A sixth consecutive rise in interest rates will put more pressure on households and especially those already in debt.

• Also Read: 6th consecutive hike in key rate

Bankruptcy Trustee President Jean Fortin at Associates observed: There is a lot of concern. “A lot of people are thinking about the future. How many more hikes to come?”

Most often it is consumer debt that creates the problem, he explained in an interview with TVA Nouvelles de Midi.

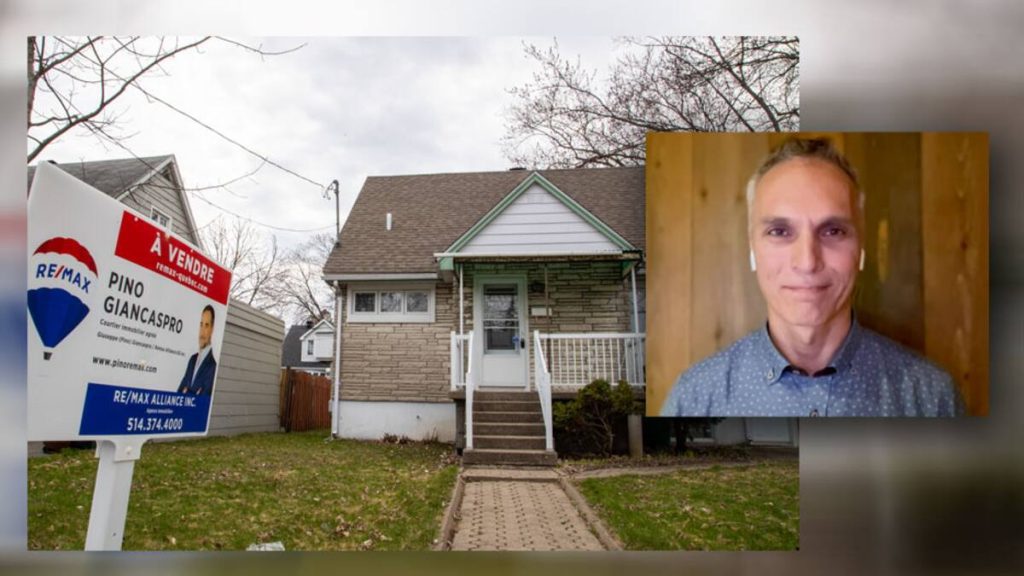

“Credit cards, personal loans, lines of credit: it’s really a burden we can’t afford. Saving the house cannot enter the budget, which is often our main asset,” explains Pierre Fortin.

A debt reduction plan can be put in place to withstand the stress of rising interest rates.

“Cut some costs to make the consumer pay off the debt more quickly, or create a consumer proposal that makes it possible to negotiate a discount with creditors,” Mr. Fortin said.

Thus, the cash released helps meet mortgage payments.

According to experts, the hike in interest rates put in place to curb inflation is temporary and may last for a year or two.

“You have to weather the storm,” he explained.

***Watch his full interview in the video above.***

![[VIDÉO] Private in health: Christian Dubey interrupted by CSN presenters](https://queenscitizen.ca/wp-content/uploads/2024/05/VIDEO-Private-in-health-Christian-Dubey-interrupted-by-CSN-presenters-720x475.jpg)

More Stories

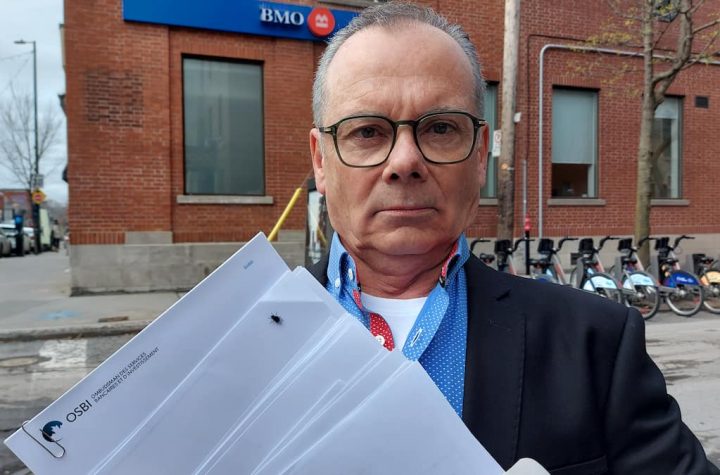

He had $42,000 stolen from his BMO account: “fraud was paid to the bank”

Grand Vie Jackpot: Stars Align for Montrealer

[VIDÉO] Private in health: Christian Dubey interrupted by CSN presenters