The Competition Bureau is investigating an Toronto-based accounting firm for submitting misleading information to lure people who want to benefit from emergency assistance programs such as the PCU.

The Bureau recently obtained a court order directing Canada to prepare tax review documents and provide relevant information.

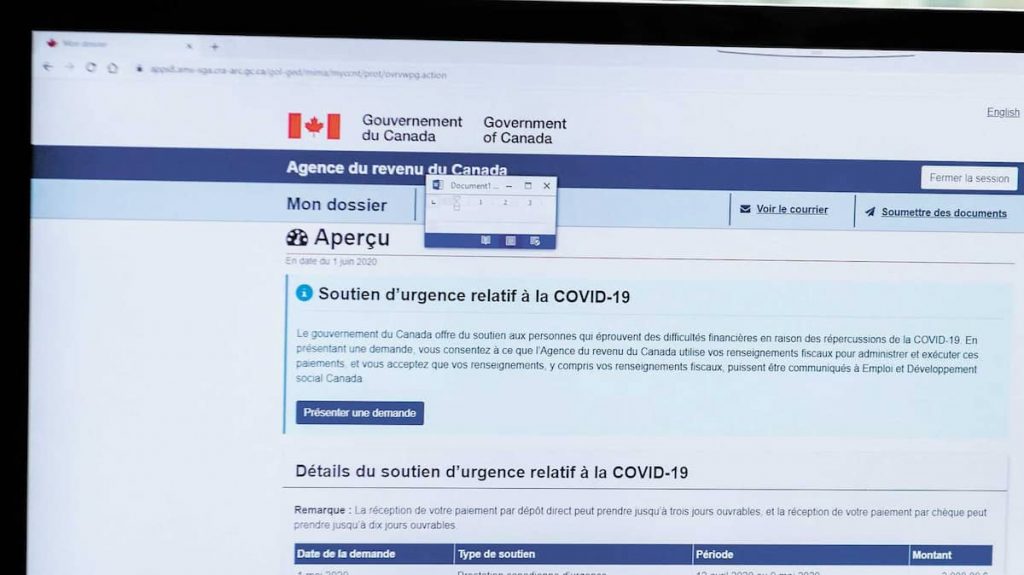

During the epidemic, the company promoted its services to those interested in benefiting from government emergency assistance programs, including Canada Emergency Benefit (CEP) and Canada Benefit, Economic Recovery (PCRE).

According to a May 2020 Financial Post article, the company is charging $ 160 per PCU application request, with a monthly total of $ 2,000. The fired person has applied for ECPs for six consecutive months, so only 60 960 can be paid for this service.

However, Canada Tax Reviews are asking for the basic information needed to submit an application for an assistance program.

The procedure for applying to a PCU is very simple, with a Canadian Revenue Agency spokesperson quoting the “Financial Post” advising the public not to do business with the company.

The company indicated that it only took these amounts when their customers received their help and condemned them for acting in violation of the law.

“The Bureau’s investigation is to determine whether Canada’s Tax Reviews’ business practices raise concerns under the provisions of the Fraudulent Marketing Practices Act of Competition Act.

More Stories

Sportswear: Lolle acquires Louis Garneau Sports

REM is still innovative enough to foot the bill

A trip to the restaurant with no regrets for these customers