorating macroeconomic outlook has led to an increased provision for credit losses, management said. A year ago, a more favorable macroeconomic environment led to changes in the rules for credit losses on credit-impaired loans.

Stifel’s analyst Mike Rizvanovic called the quarter’s performance “solid” overall and pointed out that it was better than those reported so far by other major Canadian banks, namely Royal and Scotia.

CIBC and TD will release their results on Thursday, while BMO will follow next Tuesday.

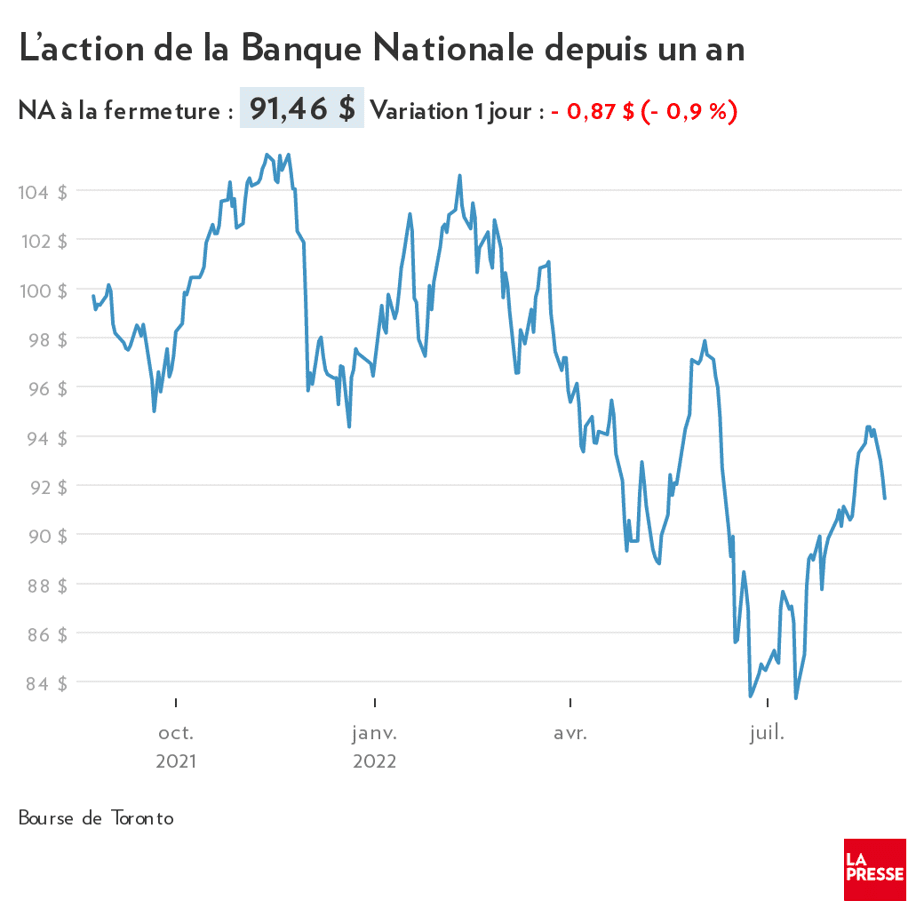

Shares of Royal lost 2.6% on the Toronto Stock Exchange on Wednesday, while National Bank shares fell 1%.

Nomination

National Bank announced Wednesday that it has appointed Etienne Dubuque to the position of executive vice president and co-head of financial markets. He will officially hold the post jointly with current incumbent Denis Girouard from 1er November.

Étienne Dubuc will join the bank’s management team and report to the CEO.

Étienne Dubuc is currently Executive Vice-President and Managing Director, Head of Equities, Currencies and Commodities, and Co-Head of Financial Markets Risk Management Solutions. He has been working in the bank for 23 years.