As the expected announcement of another key rate hike approaches, banks across the country are reaching out to their mortgage customers in an effort to avoid defaults.

• Also Read: Inflation: Consumers and businesses do not expect growth

• Also Read: Property prices have fallen in three months

• Also Read: Four Strategies for Adapting to Rising Interest Rates

The Bank of Canada will announce its next key rate on October 26. Economists are predicting an increase from 3.25 to 3.75 to reduce inflation. Instead, it further increases the interest rates and in some cases, the scheduled monthly payments do not even cover the interest.

“We sent personalized communications to all our vulnerable customers based on their financial situation. We know there will be other increases and we are checking the need for help,” said Chantal Corbil, chief spokeswoman for Desjardins, which said some of its members found themselves in bad shape.

In this case, different solutions can be considered, such as increasing the monthly payments, extending the amortization period or making a lump sum payment at the end of the loan.

According to the Bank of Canada, a third of households in the country have a mortgage, and 10% of this fraction choose a variable rate. At RBC, there are over 310,000 clients across Canada. Of this number, 77,000 will be contacted during the quarter, as their monthly payments no longer cover the interest payments. When this happens, the monthly payments will automatically increase.

“Approximately 4.4% of our clients in Quebec contact variable rate to learn how RBC can help them find solutions to meet their financial needs,” said Jacqueline Taggart, director of corporate communications at RBC.

Fixed-rate borrowers will soon have to refinance their mortgages. Starting in January 2022, the Bank of Canada’s key rate has increased by three points. For a $300,000 mortgage, a three percentage point increase in interest would mean an additional $540 in monthly repayments.

![[VIDÉO] Private in health: Christian Dubey interrupted by CSN presenters](https://queenscitizen.ca/wp-content/uploads/2024/05/VIDEO-Private-in-health-Christian-Dubey-interrupted-by-CSN-presenters-720x475.jpg)

More Stories

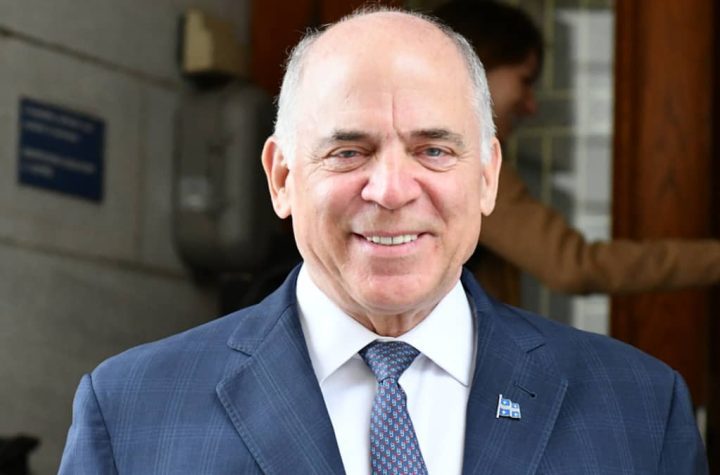

[VIDÉO] Private in health: Christian Dubey interrupted by CSN presenters

The University of Quebec at Trois-Rivières patrols its campus with luxury Mustang Mac-Is.

How do we get employees back to work?