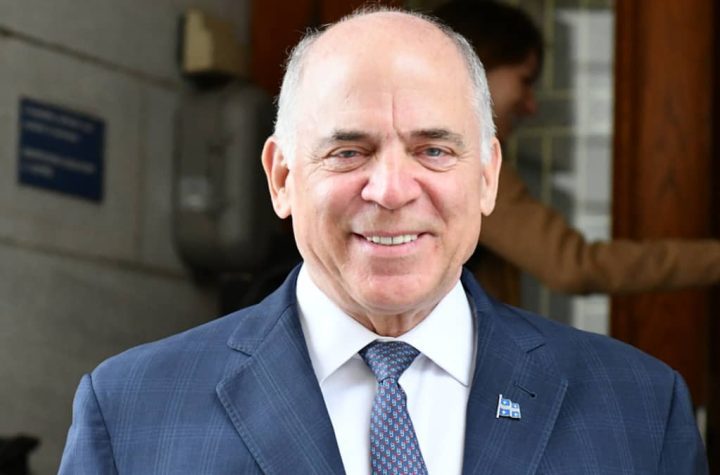

Despite strong economic uncertainty in 2023 – forced to create a scenario of recession, the first – Finance Minister Eric Girard confirms that people aged 70 and over can receive up to 2000 in the spring. $ to combat inflation.

• Also Read: Covid-19: Minister Girard infected days before budget update

As promised on the campaign trail, the fiscal update unveiled Thursday would increase the refundable tax credit for seniors assistance from $411 to $2,000.

The amount will be paid to more than 1.1 million seniors when they process their 2022 tax returns. The cost of the measure is estimated at $8 billion over five years.

The government is giving with one hand and taking back with the other, at least in part: the tax credit for seniors’ activities will be sidelined. This tax measure, which has been in existence since 2014, made it possible to cover 20% of the registration fee for certain activities. This is costing the government nearly 2 million dollars a year.

“This is a marginal credit compared to the development we are announcing today,” Minister Girard told a press conference.

Among the new elements, Quebec will follow in Ottawa’s footsteps by taxing vaping products, which should bring in $40 million a year into state coffers.

“This is a public health measure, aimed above all at protecting our young people,” Mr Girard said, calling vaping a “sin”.

Record indexing

Minister Girard, who warned that no new checks will be sent to taxpayers in 2023, also announced that social assistance programs and the parameters of the personal income tax system will be indexed to 6.44% from the new year.

For a family with two young children earning no more than $100,000, this represents a $500 increase in the family allowance.

The benefit to all taxpayers from this record indexation is estimated at $2.3 billion annually, which means about $2.2 billion for the personal income tax system and more than $161 million for social assistance benefits.

This increase is more than double that applied in 2022 (2.64%). This is the strongest index since 2002.

An alternative scenario

In the event of a recession, Minister Girard still left open the possibility of providing “direct assistance to support households or sectors of economic activity most affected by the economic slowdown”.

If the Legault government were to go with the “alternative scenario” presented in the economic update, government revenues would drop by $4.5 billion over five years.

The budget deficit is also large, at $5 billion. As suggested in the financial framework presented by the CAQ during the election campaign, the financial update included a provision for financial losses of $8 billion.

More Stories

How List Acquisition Helps Your Political Campaign Become Successful

Four escaped cows were caught

A simple administrative decision? | Press