A Torontonian is outraged by his bank’s inaction in the face of a scam that is now costing him hundreds of dollars a month in interest. James Mathelier asked the Bank of Montreal (BMO) to repay all amounts drawn from his line of credit.

The withdrawals began on April 24 after the phone call. A person claiming to be an employee BMOHe warned that someone had managed to withdraw money from his bank account.

To verify his identity, Mr. Mathelier had to share the code sent to his phone. The 63-year-old man initially questioned the procedure, but eventually provided the code to his interlocutor without confirming that money had been taken from his account. I was very nervous

He \ he said.

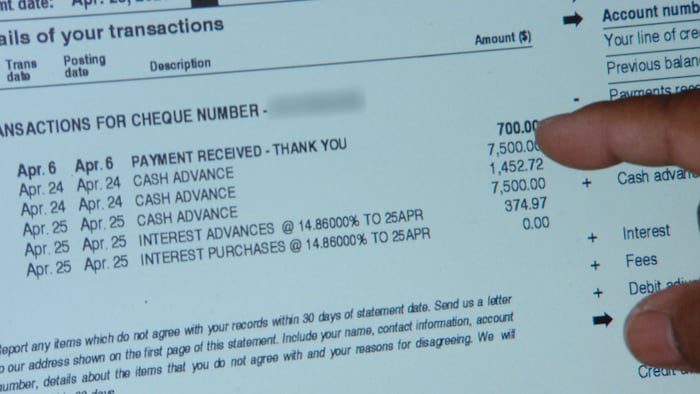

Three amounts were withdrawn from his line of credit: $7,500 and $1,452.72 on April 24, and another $7,500 on April 25.

James Mathelier contacted his bank and the Toronto Police Department to shed light on the scam and begin the process of recovering the funds. Without giving further details, the police confirmed that a report has been filed and investigations are underway.

I can’t even sleep and it’s affecting my mental health.

On May 11, the BMO He paid him back the smaller of the amounts reported stolen, but not the other two.

Please note that this is a scam, which is unfortunately not covered by our fraud services; Therefore, Bank of Montreal is not liable for any loss incurred

Clarified BMO In response to his complaint.

On April 24th and 25th three amounts totaling more than $16,000 were withdrawn from James Mathelier’s line of credit.

Photo: Radio-Canada / Philippe de Montigny

James Mathelier wonders why the financial institution reimbursed him for a portion of the amounts claimed if any liability was denied in the case. Why is there a scam for $15,000 and not for $1,452? I don’t think it makes sense

He says.

Vanessa Ifolla, an anti-fraud consultant in Halifax and a lecturer at Wilfrid Laurier University, believes. BMO He made this refund in an attempt to appease his client.

It’s strange, in my opinion, if the bank wants to repay the first amount, I mean the bank has taken a little responsibility.

When asked about this by Radio-Canada, the Bank of Montreal did not provide reasons explaining why it chose to repay one of the claimed amounts but not the other two.

Due to the priority we place on client confidentiality, we cannot provide further details on these records.

The financial institution replied in an emailed statement.

Over $200 in interest each month

James Mathelier confirmed that in addition to seeing his debts on his line of credit suddenly expand, the bank continued to charge interest on these amounts declared stolen.

Before the withdrawals in April, the BMO client was paying about $315 a month in interest on his line of credit at an annual rate of about 15%. Now that his debts have ballooned to $15,000, he has to pay more than $550 a month in interest.

With interest charged on the stolen $15,000, James Mathelier said he was struggling to make ends meet.

Photo: Radio-Canada / Greg Bruce

As the cost of living skyrocketed, Mr. Mathelier believes he can’t keep up with his teaching salary.

I’m getting kind of choked up there. I can’t stand it anymore

He laments.

Vanessa Ifolla of Wilfrid Laurier University said the bank may decide to withhold interest on the stolen amount until the case is resolved.

It appears that the client is being taken advantage of without considering the scapegoat. They can easily write down those interests. It is not required to be paid by the customer

she said.

ICI Ontario Newsletter

Subscribe to the ICI Ontario newsletter.

Bank of Montreal did not respond to specific questions from Radio-Canada, particularly regarding the interest charged to Mr. Mathelier, citing confidentiality issues.

With phone fraud and digital crime on the rise, it’s important to remember that account protection is a partnership between customers and their bank.

BMO said via email.

Customers are responsible for securing their account information, online and mobile banking passwords and PIN at all times.

In the UK, if banks make payments to fraudsters, they must repay the victims of the scams. These new regulations will come into effect in early 2024.

Anti-fraud consultant Vanessa Aifolla believes that the Canadian government should also be tough on banks in the case of scams and leave all responsibility in the hands of customers.

Banks offer more ways for people to do their banking because it is more convenient, but they also have a responsibility to protect us from problems that may arise.

she said.

Vanessa Ifolla is a financial crime expert, anti-fraud consultant and lecturer at Wilfrid Laurier University.

Photo: Radio-Canada / Brian Mackay

About $7 million was stolen in 2022

John Horncastle According to the Canadian Anti-Fraud Centre, this type of phone scam, where the caller pretends to be a bank investigator, is one of the most common in the country.

Unfortunately, this is not a unique case

He says.

In 2022, 1,000 people reported falling victim to these scams, reporting a loss of nearly $6.9 million. This year, between January and June, nearly $6 million in losses have already been recorded.

He points out that scammers often use tools to disguise their number and display the actual number of the bank in question on your phone. In some cases, scammers will even offer to remotely control your computer or ask you to provide them with a two-step verification code.

If you get a call from someone with the name of your financial institution, government agency, company, whatever, let them know you’re calling them back and call yourself.

Advice from a representative of the Anti-Fraud Centre.

While the Anti-Fraud Center has noted a sharp increase in this type of scam in recent years, it has at the same time admitted that this picture of the situation is incomplete.

Unfortunately it is estimated that only 5-10% of victims are reported to the Canadian Anti-Fraud Centre, so this is only the tip of the iceberg.

BMO It recently sent emails to its customers warning them of this type of fraud. The bank insists on never contacting them to ask for a verification code, password or answers to their security questions.

She adds that some fraudsters may already have their personal information to make the scam more believable.

We encourage customers to be diligent in protecting their online and mobile credentials, closely monitoring their account activity, and changing their password or PIN frequently.

Emphasizes BMO In a statement sent to Radio-Canada.

More Stories

Sportswear: Lolle acquires Louis Garneau Sports

REM is still innovative enough to foot the bill

A trip to the restaurant with no regrets for these customers