Insurance premium costs have increased in recent years.

Read also – Insurance: Inheritance homes are hell

Homeowners have experienced an average 20% increase in five years. For businesses, premiums have increased by 50% in the last three years.

Labor shortages, an explosion in timber prices, but also a phenomenon that has caused climate change. In fact, insurers have seen a 50% increase in claims over five years.

The epidemic is also having an impact on insurance premium prices.

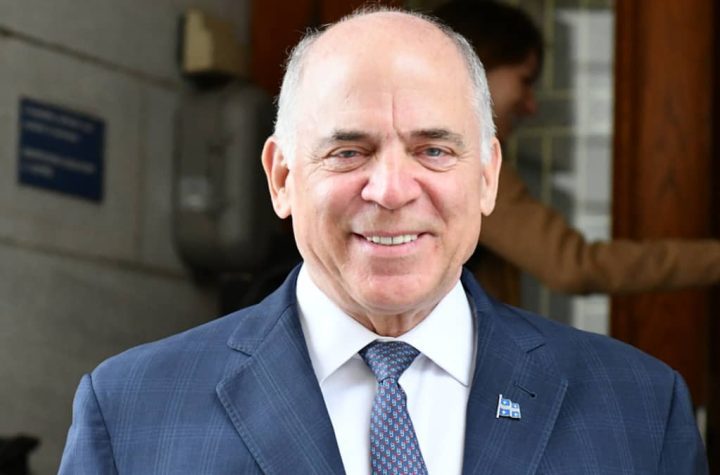

Benoit Ste-Marie, director general of the Corporation des Proprietors immobiliers du Quebec (CORPIQ), said it was difficult to insure certain sectors. This is especially the case for retail businesses, where the number of thefts has increased over the past couple of years as they close more frequently.

“Insurance companies have suffered a lot in certain key areas and need to bury their losses,” Benoit Ste-Marie explained.

In addition, the number of insurance companies is declining. Many have merged in recent years, which has reduced competition and helped raise prices.

More Stories

The University of Quebec at Trois-Rivières patrols its campus with luxury Mustang Mac-Is.

How do we get employees back to work?

Privatizing Hydro-Québec (or how to “Fitzgibbon” the economy)