Recent revelations suggest that interest rates, inflation and an explosion in property prices are encouraging city dwellers to seek to move to less expensive cities, particularly Quebec and Trois-Rivières. The Most Affordable Canadian Cities Report By Royal LePage, published this Wednesday.

Escape the metropolis

Finding an affordable property can seem like a utopian project, especially for first-time buyers. While big cities always offer cultural events, diverse entertainment, public transportation, diverse jobs and attract newcomers, half of Montrealers, Torontonians and Vancouverites are considering moving elsewhere, a report based on a pan-Canadian survey revealed in mid-May by Hill & Knowlton. If they find a job in another city or a location that allows them to work remotely, 45% of current homeowners in these three cities will buy a cheaper home elsewhere and 60% of renters will move.

Four affordable options

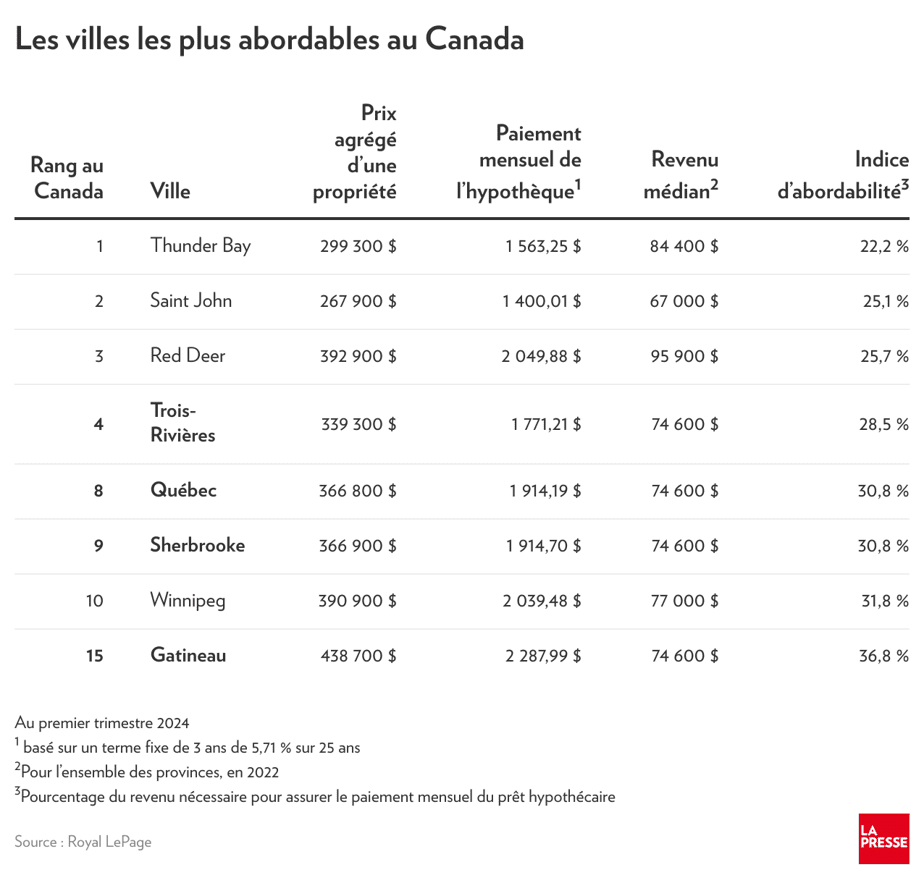

Households should not spend more than 35% of their gross income on housing, the federal government's website reminds. According to Royal LePage's calculations, 15 Canadian cities stand out in terms of affordability, including four in Quebec: Trois-Rivières, Quebec, Sherbrooke and Gatineau.

Royal LePage created an affordability index based on the percentage of income needed to meet monthly mortgage payments, with a three-year fixed rate of 5.71% amortized over 25 years. Its index includes a 20% down payment for homeowners, provincial median income based on 2022 Statistics Canada data, and city-wide total property prices from Royal LePage statistics for the first quarter of 2024.

“In real estate, there is an old adage: 'Drive until you make it.'

Cheapest in the province

According to the Royal LePage Index, Trois-Rivières ranks fourth and is the most expensive city in the province. Those who are thinking of settling there by becoming owners need to allocate an average of 28.5% of their monthly income. For comparison, Canada's cheapest city, Thunder Bay, requires 22.2% of a household's monthly income.

“Demand from buyers from Greater Montreal, especially from the real estate boom triggered by the pandemic,” analyzed Martin LeBlanc, a certified real estate broker at the Royal Lepage Center in Trois-Rivières, reports that the Maricy area is an important industrial attraction.

“Demand extends to a variety of properties, but is most pronounced in condominiums, which mainly attract first-time buyers and retirees,” he continues. The income property segment is also experiencing increased demand as it offers better profitability ratios to investors than other densely populated areas, especially with the prevailing interest rates. »

In 2021, Statistics Canada collected data on households that spent 30% or more of their income on household expenses. Trois-Rivières has the lowest number of residents exceeding this limit with 20.3%. In Quebec, they were 23.5%, in Sherbrooke 24.4%, in Gatineau 32.7% and in Montreal 27.9%.

Quebec, the favorite

Half of residents in the Greater Montreal area (54%) want to leave the metropolis. Where do they choose to settle? In Quebec, say 29 % of survey respondents; Next come Sherbrooke (15%) and Trois-Rivières (12%). Elsewhere in Canada, Edmonton was the top choice among respondents in the Greater Toronto Area (19%) and Greater Vancouver Area (19%).

Those who want to move are not only motivated by the low cost of living, but also want to be closer to nature and live a more peaceful life.

To move to Quebec, you need to allocate 30.8% of your monthly income to housing costs, as in Sherbrooke. In Gatineau, it comes to 15e rank, you should plan for 36.8% of your monthly income.