On the surface, Friday is a relatively flat finish S&P 500 Index (SNPINDEX: ^ SPX) It may seem like a quiet day on Wall Street. Reality: This is another painful volatile day in volatile week for tech stocks, which have fallen to wipe out profits in almost every other sector.

Amazon (Nasdaq: AMZN) Shares fell nearly 2%, with each tech stock closing at the end of the week with a market cap of more than $ 200 billion. As technology fell, all sectors except real estate gained value, with industries and equipment sectors accounting for more than 1%. Fertilizer Company Mosaic, Paper and packaging giant Avery Dennison, Mining giant Freeport-McMoran, And refiner Marathon Petroleum Their sectors are 3% or more.

Image Source: Getty Images.

Investors continue to emerge from large tech stocks

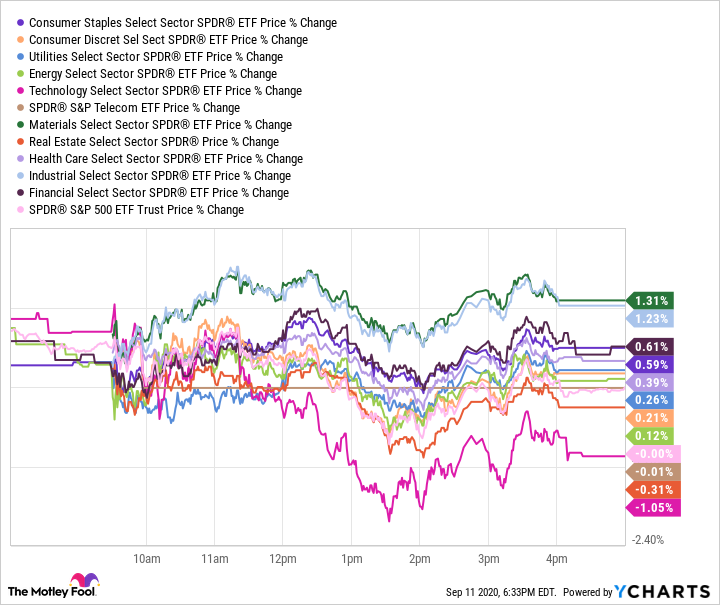

Today’s tech stock sale continued the trend of the S&P 500 tech sector losing more than 11% of its value from last week’s market high. The worst sector performance in the S&P 500 during that period was very easy, with the telecom and energy sector overcoming the downturn and also experiencing an influx of large investors. Here’s how to measure these fields Energy Select Sector SPDR ETF, Technology Select Sector SPDR ETF, And Telecom Select Sector SPDR ETF) And the complete index (as shown SPDRS & P500 ETF Trust) Since September 2 S&P has reached its all-time high.

Each sector has been selling since high, but Tech sector Led the lion’s share of the losses.

Outside tech sector sales have wiped out widespread profits almost everywhere

Here’s how All sectors Closed Friday:

The largest, most valuable companies in the US are mostly technology companies, which move the wider market as they move. That way you will be able to reduce the performance of one sector especially in the market in which almost all other sectors move higher and still finish at break even.

Here is another context: The five largest tech companies in the S&P 500, Apple (Nasdaq: AAPL), Amazon (technically classified as a consumer goods retailer, but it is a very tech company), Microsoft (Nasdaq: MSFT), Alphabet (Nasdaq: GOOG)(Nasdaq: GOOGL), And Facebook (Nasdaq: FB) It had a market cap of 9 6.9 trillion at the close of trading on Friday. Five largest non-tech companies, Berkshire Hathaway, Walmart, Johnson & Johnson, Procter & Gamble, And JPMorgan Chase, market has a market cap of 1.9 trillion.

Tech companies are having a huge impact on the US stock markets, including the highly diverse S&P 500 index. The sector has driven this segment of investor returns this year. As the coronavirus epidemic continues to weigh on the global economy, many investors have reaped those benefits over the past two weeks in a precarious economic environment.

Get used to instability

It has become a consistent refrain, but stock investors must come to terms. Record volatility is a hallmark of 2020, and that volatility continues to cast a long shadow over investors – with regard to economic, political and health – with much uncertainty.

Tech has been a big loser for the past two weeks, but it has performed well in this and previous years. As big tech becomes a big part of how we live and work in the coming years, the long-term trend of performance is likely to return. It’s a good idea to remember before stock investors join others at the big tech exodus.

More Stories

Saint Laurent Distillery went bankrupt

When even teachers buy peace with candies and curtains!

Trudeau: Bury of social cohesion