Clothing retailers said on Monday that they had submitted to begin Chapter 11 proceedings in federal bankruptcy court in the Eastern District of Virginia. The company also said it had reached an agreement with lenders to convert around $ 1.65 billion in debt into equity.

Filing bankruptcy does not always mean the company will close down. Many companies use bankruptcy to reduce debts and other obligations that they are unable to do when closing down operations and unprofitable locations.

Retailers also often use store closure sales to liquidate inventory and collect the money they need to fund operations during bankruptcy reorganization, said Reshmi Basu, a retail bankruptcy expert at Debtwire, which tracks the finances of troubled companies.

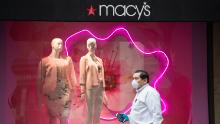

The J.Crew bankruptcy filing is the latest sign of a pandemic strain on retailers. UBS analysts said last month that “retail store closure is likely to increase in the post-COVID-19 world,” and that the gap between well-positioned retailers and struggling chains will widen due to the outbreak.

The group estimates assets and liabilities between $ 1 billion and $ 10 billion in filing for bankruptcy.

J. Crew started as a catalog-only retailer in 1983, before opening its first store in New York City in 1989. The company, known for its preppy clothing, was bought by private equity firms TPG Capital and Leonard Green & Partners in a $ 3 billion deal that closed in 2011.

It has grown rapidly in the nine years since the deal was closed, almost double the number of stores. But it has also accumulated more debt. It had $ 50 million in long-term debt on its books in 2010 before the deal was announced. It had $ 1.7 billion on February 1.

The company operates nearly 500 stores, including J.Crew, Madewell and J.Crew factory stores, but outlets have been closed by health problems around the coronavirus.

The company’s overall sales increased 2% last year, to $ 2.5 billion. But there is a big difference between the success of the two brands, because sales at the Madewell site that opened for at least one year rose 10% last year, while sales fell 1% at J.Crew branded stores.

“Madewell should be a savior’s grace. This is an asset that creditors have been fighting for years,” Basu said. “But no one wants to do an IPO now, especially a retail IPO. Covid-19 reverses everything.”

The company posted a net loss of $ 78.8 million during the latest fiscal year, an increase from a loss of $ 120 million in the previous year. Adjusted earnings before interest and taxes were $ 250.7 million, more than double the previous year – $ 112.8 million – indicating that the company might be able to complete a turnaround if plans for the Madewell IPO were not slipped by the virus.

“As we strive to reopen our stores as quickly and as safely as possible, this comprehensive financial restructuring will enable our businesses and brands to develop over the coming years,” Singer said on Monday.

– Michelle Toh contributed to this report.

More Stories

Buy Instagram Followers and Likes: A Detailed Review of InsFollowPro.com

Things to Consider When Going with Sliding Patio for Backyard

Where to Start Automation. Monitor Stands