(Bloomberg) — In late 2018, as Deutsche Bank AG executives mulled the future of their troubled loan company, Chairman Paul Achleitner encouraged them to emulate a payments company that experienced grow to be a wunderkind of German finance: Wirecard AG.

The two organizations were already shut. Deutsche Bank was a key loan provider to Wirecard and its main government officer, Markus Braun, who also sat on one particular of its regional advisory boards. Andreas Loetscher, an Ernst & Youthful lover who had overseen various audits of Wirecard’s final results, had not long ago joined Deutsche Financial institution as main accounting officer. DWS, the bank’s asset-management unit, was a shareholder.

Yet guiding the scenes, uncertainties were being developing whether or not the fintech’s achievement was for true. Deutsche Bank’s investment bankers argued its accounts were opaque and the inventory overvalued, and threat professionals sought means to minimize their exposure devoid of rattling marketplaces. In excess of the training course of the following yr, Deutsche Bank unwound or hedged most of some $300 million it experienced agreed to lend to Braun and his business — whilst its asset administration arm retained piling in, an analyst upgraded the inventory and its bankers served the business increase debt.

This tale of Deutsche Bank’s ties to Wirecard is centered on accounts of people with immediate awareness of the situations who spoke on problem of anonymity. It spotlights the complicated romance of Germany’s monetary elite with a corporation that was belittled at first, then admired and eventually bedeviled when it imploded in a spectacular accounting scandal final month. Now Deutsche Bank is coming total circle, considering a economic lifeline for elements of the agency as it sorts by means of the rubble of a rival that only final year approached it about an all-out merger.

A spokesman for Deutsche Bank declined to comment on the lender’s ties to Wirecard.

Wirecard’s Story

Wirecard’s allure for the planet of German finance is difficult to overstate. Commenced as a payments service provider to gaming and adult entertainment sites, it was the butt of jokes at initially on the govt flooring of some German creditors. Nonetheless as the country’s money market struggled to adapt to tighter laws and unfavorable interest prices following the 2008 financial crisis, the startup from the suburbs of Munich someway bucked the craze.

Out of the blue in this article was a young organization that appeared to get pleasure from breathtaking expansion by applying engineering to the plumbing of payments, and shareholders beloved it. The company’s sector price experienced exploded since the economical disaster, eclipsing 150-yr-old Deutsche Lender. By late 2018, Wirecard changed Commerzbank AG in Germany’s benchmark DAX Index.

Achleitner, at the meeting in Hamburg in late 2018, requested why Deutsche Bank’s transaction lender was not finding the very same consideration as Wirecard’s. He was on the lookout to bolster Deutsche Bank’s very own payment small business soon after naming Christian Stitching CEO previously that yr — an government with in depth encounter in company banking.

Soon soon after that meeting, in January 2019, the Money Situations revealed the first in a collection of articles or blog posts alleging accounting irregularities at a device of Wirecard, sending the shares into a tailspin. The payments agency — and even regulators — brushed it off as the get the job done of short sellers searching for a speedy earnings, but the FT stood by its reporting in the course of.

At Deutsche Bank, some executives grew alarmed, together with Garth Ritchie, the head of financial investment banking at the time. Ritchie’s skepticism experienced arisen in element from discussions with hedge-fund shoppers that experienced carried out their have investigate into the firm’s workings, and who had been betting versus the inventory. His unit oversaw a 150 million-euro bank loan to Braun that was secured by Wirecard shares, so if the shares fell, the financial institution could shed a ton of funds.

Danger supervisors led by Stuart Lewis, Deutsche Bank’s chief possibility officer, have been also worried. The lender experienced agreed to supply close to 120 million euros to Wirecard as component of that firm’s revolving credit history facility, but the payments business was expanding extremely promptly and Deutsche Bank didn’t absolutely understand all the components at participate in. They reduced their publicity and elevated their hedge in the wake of the FT tale.

Kirch Lawsuit

Lewis also shared Ritchie’s concern about the margin bank loan to Braun. The financial debt was due for renewal at the stop of 2019, but some traders preferred to get rid of it just before. Still accomplishing so could mail a message to marketplaces that Germany’s largest lender experienced missing assurance in the business and could possibly drive Wirecard about the edge. Deutsche Financial institution itself would be at risk of yet another billion-dollar lawsuit like the a person with the heirs of of Leo Kirch above the collapse of his media group, which dragged on for extra than a 10 years right until 2014.

The allegations in the FT were being weighing on Wirecard’s shares, but the enterprise was nevertheless much more useful on the inventory market than Deutsche Lender. And so, in the spring of past calendar year, its executives were discussing an audacious stage that would have specified them a way out: a total-fledged merger with Deutsche Bank. They approached the Frankfurt financial institution, but the lender swiftly ended the exploratory talks.

Wirecard did score a victory all-around that time in initiatives to restore marketplace self confidence. In April, SoftBank Team Corp., the Japanese telecommunications operator turned tech trader, agreed to put 900 million euros into the German corporation, offering a improve to the inventory. Nooshin Nejati, an fairness analyst at Deutsche Financial institution in Frankfurt, modified her ranking on Wirecard to buy from maintain the adhering to month and predicted that its shares would soar about 40% to 200 euros in a yr.

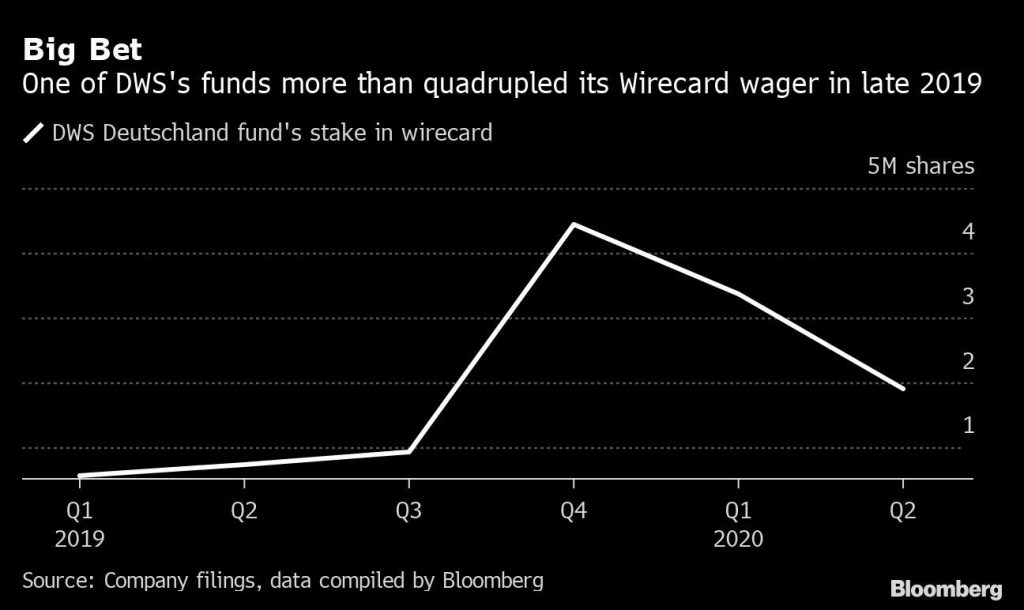

Fund administrators at DWS ended up also bullish on Wirecard. Above the system of the 12 months, the company elevated its holding from less than 2 million shares to over 7 million. The most important acquire arrived right after the Wirecard’s share value plunged extra than a fifth in the span of a couple of days pursuing a further crucial FT report. Stock pickers led by Tim Albrecht went all in.

DWS and Albrecht declined to remark. The investment firm reported past month it ideas to file a lawsuit from Wirecard and Braun.

Albrecht saw the Oct selloff as a probability to lock in significant gains down the street, he explained in a current newspaper interview. His 4.1 billion-euro DWS Deutschland fund upped its stake by far more than 3.5 million shares among September and December 2019, in accordance to knowledge compiled by Bloomberg and business filings. DWS Aktien Strategie Deutschland and DWS ESG Investa both extra than doubled their holdings over the very same time period.

Just as they piled in, executives in Deutsche Bank’s twin towers throughout the road from DWS built up their head about Wirecard. Softbank, whose April announcement was witnessed as a indicator of self esteem in Wirecard, experienced considering that gotten chilly toes and was placing up a complex transaction to promote off the investment and stay clear of putting up dollars itself.

Deutsche Bank’s investment decision bankers experienced been supplied, informally, a likelihood to aid on the convertible bond Wirecard was preparing to offer as component of the Softbank arrangement, but they declined simply because they didn’t want the possibility on their textbooks. They did aid Wirecard raise a individual, 500 million-euro bond in September, but that credit card debt was marketed on to other investors.

By early November, Deutsche Bank’s chance administrators decided that they would not renew the margin financial loan to Wirecard CEO Braun. They rolled about aspect of the personal debt and established up a repayment prepare. Braun inevitably got an additional mortgage, from Oldenburgische Landesbank, a compact regional lender backed by private fairness buyers like Apollo World-wide Administration, in accordance to persons acquainted with the make any difference.

When Wirecard spiraled toward insolvency this spring — just after admitting that far more than $2 billion that it had claimed to have in belongings most likely did not exist — the financial loan to CEO Braun was no lengthier on Deutsche Bank’s guides. And whilst the company is amid a team of 15 loan companies owed some 1.6 billion euros by Wirecard, its actual publicity is nearer to 70 million euros, assuming the credit history facility was 90% drawn down. By comparison, Commerzbank, ABN Amro Bank NV and ING Groep NV are just about every owed more than 2 times as significantly, Bloomberg has noted.

But Deutsche Financial institution remains uncovered on other fronts. DWS needs to clarify losses from the financial commitment to its purchasers. Loetscher, Deutsche Bank’s main accountant, is the goal of a legal complaint for his job in Wirecard’s audits when he was working for E&Y.

“There are a lot of unresolved inquiries all over Wirecard,” stated Sebastian Kraemer-Bach, a spokesman for Deutsche Lender in Frankfurt. “We very respect operating with Andreas Loetscher,” he stated, including that the presumption of innocence applies. Loetscher declined to comment.

Deutsche Bank is now taking into consideration getting Wirecard’s banking functions, which have been ringfenced from the rest of the payments enterprise by BaFin, the German regulator. Alternatives contain taking on items of Wirecard Lender or the device in its entirety, individuals common with the make any difference stated, including that the financial institution is nonetheless debating other methods to support Wirecard Lender and hasn’t manufactured a final determination.

For extra articles or blog posts like this, be sure to go to us at bloomberg.com

Subscribe now to stay forward with the most reliable business information source.

©2020 Bloomberg L.P.

More Stories

Scotiabank customers can't get their pay: “We've fixed the problem”

His wife was badly beaten at CHSLD

Here is my response to Minister Pierre Fitzgibbon's insult about the school tax