2021 saw a meteoric rise in the cost of car claims. According to data compiled by financial product comparison platform HelloSafe, while the number of claims increased by only 3.4%, repair costs increased by 11.2%.

Posted at 11:00 am

The average cost of claims increased from $4,149 to $4,461 between 2020 and 2021. In total, auto claims cost insurance companies nearly $2.2 billion.

HelloSafe analysts explained that the cost of replacement parts in vehicles, especially newer car models with their multiple electronic components, is constantly increasing. The cost of replacing a damaged vehicle also follows the overall increase in the value of the vehicle. In addition, labor shortages are forcing mechanics to raise wages.

Premiums have gone up

Unsurprisingly, premiums have increased in 2021. Quebecers paid an average of $43 as the average auto insurance premium rose from $732 to $775. 5.87 percent increased.

Quebecers expect to pay a higher premium in urban areas like Montreal and Quebec. But this is not always the case. For example, in Quebec, the average premium is $754, rising to $777 in the Laurentians and $800 on the North Shore.

It is better to have a vehicle when you live in Bas-Saint-Laurent than in Nord-du-Quebec. The gap is huge. We go from $623 to $1217.

West of Montreal prices rose the most from 2020 to 2021, with a 6.85% increase. Nord-du-Québec, with its highest premiums, experienced the lowest increase at 2.36%.

split up

Chaudière-Appalaches or the suburbs of Montreal can choose to have their damaged vehicle repaired. These are the areas where repairs are less expensive. On the other hand, Nord-du-Québec, Laval and West Montreal stand out for their higher prices than the rest of the province.

More disasters in Montreal

Disasters are especially happening in densely populated urban areas center and Montreal East (11.9%), Laval region (9.76%), Montreal West (9.71%) and Quebec Urban Community (9.6%).

Significantly lower in Nord-du-Québec (6.9%), Abitibi-Témiscamingue (7.5%) and Center-du-Québec (7.7%).

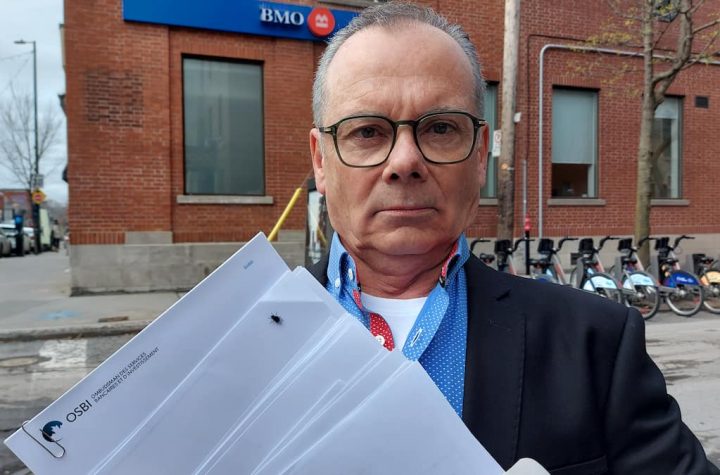

Data is taken from 2021 Automobile Insurance Statistical Report Published by the Groupement des Assures Automobiles (GAA) in Quebec.