Hundreds of lots, lots or buildings in the territory of Quebec City could be auctioned on November 22 if their owners do not pay the municipality on time.

The law allows municipalities to sell any property that has unpaid taxes, regardless of the amount owed, after a period of at least six months.

At the end of September, 503 properties in Quebec were threatened with auction by the city. With the exception of 2022, which includes amounts due in 2020 and 2021, this is the largest number of buildings whose owners have been in default for five years.

Properties auctioned for unpaid taxes in Quebec City

| the year | No. of assets |

|---|---|

| 2018 | 339 |

| 2019 | 388 |

| 2021 | 142 |

| 2022* | 531 |

| 2023 | 503 |

According to Quebec City spokesman Jean-Pascal Lavoie, the number is comparable to previous years. Since the first notice was sent to affected citizens, the number of buildings threatened with sale has dropped to 363. Year after year, a large percentage of properties go unsold because owners pay their debts on time. Since 2018, 88 properties have been sold during this auction.

In the coming weeks, the City will communicate with employers affected by this process to support them in finding a solution.

said Mr. Lavoini by email.

Since 2018, 88 properties in default have been sold at Quebec City auctions.

Photo: Radio-Canada / Alexandre Vallee-Roy

All indications are that the number of listed buildings will decrease in the run-up to the November 22 sale.

“This is just the beginning”

These figures do not surprise Christian-Pierre Côté, an expert in research and data analysis at Côté Mercier. This is just the beginning

He \ he said. Starting in March 2022, the Bank of Canada’s key rate will increase from 0.25% to 5%. However, Mr. Quote pointed out.

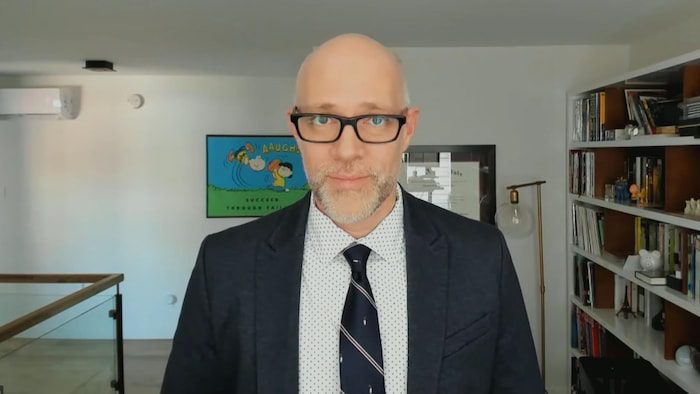

Stefan Leblond, insolvency and bankruptcy trustee, is not surprised by the large number of employers in payment default either.

Inflation and rising house prices Without equality with the past

According to him, hurt. People are delaying their tax payments, there are a lot of people who are delaying their mortgage payments, the banks are accommodating them for a while, but at some point, something has to go wrong somewhere.

Stephen Leblond is a licensed bankruptcy trustee in Quebec.

Photo: Radio-Canada / Raphael Beaumont-Drouin

Rising interest rates

Sebastian McMahon, chief strategist and senior economist at the IA Industrial Alliance, lamented the figures, which he linked to rising interest rates and the cost of living.

We see that this has collateral effects. There are households that are a little stuck, then we see surpluses like this, so it’s a very distressing thing

He \ he said.

Sebastian McMahon is Chief Strategist and Senior Economist at the IA Industrial Alliance. (archive photo)

Photo: Radio-Canada

In the short term, we should not expect a quick return to low interest rates, but according to him the situation may stabilize.

When we look at central banks, the message is clear that we are approaching the end of the tightening cycle.

Stefan Lebland believes that in some cases, heartbreaking choices have to be made.

What is also difficult for people to understand is their desire to keep their home at all costs, in some cases, this is possible, but in some cases, it is the source of all their problems. 50, 60, 70% of their salary goes towards their accommodation.

He urged cities to review the way they tax property owners based on increases in property values.

In collaboration with Jeremy Camirand

More Stories

Sportswear: Lolle acquires Louis Garneau Sports

REM is still innovative enough to foot the bill

A trip to the restaurant with no regrets for these customers