There are always good reasons not to cut taxes in Quebec. 10, 25 or 40 years ago today.

Posted at 6:30 am

This reflex probably comes from our social-democratic heart, dear to René Lévesque, who has made Quebec less violent — whatever people say lately — and less unequal than anywhere else in America.

There are always good reasons to put more money into health, to put more money into education, to put more money into people with less money, because regardless of the times, there are always obvious problems to solve.

But putting more money in, that’s really the solution, knowing that Quebec ranks ninth among the most spendthrift states in the world, which also ranks ninth in economic stress.1.

Some point to the fragility of our public finances and the greed of the government in the face of collective services, but these arguments do not stand up to the analysis of the pre-election report (which was approved by the Auditor General of Quebec, I must remind you ).

Our surplus

Quebec ended 2022 (March 31) with a surplus of $3.3 billion, and the report predicts a surplus of between $1.8 and $3.3 billion over the next five years.

Oh, and beware, this expected surplus is deducted from the provision for financial losses of 2 billion each year, which are available if these losses are lower than expected. In short, a substantial surplus is expected2.

Our public services? Reading the report, we see that they benefit from significant and recurring funding.

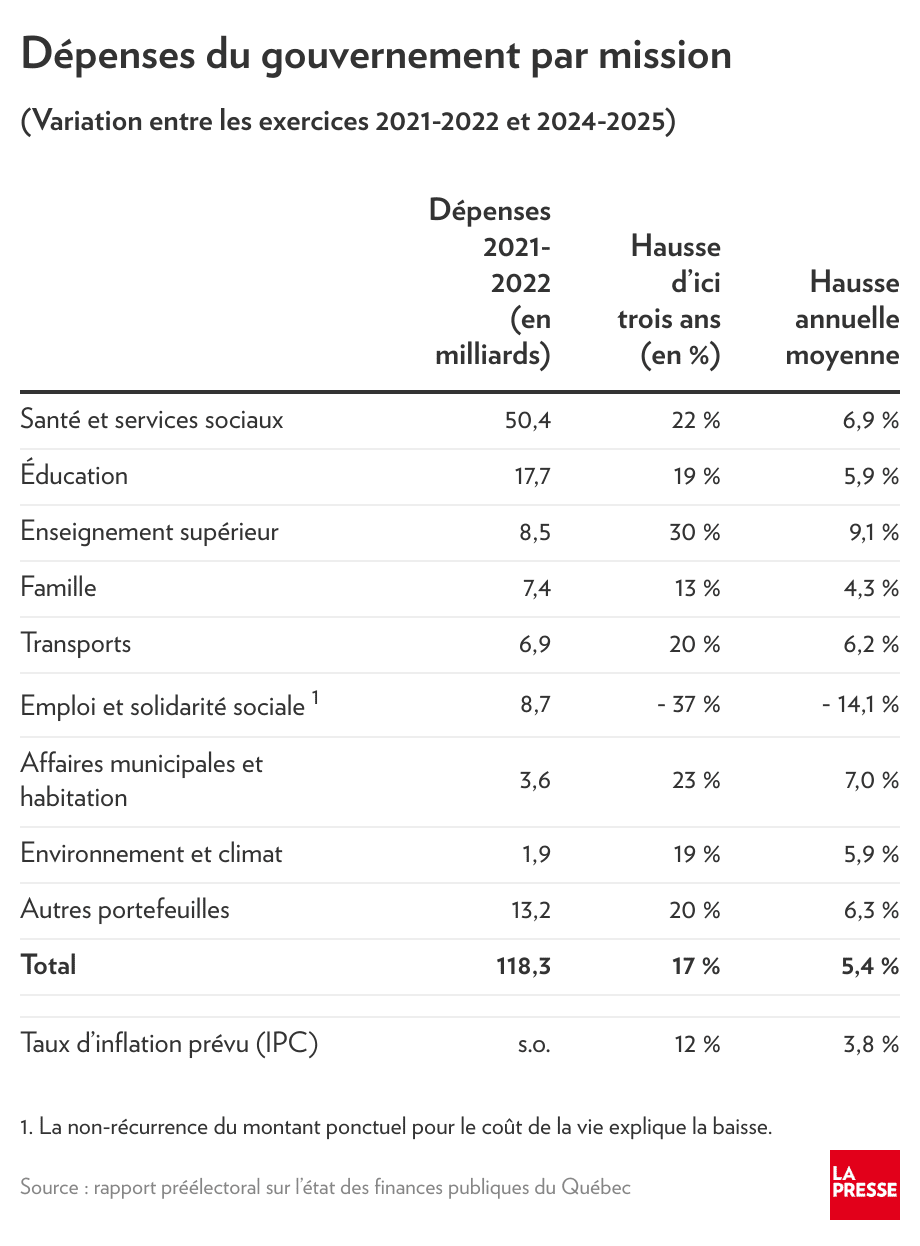

According to the report data, in three years, the government added 20 billion in state missions, which is an increase of 17% (or an average of 5.4% per year). The increase was much higher than expected inflation during the period (3.8% per annum).

Does health eat everything? Not well. The increase in health over three years was 22%, but 30% in higher education, 23% in municipal affairs and housing and 19% in education, well above expected inflation.

Are repairs to schools, roads and other infrastructure neglected? will see For several years, the government has had a plan to invest approximately $90 billion over 10 years under what is known as the Quebec Infrastructure Plan, or PQI. However, this amount has gradually increased from 91 billion in 2017 to 142 billion by 2022.

Sure, it will take more money to restore our network to good condition and rehabilitate old assets before adding many new ones, but who’s to say Quebec is standing still?

In short, regarding our public finances, the tax cuts proposed by three out of five parties are far from irresponsible and cannot be financed by a form of austerity… if they are reasonable.

The Inflation Argument

A final argument against tax cuts is their effect on inflation. The logic is as follows: giving money to taxpayers is likely to stimulate demand for goods and services and raise prices further. It is therefore detrimental to the Bank of Canada’s efforts and is best not to do so.

But knowing that the tax cut represents only 1% of the $250 billion spent by Quebec households this year, is the 2 to 3 billion in tax relief likely to significantly affect inflation?3 ?

Above all, the proposed alternative solution to tax cuts is to keep money in the hands of the government, which can be used to improve our services.

Now, government spending with our taxes equals taxpayer spending.

Tax cuts cause leakage, meaning taxpayers spend part of the money elsewhere (on trips, for example) or they can be even higher because the government spends its funds locally, saving a portion that doesn’t fuel our inflation.

Of course, the only way to avoid creating inflation, in this case, is for taxpayers or the government not to spend this money, and therefore use it to reduce debt, for example. Do I need to rephrase that our public debt has melted below the bar we collectively decided 15 years ago?

“I doubt the tax cuts will be inflationary because they tend to come in recessions. They come at a good time in the economic cycle. They have a compensating effect, allowing households to curb their debt service growth [paiements mensuels de dette] “, argues Stefan Marion, Chief Economist of the National Bank.

In short, tax deductions are not disconnected in the present case.

A factor to consider in this age of labor shortages, especially since lower taxes on income tend to encourage work in general 4.

Can we pocket the proposed $300 to $1,200 in Quebec at once, according to our profile, guilt-free, without anticipating the disaster these tax cuts will cause? Be happy with the relief they provide to our personal finances, which have been hit hard by inflation and rising interest rates?

Clarity on room for maneuver

I need to clarify something in the column on Generation Fund. I suggested that by holding the debt steady at 35% of GDP—rather than letting it fall—there would be room for maneuver after five years, even after cutting taxes and increasing government spending. However, the 9 billion margin excludes any new annual increase in non-recurring, infrastructure spending. Your Kalpa

1. For details, consult the following two documents from the CFFP of the University of Sherbrooke:

2. These surpluses are before payments to the Generations Fund and are therefore comparable to other areas in other provinces. According to the report, after payments to the Generations Fund, budgets will be in deficit by 1.3 billion to 1.9 billion, while payments to the fund have increased by 50% over the period (5.2 billion in 2026-2027).

3. Of this amount, approximately 11% goes to food, 15% to transport and 22% to housing, in particular.

4. This argument is valid, but this incentive to work is generally stronger when the top marginal rate is lowered rather than the top two tiers of rates as proposed by all three political parties.