Shares of Tesla (Nasdaq: TSLA) Continue to defy gravity, but it is not the only electric-vehicle manufacturer to have outsized revenue in 2020. In a world that is moving even faster towards renewable energy sources, there is reason to be excited for a product that can successfully replace the internal combustion engine.

If you are an investor, you need to know if these values are justified or if you are a victim of another stock market bubble.

Image Source: Getty Images.

Follow the leader

In them Manufacturers of battery-electric vehicles (BEVs), Tesla was certainly the first carrier and leader in mass production. While Chinese manufacturers are also increasing sales, product volume is very small. NIO (NYSE: NIO) July sales reported a 322% year-over-year increase and deliveries in August doubled compared to 2019. At about 4,000 vehicles, however, this is only 10% of Tesla’s volume. And the newly public XPeng (NYSE: XPEV) Distributed over 20,000 units of it Electric crossover and sedan As of July 31st.

In the US, there is still a lot to launch in the near future. These include Rivian, Fisker, Workhorse Group (Nasdaq: WKHS), Nicola (Nasdaq: NKLA), And Lordstown Motors.

What about the potential bubble?

Both Fisker and Lordstown Motors have announced plans to trade publicly through a merger with a Special Purpose Acquisition Company (SPAC). Fisker is purchased and brought in by the public Spartan Energy Acquisition (NYSE: SPAQ), And Lordstown plans to close its merger Diamond Peak Holdings (Nasdaq: DPHC) Later in 2020.

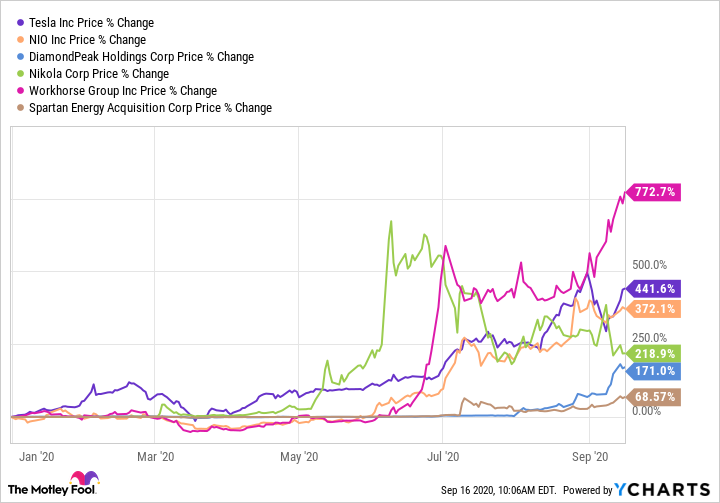

Share prices of SPACs have already risen, and all of these stocks (with the exception of XPeng, which started trading last month) have outsourced returns this year.

Data by Wycharts.

Competition is on the way

Tesla has a BEV market as it raises production and sales. Investors were satisfied with the auction of shares in the hope that the long-term result would be a vertically integrated renewable energy company with electric vehicles, solar panels and leading battery and energy storage technology.

While all of this can pay off, investing in hope can lead to tremendous values. And legal competition is coming from other BEV manufacturers Established vehicle manufacturers.

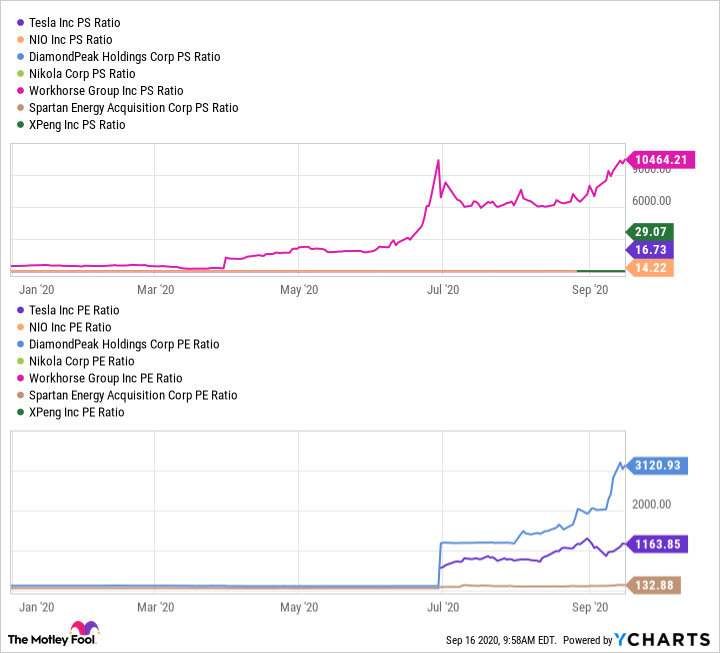

These EV startups are hard to predict because some people don’t even have sales, only earnings. Using those metrics for companies that do so will show revenue-to-revenue and price-to-sales ratios that make sense with business-fundamentals.

Data by Wycharts.

What comes next

There is nothing wrong with investing in ula attendees with a small portion of the portfolio. By definition, these types of investments have long-term time limits when a company’s product or technology is sophisticated. When ulation hags made by a large group of investors drive share prices beyond any reasonable valuation, it is called a bubble.

Tesla can live up to expectations and dominate the BEV, battery, storage and solar-panel markets. But the acceleration of its share prices, along with other new players in the sector, shows the forms of the market bubble. Investors can take a detour until the bubble bursts before adding money to most of these names.

More Stories

Demolition of Sainte-Madeleine Church: A turning of the page of history

Honda, Northvolt, Ford, Volkswagen: Which is the best battery project?

Not all users will like the suggested tip