According to a recent BMO survey, one-third of Canadian buyers expect housing prices to rise next year as well.

A poll released on Monday found that 84% of buyers expect inflation to rise and three-quarters expect a further increase in interest rates.

“These financial constraints are having a major impact on these consumers’ purchase plans, what they buy and when they buy.

Many understood that more would have to be spent; The impact will be shared on Lead Times, with purchases made before prices rise further, while others will wait to see if prices fall, “said Hassan Pirnia, head of retail lending and financing products at BMO Financial Group’s Real Estate.

Therefore, 68% of respondents indicated that they would like to change the amount they would like to spend on their home purchase. They are willing to spend 73% more, either because prices have risen (55% of them), because their income has increased (28%) or because of savings made during the epidemic (27%).

Over the past year, the survey shows that the amount of people wanting to buy a home has increased by 26% to 100,000%. On average, homebuyers across the country are expected to pay $ 588,000.

In addition, the interest in buying a house in major urban centers in the country increased by 5% in one year, but with the return to the office the priority to move away from the main centers decreased.

The survey was conducted online between February 24 and March 7 among 1,003 Canadians looking to buy a home in the next 12 months.

![[VIDÉO] Private in health: Christian Dubey interrupted by CSN presenters](https://queenscitizen.ca/wp-content/uploads/2024/05/VIDEO-Private-in-health-Christian-Dubey-interrupted-by-CSN-presenters-720x475.jpg)

More Stories

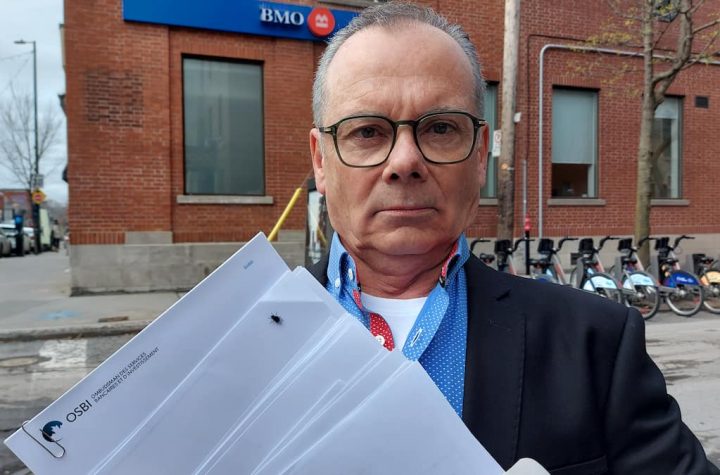

He had $42,000 stolen from his BMO account: “fraud was paid to the bank”

Grand Vie Jackpot: Stars Align for Montrealer

[VIDÉO] Private in health: Christian Dubey interrupted by CSN presenters