Following rising to a report large previous year in Canada, paying on property renovations fell off a cliff in the early days of the COVID-19 pandemic.

But the months of lockdowns and the seemingly infinite purgatory of doing work from home have Canadians as soon as once more opening up their wallets to make their short-term workplaces as tolerable as attainable.

In a modern report, Toronto-centered authentic estate consultancy Altus Team calculated that Canadians put in extra than $80 billion on property advancements past year, a tally that outpaced progress in the over-all economy.

And the year’s residence reno boom was especially remarkable, looking at that the sector shrank by far more than five for every cent the year in advance of.

“If we go back to very last spring, curiosity charges have been tumbling, so we were using very superior,” CEO Peter Norman claimed in an job interview with CBC Information.

The $80.1 billion that Canadians spent on correcting up existing households previous year was extra than they put in on new kinds — and it was a huge purpose why firms that tailor to that sector were being feeling hopeful that 2020 was heading to be an additional potent calendar year.

Then COVID-19 struck — and just as the pandemic experienced a destructive impact on almost every little thing else in the financial state, it introduced that spending to a grinding halt. What was shaping up to be a sturdy year for renovations cooled off completely in March and April.

Altus Team is now forecasting that following a document 2019, shelling out on dwelling renovations will slide in each and every province this yr.

Norman said there’s a delay of a number of months in the info, so only now is there some sense of what type of activity was taking location in May perhaps and June. But it would seem that all all those months cooped up at dwelling compelled Canadians to move forward with property reno initiatives they either weren’t planning before or put on pause in March and April.

That’s no shock to Melanna Giannakis. As a branch manager with Meridian Credit rating Union, she said the exercise at her branch in Fonthill, Ont., a community in the Niagara location of southern Ontario, mirrors the traits that Altus is seeing across the nation: booming demand, adopted by a complete deep freeze and now a resurgence.

Line of credit financial debt grows to fork out for renos

Considerably of that action is becoming paid for by property owners borrowing towards the fairness in their property to tailor their house to the new fact of their lives.

“At the beginning of the pandemic, the once-a-year progress level of dwelling equity traces of credit doubled and just about tripled for private use,” Giannakis stated in an job interview.

Some of that revenue was likely used to pay back the expenses as incomes fell and job losses included up in the early days of March and April.

But a great deal of it has been going to fork out for household renovations.

“One of the main matters I’m finding is men and women are a lot less worried about where by they are dwelling and extra concerned with how they are residing,” Giannakis mentioned.

The large rise in the selection of people doing the job from residence has transformed the game for real estate, as millions of Canadians are now a lot less tethered to downtown workplaces. That’s leading to a actual estate growth in remote, a lot less dense environments.

Individuals keeping place in city centres want to spend funds to make their properties improved suited for them in the new reality, Giannakis mentioned.

“Individuals want extra room and a lot more room — household offices with awesome backdrops for video clip conferencing, for instance, house gyms, finished basements, backyards swimming pools…. They want their possess very little hideaway they can hunker down in.”

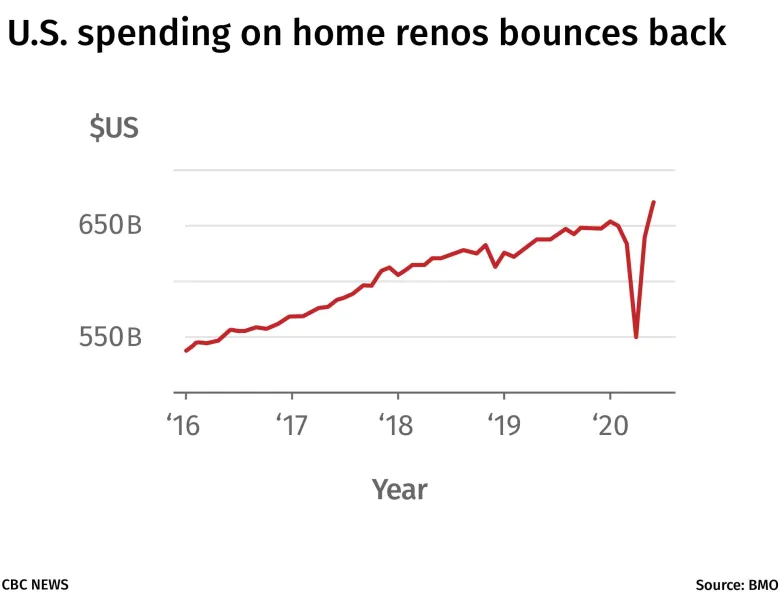

It truly is not just a Canadian pattern, possibly. Bank of Montreal economist Sal Guatieri noted in a new report that just after plummetting in March and April, U.S. shoppers are paying out much more than at any time on their households again. In June, paying on household furnishings, products and routine maintenance eclipsed $650 billion US in June and is now back again earlier mentioned its pre-pandemic level.

“Telework has presently spurred spending on property convenience,” he mentioned, especially for a person variety of renovation: house places of work. “Need for in-dwelling business office renovations looks to have risen sharply.”

That’s not to counsel that homeowners are shelling out willy-nilly. Norman cited Altus information demonstrating that the number of property owners scheduling renos costing at the very least $5,000 has declined compared with last year, but it really is still soaring from its March small.

Though indications are that the reno marketplace is recovering strongly, the drop was so steep that even with the current boom, it is unlikely that paying out in 2020 will occur out ahead of previous year’s strong pace.

“We do be expecting issues to be a small bit subdued this yr relative to the previous year,” Norman explained.

“We just will never see that exact same amount of advancement.”

![[VIDÉO] Private in health: Christian Dubey interrupted by CSN presenters](https://queenscitizen.ca/wp-content/uploads/2024/05/VIDEO-Private-in-health-Christian-Dubey-interrupted-by-CSN-presenters-720x475.jpg)

More Stories

Where to Start Automation. Monitor Stands

Amid Rising Water Rates, Property Managers Save 15 to 35 Per Cent With Canadian Water Savings’ Smart Valve™

The Casino Industry’s New Era: Navigating the Surge of Online Gambling