Have you ever applied for a loan, credit card or financed the purchase of furniture or household appliances? In this case, you must have a credit report. Here’s what it is and exactly what it entails.

The two major credit agencies, Equifax and TransUnion, prepare a comprehensive bulletin about you. The latter can be approached through trade creditors.

It is, in a way, your “heritage”, an indicator that allows financial institutions and some firms to assess the risk you represent.

It is on this basis that they agree to grant you a loan or credit card, for example.

Credit scores and score

Every credit report has two parts:

Credit scores (R-1 to R-9, or I-1 to I-9, or M-1 to M-9), which describe your repayment habits and payment history. The letters correspond to different categories of financial products (R: revolving credit; I: installment credit; M: mortgage loan). At the same time the numbers represent a scale from best to worst.

For example, an R-1 means you pay your bills on time, and an R-9 means you’ve left without leaving an address, your account has been canceled, or you’re bankrupt.

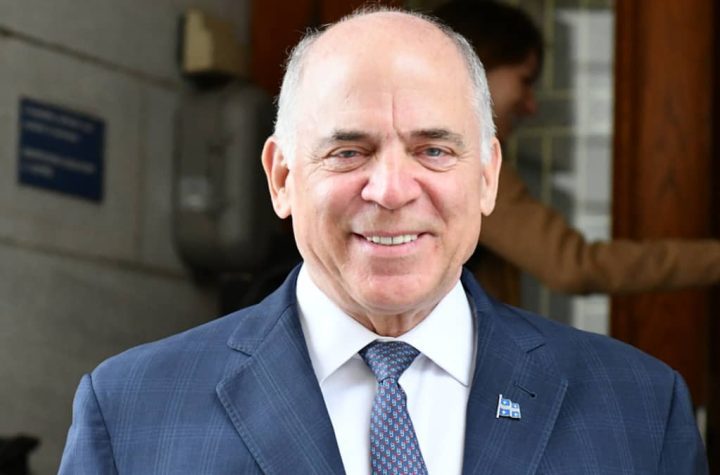

“All ratings assigned to consumers remain on their file for six years,” explains Pierre Fortin, licensed bankruptcy trustee and president of Jean Fortin et Associates.

A score is a score ranging from 300 (worst) to 900 (best) that reflects the general quality of your credit file as calculated by agencies that integrate various factors. The higher you are on the scale, the more favorably lenders will look at you, as your risk of default on loan payments will be lower.

Be aware that every time you apply for a loan (car, mortgage, etc.), card or line of credit, the lending institution will consult your file.

Do you need a good record?

“If your credit report is good, you have a better chance of being granted a lower interest rate,” says Pierre Fortin.

But that’s not all. Landlords also consult credit files before signing a lease with a tenant, he says, and car or home insurance premiums can also vary depending on the quality of an insured’s file.

Why? This is because the debtor is less likely to take care of his property – for example maintaining the roof of his property – and is therefore more likely to make claims.

But you can’t just dig up your credit report on a whim! You must give your permission first. However, any request for a loan, quote for insurance, landlord, etc. will require it.

So it’s a double-edged sword: if you say no, you may also be denied the good or service you want.

Tips

- You should check your file at least once a year and make sure there are no errors before you apply for credit. This will let you know if someone is trying to get credit on your behalf, or if you’re a victim of fraud.

- We all have the right to check our own credit report and doing so regularly will have no negative impact. In addition, both agencies recently eased access to information by allowing consumers to consult their score for free. To learn more: equifax.ca And transunion.ca

- If you need help better understanding your credit report, Jean Fortin, Counselors and Trustees (JeanFortin.com) may help you see things more clearly. You can also find a lot of information on the Financial Consumer Agency of Canada’s website (canada.ca/en/financial-consumer-agency)

![[VIDÉO] Private in health: Christian Dubey interrupted by CSN presenters](https://queenscitizen.ca/wp-content/uploads/2024/05/VIDEO-Private-in-health-Christian-Dubey-interrupted-by-CSN-presenters-720x475.jpg)

More Stories

[VIDÉO] Private in health: Christian Dubey interrupted by CSN presenters

The University of Quebec at Trois-Rivières patrols its campus with luxury Mustang Mac-Is.

How do we get employees back to work?