(Bloomberg) — Wirecard AG has temporarily suspended its outgoing main running officer soon after revealing that auditors could not locate about 1.9 billion euros ($2.1 billion) in funds, spooking traders and casting doubt on the company’s management and survival.

Jan Marsalek has been suspended on a revocable basis until June 30, the business explained in a assertion on Thursday. James Freis, who had previously been tapped to lead the company’s new “integrity, legal and compliance” section beginning up coming month, will start out in his purpose right away. Marsalek was owing to action down from the COO part to a new place in cost of organization advancement, Wirecard claimed in Might.

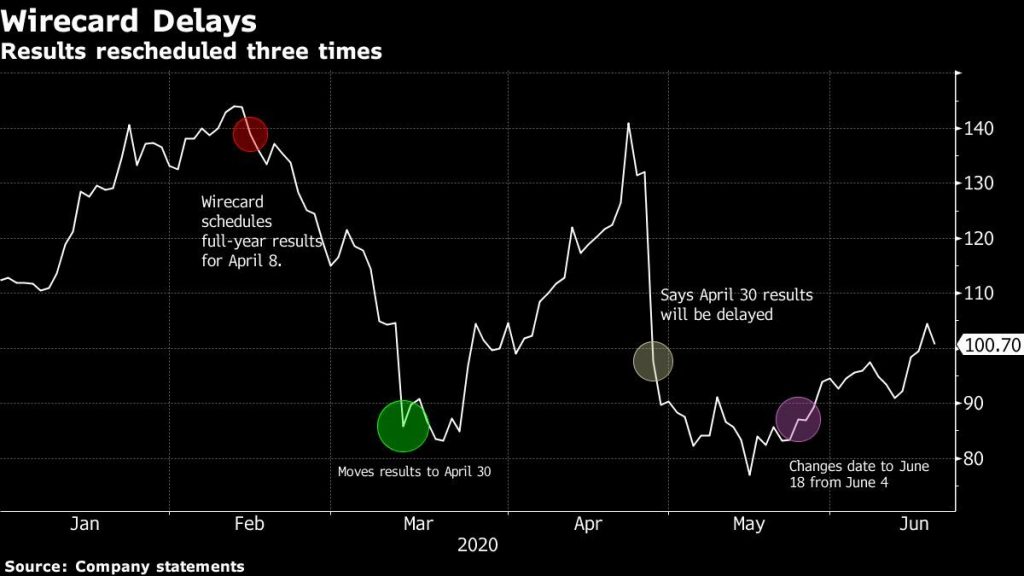

The corporation suffered a single of the worst stock slumps in the history of Germany’s benchmark index on Thursday soon after revealing that auditors had been unable to locate billions of cash that was supposed to be held in Asian banking institutions. The organization warned financial loans of as a great deal as 2 billion euros could be terminated if its audited annual report, delayed for the fourth time, was not posted by June 19.

Marsalek had tried using to get in contact with the two Asian banks and trustees above the previous two times to get better the missing funds, but wasn’t profitable, in accordance to a man or woman familiar with the make any difference. It’s unclear if the cash can be recovered, the particular person extra.

A representative for Wirecard did not answer to requests for remark. Marsalek could not straight away be achieved for comment.

Ernst & Youthful was unable to verify the location of the hard cash in particular trust accounts, and there was evidence that “spurious equilibrium confirmations” had been presented, Wirecard stated in a statement on Thursday. Which is about a quarter of the consolidated stability sheet overall, Wirecard stated.

“We are surprised,” reported Ingo Speich, a fund supervisor at Deka Investments, a leading 10 shareholder at the business. “A new get started in terms of personnel is additional urgent than ever.”

The escalating crisis also calls into doubt the long term of Chief Government Officer Markus Braun, who is the company’s greatest shareholder. Braun has been at the helm due to the fact 2002, building the enterprise from a startup into a payment company whose technology facilitates transactions around the earth.

Braun painted the organization as a prospective target in a independent statement. The CEO has been resisting calls to resign and aggressively defending the corporation in opposition to accusations of accounting fraud, led by a sequence of article content in the Economic Periods.

“It is presently unclear whether fraudulent transactions to the detriment of Wirecard AG have happened,” reported Braun, incorporating that the corporation will file a grievance towards unnamed people.

The inventory dropped as considerably as 67% to 35.85 euros in Frankfurt on Thursday, the largest tumble on file and the most significant for a member of Germany’s prestigious 30-enterprise DAX stock index. Wirecard’s bonds also suffered a record plunge.

Bank loan Issue

Wirecard warned financial loans up to 2 billion euros could be terminated if its audited yearly report was not posted by June 19. Analysts at Morgan Stanley estimated that Wirecard has obtainable money of all-around 220 million euros, if it can not track down the lacking $2.1 billion.

“While we would expect Wirecard to seek out covenant waivers, if the banking companies call 2 billion-euros of personal debt and that is mostly drawn, then we be expecting investor emphasis to convert to the harmony sheet and liquidity,” explained analysts at Morgan Stanley in a be aware on Thursday.

Wolfgang Donie, analyst at NordLB, warned that the “overall circumstance at Wirecard can only be described as intolerable and the scandal is now becoming a crisis that is threatening the existence of the corporation.”

German economical marketplaces regulator BaFin explained it is analyzing Wirecard’s disclosure on Thursday as element of its investigation into irrespective of whether the corporation violated procedures against market manipulation, according to a spokeswoman.

In September 2018, Wirecard achieved a market place valuation of 24.6 billion euros, changing Commerzbank AG in the DAX along with titans these types of as Volkswagen AG, Siemens AG, and Deutsche Lender AG. Next Thursday’s collapse, the organization is valued at all around 6.7 billion euros.

“Wirecard’s retreat could be terminal,” said Neil Campling, an analyst at Mirabaud Securities.

Asian Banking companies

EY advised Wirecard that their final results will have to have added audits soon after two unnamed Asian banking institutions that have been controlling the company’s escrow were unable to locate accounts with about 1.9 billion euros in resources, Wirecard mentioned in an supplemental statement. These cash experienced been established apart for danger management, the business claimed.

Wirecard reported last thirty day period that the hottest delay in publishing benefits was because of to Ernst & Younger needing much more time to complete its critique, and that the auditor hadn’t observed nearly anything substance in just the scope of its do the job. Wirecard had beforehand postponed the results while it was functioning with KPMG on a probe into allegations about accounting irregularities.

Braun has aggressively fought in opposition to allegations that the company’s financials have been mismanaged. Braun has also resisted calls from activist investors TCI Fund Management Ltd. to action down, promising to get back trader self-assurance and improve compliance and command.

Wirecard headquarters were searched in May possibly by German prosecutors as element of a probe involving the company’s senior management.

Wirecard reported in February that total-12 months income rose about 38% to 2.8 billion euros though earnings ahead of fascination, taxes, depreciation and amortization jumped 40% to 785 million euros.

(Up to date with Wirecard statement, CEO remark, context on financial loans.)

For a lot more posts like this, please stop by us at bloomberg.com

Subscribe now to keep ahead with the most dependable enterprise information resource.

©2020 Bloomberg L.P.

More Stories

Scotiabank customers can't get their pay: “We've fixed the problem”

His wife was badly beaten at CHSLD

Here is my response to Minister Pierre Fitzgibbon's insult about the school tax