BMO denies all liability in a series of frauds involving a 66-year-old woman from Rawdon last fall that totaled $30,000.

• Also Read – Their defrauded bank accounts: BN reimburses, BMO denies

• Also Read – Her account was emptied by unauthorized transfers: BMO refused to reimburse this mother

• Also Read – His bank was defrauded and neglected: BMO withheld his own money for 37 days

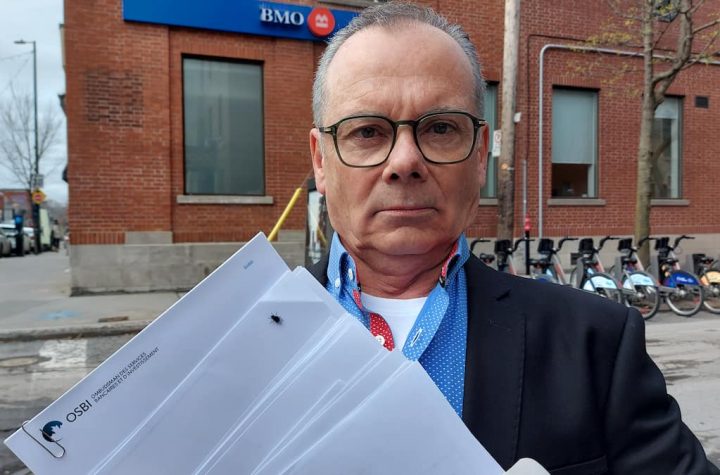

“My mom can’t sleep at night, she’s very emotional and that’s why I’m talking to you,” said her son Patrick Belly. This is his retirement money! »

On September 28, Diane Bertrand discovered that she had unknowingly made two transfers of $10,000 each to an unknown recipient, Ilaria Molisseau, within a week. Global transfer functionality is used. Offered from 2021 at BMO to facilitate international money transfers via mobile device.

Upset, Ms. Bertrand called BMO and went to a branch where her bank card and credit card were destroyed. He was given a new debit card.

“The bank employee told him that till further notice, only deposits are possible and not withdrawals,” said his son, who looks after the property management for his mother.

However, on October 4, the third time in Euros was transferred to another complete stranger, Alessia D’Imperio, for $9,995.

“How can we allow a third transaction of $10,000 without doing anything? Our money is not protected! said Patrick Belly indignantly.

Shock and dash hopes

A shocked Ms. Bertrand returned to BMO, where she was given another new debit card. She was also asked to scan her cell phone for viruses, which she did.

She filed a police complaint and transferred the money she had to Desjardins.

Before Christmas, BMO’s complaint review office asked Ms. denied Bertrand’s request, giving her credit only for the $63.24 bill incurred for cell phone analysis. In its denial letter, BMO wrote that the customer “contributed to the unauthorized use of her account by failing to secure her debit card and confidential identification codes.”

Outdated protection tools

The letter also indicates that the client did not immediately change her passwords as instructed and that she used single-use codes sent to her via text message for transactions.

“One-time codes are sent to the fraudster if the phone is compromised. This is an obsolete method! Security experts have been telling banks to stop using it for at least ten years,” responded Simon Marchand, fraud prevention expert at Geocomply.

Changing the card password via a compromised device leaves the victim unprotected, he said. The expert feels that banks have a responsibility to protect their customers as well as themselves. Even more so when it comes to vulnerable clients who are not comfortable with technology.

“We know a person has been defrauded, we take action to destroy the cards and these are large amounts, so why didn’t we call the client to confirm she was involved? It also asks banks to invest in voice or behavioral biometrics to improve customer security.

At BMO, we cannot comment on a specific situation for privacy reasons, but we say that protecting customers is a priority and that each case is taken seriously.

“Account protection has always been a partnership between customers and their bank. Customers are responsible for protecting their bank account information, online and mobile credentials and changing passwords frequently,” the firm wrote.

In November, News magazine BMO uncovered other cases of wire transfer fraud for which the firm denied refunds. Some of them were later repaid.

More Stories

More taxes for more services: Disillusioned

Fixed Income: The Hardest Goal to Achieve?

Radio silence: Couple of octogenarians still left behind by Norwegian cruise line