The Bank of Canada has already raised its key rate on a historic basis, and while a new increase could be announced tomorrow, many homeowners are at their wits’ end.

• Also Read: Mortgages: Thousands of people on the brink

• Also Read: Rising food prices: $1,000 more on groceries for a family of four

• Also Read: Ottawa has invested in the construction of 91 affordable housing units in Montreal

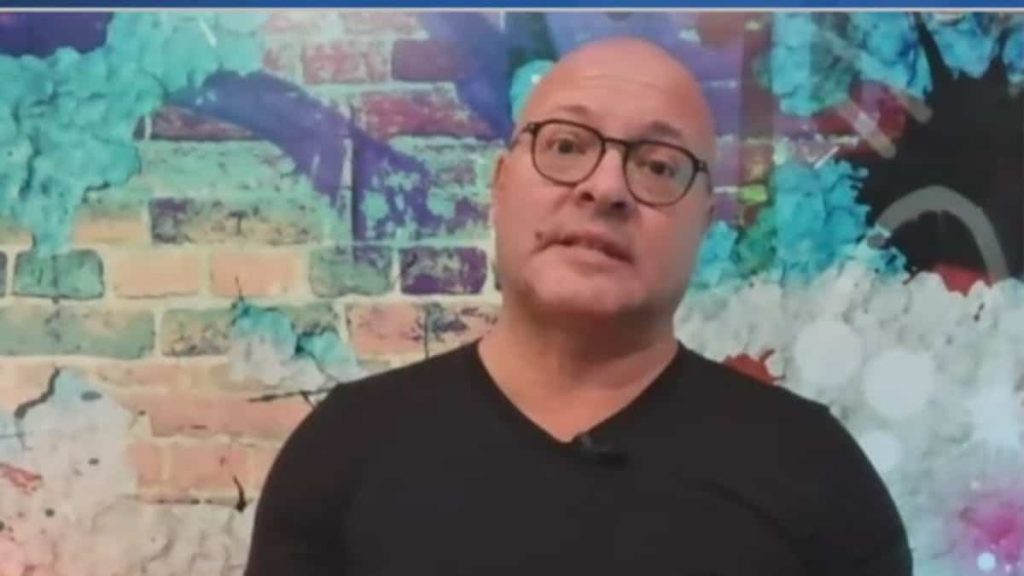

Stéphane Breuer, a mortgage broker at the firm “Les Architectes Hypothécaires”, admitted in an interview with TVA Nouvelles that he was perplexed by the situation despite his long experience.

“I’ve been a mortgage broker for 25 years, and then I’m very surprised by everything that’s going to happen this year. First, with all the increases we’ve had in the last nine months with the Bank of Canada. Then, with everything that’s going to happen with variable rates, fixed payments,” he explained.

Note that this situation is historic for the Bank of Canada.

“The Bank of Canada has raised the key rate by 3.5% within nine months. Historically, we’ve never seen, tomorrow there’s another announcement from the Bank of Canada that’s going to be 0.5%. I’m not saying there’s nothing there, 0.5%, but historically the Bank of Canada, 0.5% , it’s happened four or five times, and this year, just in 2022, we broke all the records,” explained Mr. Breuer.

We recently learned that a third of all real estate loans in the portfolios of major Canadian banks now have a 30-year amortization period, compared to zero a year ago.

For many owners, extending their mortgage over 30 years is a solution to reduce rate increases: these owners’ monthly payments are affordable, but the mortgage will take longer to pay off.

Under these circumstances, variable rate homeowners, as well as those with mortgages, face an especially uncertain future.

“Let’s not forget the people who have mortgages at variable rates, so they’ve seen their mortgage payments go up. The people who have a fixed rate mortgage that’s due in 2023, 2024, or 2025, that’s going to pay off their mortgage, what’s going to happen to these people? Mr. Breuer.

New employers are among the most vulnerable employers.

“A first-time buyer who bought with a 5% down payment two years ago…he’s in trouble right now because he’s really delinquent on his mortgage. If you’ve owned your home for 10, 15 or 20 years and you’ve made the same payment the whole time, you’re definitely at some point. , paid back some capital, especially during the COVID-19 crisis, because mortgage rates are historically low,” explained Breuer.

For some, a sudden increase in the policy rate is unbearable.

“Everyone’s situation is really different. I had clients who, this morning, called me and said to me: “I’m currently on my mortgage loan, I’m not paying back the principal anymore, it’s just interest, and then I started to delay: my department wants to meet with me,” Mr. Breuer said.

These disaster scenarios are multiplying, with some owners losing several thousand dollars a year.

“For a typical mortgage payment of $300,000, that’s about a 1200 a month payment in March. Today my rate is 5%, payout is 1745, so $545 up from March. And tomorrow we have another 0.5% increase, which is a $631 increase from the start of the year. That’s money right there, that’s six, seven, eight thousand dollars a year less in somebody’s pocket, then that’s net,” Mr. Breuer explained.

However, the mortgage broker would like to point out that major Canadian banks are investigating the current situation.

“Those who think banks should seize houses, well no, they’re not for it, then they don’t want it either”, assured Mr Breuer.

More Stories

Sportswear: Lolle acquires Louis Garneau Sports

REM is still innovative enough to foot the bill

A trip to the restaurant with no regrets for these customers