The rate of tax burden in Quebec is very high, but the total tax revenue collected by all public administrations (federal, provincial, municipal) is 38.8% of Quebec GDP.

This is 4.3 percentage points higher than the flat tax rate to which all Canadians are subject.

Quebec is ranked 19th out of 26 member countries of the OECD (Organization for Economic Co-operation and Development) in 2020.e rank.

Our tax burden rate is 5.3 percent higher than the average rate of OECD members (33.5%). By comparison, Canada ranks 10the With a tax burden rate of 34.5% of its GDP and the United States ranks 5the rank, at a rate of only 25.5%.

As we can see, Quebecers are among the highest taxed and tax payers in the world.

What do they think?

According to a study published by Frédéric Halle-Rochon, Luc Godbout and Antoine Genest-Grégoire from the Chair of Taxation and Public Finance at the University of Sherbrooke, Quebecers have a “paradoxical relationship” with their tax burden.

According to a poll conducted by the firm Léger in the days following Legault’s presentation of the government’s budget last March, 57.6% of respondents believed they should pay too much tax.

This perception of tax suppression usually fluctuates around 60%, peaking at 70% in 2011, the memorable year of the formation of the Charbonneau Commission on corruption in the awarding of public contracts and the rise of the QST.

According to public services?

Now, when we ask Quebecers whether they pay too much tax for all government programs and services, the rate of those who think they pay too much drops to 53.1%.

Of course, there are distinctly different perceptions depending on the income and occupation level of the people surveyed.

Workers, 63%, feel they pay too much tax. The rate drops dramatically among students (37.7%) and retirees and homemakers (41.2%).

Among other important nuances, among people who believe they pay too much tax for government programs and services, we observe 35 to 64-year-olds with a rate of 60.5%; individuals earning $100,000 or more (59%); Families with children (63.3%).

Contradiction… satisfaction!

But when researchers Halle-Rochon, Godbout, and Genest-Grégoire talk about a “paradoxical relationship” in the context of tax burden, here’s an example.

Although 53.6% of Quebecers perceive that they pay too much tax, the fact remains that they seem to “all agree or be neutral about a fair share of public services” regarding the taxes they pay.

As evidence, 60.2% of surveyed Quebecers have a positive view of the tax burden, of which 7.8% “strongly agree”; 17.5% “agree”; and 34.9% were “neutral”.

An increase in QST?

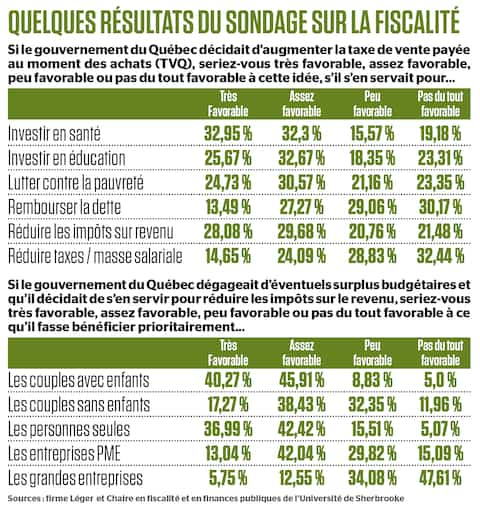

What would you say to an increase in the sales tax (QST) for the Quebec government to generate additional revenue to finance certain public services or tax breaks?

An increase in health care spending has been a great “blessing” of taxpayers while 65.3% of survey respondents favored an increase in the QST for this purpose.

Increasing the QST to invest more in education is supported by 58.3% of respondents, a reduction in personal income taxes by 57.8% and fighting poverty benefits by 55.3%.

Paying more QST to reduce government debt and employers paying taxes is no good! A majority of respondents were not in favor, ie 59.3% for the debt reduction and 61.3% for the reduction of employers’ payroll taxes.

In the event that the budget returns to surplus, who should the government prioritize if they decide to cut income taxes?

Couples with children are supported by 86.2% of survey respondents. In second place are single people with a support rate of 79.4%.

In contrast, around 82% of people are not in favor of tax cuts for large corporations.

More Stories

How List Acquisition Helps Your Political Campaign Become Successful

Four escaped cows were caught

A simple administrative decision? | Press