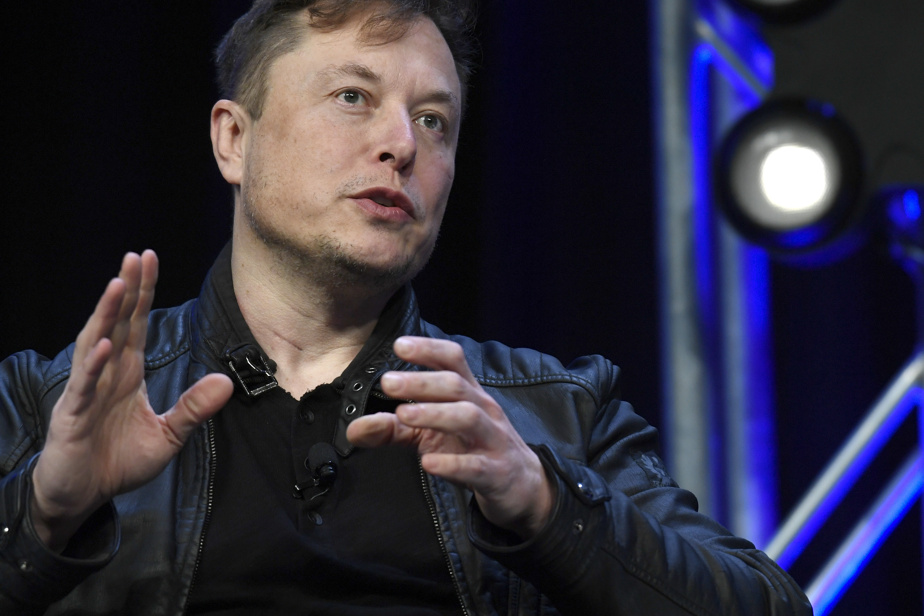

(New York) Tesla's boss, billionaire Elon Musk, confirmed in a message published on his social network X during the night from Wednesday to Thursday that the carmaker's shareholders had approved his mega-remuneration “with a large majority”.

“Tesla's two shareholder resolutions have now been approved by an overwhelming majority!”, Mr. Musk wrote.

From 2022 his messages about Tesla must be first approved by a lawyer before they can be published on social networks.

The results have not been officially announced at this stage, with the regular meeting set to begin at 3:30pm Austin time. Tesla did not immediately respond when asked by AFP.

Two of the resolutions he's referring to are his compensation plan, valued at $56 billion in 2018, and moving Tesla's residence from Delaware to Texas.

At 9:50 a.m. (Eastern Time), Tesla shares were up 7.01% on the New York Stock Exchange.

“Uncork the champagne for musk,” Wedbush analysts said in a note.

“Despite the opposition of some large institutional shareholders, we believe the overwhelming vote of small holders in favor of both resolutions will be key to their approval,” they continued.

Well aware of the importance of individual shareholders, the group led a whole campaign until the last moment to encourage them to vote.

“Your vote is critical to Tesla's future growth and success and the value of your investment,” the electric vehicle expert emphasized in the video, explaining how to vote with the help of his humanoid robot Optimus.

Along with a temporary website with countdown and advocacy advertising inserts, it offered, through a lottery, fifteen visits to the Austin mega-factory with Elon Musk and Franz von Holzhausen, Tesla's chief designer.

Several major carriers have announced for several days that they oppose the financial package, as a certain number had already done so on March 21, 2018, when it was presented to shareholders at an extraordinary general meeting.

The “yes” vote won 73%, excluding the votes of Elon Musk and his brother Kimball.

The package offered for distribution of shares over a period of ten years based on specific targets.

Leave the road

But a shareholder appeal to a Delaware court led to its cancellation in late January.

In mid-April, the board of directors took a maneuver to get it back on track by putting it on the menu for Thursday's regular general meeting.

“The board supports this compensation plan. We believe that in 2018, we have asked Elon to pursue ambitious goals to grow the company,” the board argued at the time.

Tesla shares were valued at $20.70 at Wall Street's close the day before the 2018 AGM and $177.29 at Wednesday's close.

“We think investors should be prepared for a volatile week for their stocks,” warned CFRA Research analyst Garrett Nelson.

According to him, individual shareholders own 40% of the manufacturers' capital.

The fear underlined by analysts such as other experts and shareholders in favor of the plan is that in the event of AG refusal, the billionaire will move away from Tesla to devote himself more to his other companies (SpaceX, X, xAI, Starlink, etc.).

However, for many, Tesla is nothing without Elon Musk.

“Tesla is better with Elon. Tesla is Elon,” said Ron Barron, head of Barron's Funds, which has invested $3 billion in Tesla shares. “Elon fulfilled his compensation agreement. Elon earned his salary.

Vanguard, the leading investor with a 7.23% stake by the end of 2023, declined to disclose its vote and BlackRock, the second-largest investor with 5.9%, did not respond to questions from AFP.

According to Wall Street JournalIn 2018, the former voted against while the latter approved the plan.

The California Teachers Pension Fund (CalSTRS), one of the three largest in the United States, voted for the plan, which its investment director Chris Eilman described as “ridiculous.”

The same rejection from Norwegian sovereign wealth fund NBIM – the world's largest and a 0.98% Tesla shareholder by the end of 2023 – as of 2018.