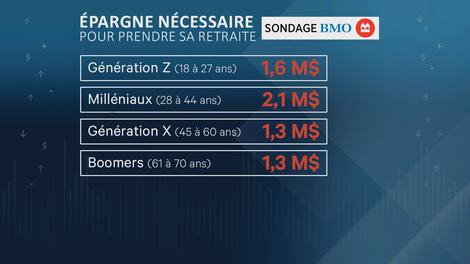

A BMO survey of different generations' expectations of their retirement needs revealed this week that millennials expect to save $2.1 million to retire, but what is it really? ?

In an interview on the “Le Bilan” show, Fabian Major, financial planner and wealth management advisor at Equipe Major, argued that this number is far from reality and that it is possible to retire with very little savings.

VAT News

“I think it's going to be one of those economic myths that we'll remember for a long time, the stories that we're going to tell ourselves when we're older,” he said. This is obviously an exaggeration.”

A financial planner instead estimated that a $70,000 annuity indexed over 25 years would require accumulating approximately $826,000.

He believes that Millennials' perception that they need a lot of money to retire reflects a lack of financial awareness and need.

“It's definitely a cry from the heart that's tied to debt, because we have people who say to themselves that they have a $125,000 standard of living, a house, two cars that aren't paid for, and a huge burden. Credit cards are full, taking up a large part of the budget,” he says. Debt should be settled quickly.

“It's not that hard to get over the cliff as long as you save money and save money almost every month,” he says.

However, property like house should not be included in this amount.

“Everybody I've seen who's included a home in their plans has had a hit somewhere,” says the wealth management consultant. We've seen a big increase in value over the last 10 years, but we've had to relocate.

“If someone lives outside the major centers and wants to be close to their children and grandchildren, for example if they sold their house outside of Montreal for $500,000 and they want to buy a small condo at $500,000, we may not have enough,” he continues. Because it's always a necessary lifestyle expense.”

Mr Major strongly advises people to take an interest in their personal finances as early as possible to avoid being caught off guard as they approach retirement.

“The most unfortunate thing is that there are people who don't make investment choices and are not interested in them, so it doesn't make money, it doesn't generate interest,” he says. That's why towards the end of our careers, perhaps at age 50, we need to set aside a lot of money to make up for the interest we didn't earn because we're no longer interested in his finances. That's the tragedy, I think.

Watch the full interview in the video above

More Stories

Sportswear: Lolle acquires Louis Garneau Sports

REM is still innovative enough to foot the bill

A trip to the restaurant with no regrets for these customers