If responsible investing piques your interest, don’t wait for your financial advisor to discuss it with you in depth. Because you may never own mutual funds or stocks that respect your favorite principles.

Posted at 6:30 am

Although the media has published countless articles on responsible investments and ESG (environmental, social and governance) standards, it is clear where the information does not always go.

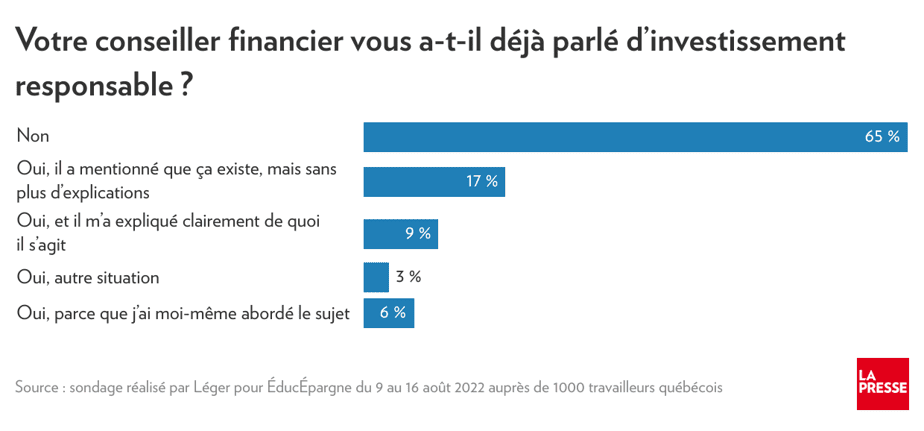

A survey conducted by Léger for ÉducÉpargne, the results of which will be released Monday, revealed that 65% of Quebecers who entrust their money to financial professionals have never heard of the subject. At worst, only 9% are eligible for name-appropriate explanations. Climate change is a concern, and while the values of good governance are at the heart of the concerns, this is troubling.

At ÉducÉpargne, an NPO dedicated to the financial education of Quebecers, general manager Louis-Alexandre Lacoste agrees that “a lot of effort needs to be done” on the part of financial institutions to better inform savers. “I get the impression that those who deal with responsible investing don’t have direct contact with clients,” he says.

Avoiding the subject creates a vicious cycle. The less advisers talk about responsible investing, the less interested and curious their clients are about it. At the limit, lack of enthusiasm and promotional efforts can also lead to mistrust.

The silence is even sadder as 53% of Quebec workers say they are very (11%) or somewhat (42%) interested in responsible investment strategies and products, according to EducÉpargne. When it comes to investing, most people lose their appetite.

Professionals justify their complacency mainly due to a lack of information, revealed an Association for Responsible Investment (AIR) report published earlier in the year. “I don’t know much about it” was chosen by 70% of consultants.

The majority is right to avoid the subject. Of the 539 advisors who participated in the study in Canada, only 32 (6%) were able to correctly identify which of the responsible investment statements was correct.

“Furthermore, it appears that some advisers overestimated their knowledge, as nearly one-fifth of advisers who claimed to have an excellent or very good level of knowledge about RI failed to correctly identify one in three true statements,” reports ‘AIR. This is not a guarantee.

Consultants surveyed also expressed some level of concern about greenwashing (Green washing), lack of standards, financial performance, quality of products offered, lack of fund certification etc. Admittedly, these are very legitimate questions.

However, AIR calculates that “50% of investors don’t receive the information their advisors want them to get.”

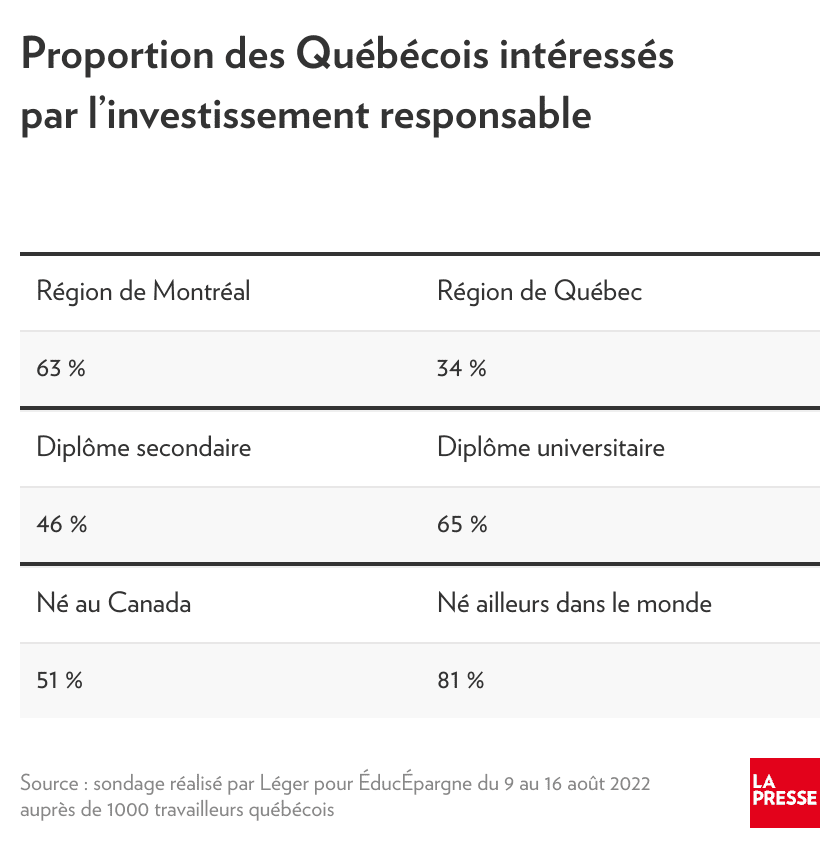

The EducÉpargne survey revealed significant disparities in Quebecers’ interest in financial products and investment strategies that respect ESG criteria.

In the Montreal area, 63% of respondents would like to know more about this topic. In the Quebec region this rate drops to 34%. Too much gap.

“It is particularly respondents who have a university degree, a mother tongue other than French and those who were not born in Canada who have a significant interest in responsible investments. The profiles of these people mostly live in Montreal,” explains Roxanne Bazinet, director of research at Léger.

As for the ESG acronym, viral ads are essential to its notoriety.

One in four (23%) could figure out the meaning of three letters, even when given the answer choices! And 40% of the respondents did not even dare to choose an answer. These figures show that there is still a long way to go before environmental, social and governance standards are a natural part of conversations.

The issue of returns through responsible investment products should also be clarified once and for all. Roughly speaking, half of Quebecers believe that responsible investments will yield the same or more.

The other half believe the opposite or ignore the answer. Opinions are very divided. However, studies over the years have concluded that considering ESG factors has a neutral or positive impact on returns.

I agree, taking weapons, oil, tobacco or pornography out of your RRSP is not very clear. But efforts are underway to make life easier for savers. Desjardins, for example, summarizes its policy and approach to creating its responsible mutual funds in five short pages.

On the ÉducÉpargne side, we will hold a webinar on the question on September 23, which we promise will allow everyone to understand and ask the right questions. But you still need to get the right answers.